Singapore E-Learning Market Size, Share, and COVID-19 Impact Analysis, By Technology (Online, LMS, Mobile, and Others), By Provider (Service and Content), By Application (Corporate, Academic, and Government), and Singapore E-Learning Market Insights, Industry Trend, Forecasts to 2033

Industry: Electronics, ICT & MediaSingapore E-Learning Market Insights Forecasts to 2033

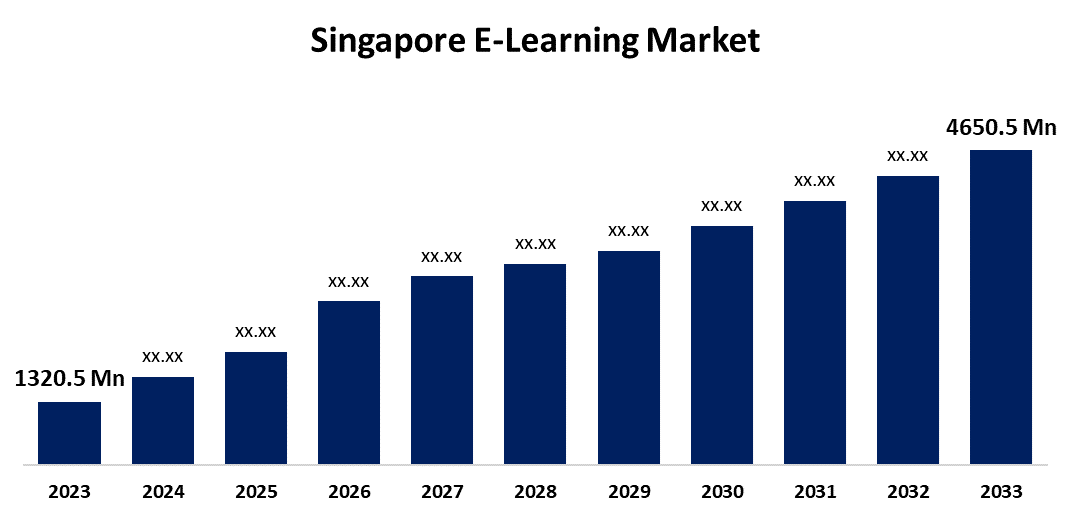

- The Singapore E-Learning Market Size was valued at USD 1320.5 Million in 2023.

- The Market is growing at a CAGR of 13.42% from 2023 to 2033

- The Singapore E-Learning Market Size is expected to reach USD 4650.5 Million by 2033

Get more details on this report -

The Singapore E-Learning Market Size is anticipated to exceed USD 4650.5 Million by 2033, growing at a CAGR of 13.42% from 2023 to 2033. The increasing adoption of digital technology, government focus on integrating technology for enhancing learning outcomes, shift towards innovative learning technology, high speed internet, and widespread use of smartphones and tablets are driving the growth of the e-learning market in Singapore.

Market Overview

E-learning or electronic learning refers to online education, training, and knowledge sharing conducted over the Internet. It includes academic education, corporate training, and skill development courses. Electronic devices and computer-assisted technologies such as web-based mentoring, educational computer games, and laptop computers are used for conducting learning activities. There is a growing adoption of learning experience platforms (LXPs) in the country. The increasing technical development in e-learning which includes artificial intelligence (AI), virtual reality (VR), and augmented reality (AR) enables enticing, interactive, and tailored learning experiences, thereby providing lucrative market opportunities for e-learning.

Report Coverage

This research report categorizes the market for the Singapore e-learning market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore e-learning market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore e-learning market.

Singapore E-Learning Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1320.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 13.42% |

| 2033 Value Projection: | USD 4650.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Application, By Provider, Covid-19 Empact, Challenges, Growth, Analysis |

| Companies covered:: | Antoree Pte. Ltd., Gem Learning, Gnowbe Group Ltd., Inchone Pte Ltd., Coursepad Pte Ltd., KooBits Learning Pte Ltd., Marshall Cavendish Education, Kydon, Xiamen Phoenix OneSoft CO., LTD., Wizlearn Technologies, and Other Key Vendors. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The increasing adoption of smart digital technologies in the education system for improve teaching and enhanced learning is driving market growth. Further, the government's focus on integrating technology to enhance learning outcomes is propelling the market. The shift towards innovative learning technology by using digital tools like online platforms, apps, and virtual classrooms for increasing accessibility of education and improving outcomes is significantly contributing to drive the market growth. As per the report of a data and business intelligence platform, Statista, Singapore is the top listed country for fixed broadband connections as of January 2024 with an expected average fixed broadband connection speed of 277.57 Mbps. The high level of connectivity, increased access of internet and computers along wit widespread use of smartphones and tablets are propelling the Singapore e-learning market.

Restraining Factors

The challenge of maintaining student interest and motivation in a virtual setting may hinder the market. Ensuring equitable access to technology and the Internet is a major concern, especially for underprivileged and marginalized groups. The rising concerns about educational inequality is challenging the market.

Market Segmentation

The Singapore E-Learning Market share is classified into technology, provider, and application.

- The online segment is anticipated to hold the largest market share during the forecast period.

The Singapore e-learning market is segmented technology into online, LMS, mobile, and others. Among these, the online segment is anticipated to hold the largest market share during the forecast period. Online learning is the most recent and widely used type of distance education. It has significantly impacted post-secondary education, and the tendency is continuing to increase. The introduction of online training courses as a digital learning option for elementary and secondary school, are boosting market growth.

- The content segment accounted for the largest revenue share of the Singapore e-learning market in 2023.

The Singapore e-learning market is segmented by provider into service and content. Among these, the content segment accounted for the largest revenue share of the Singapore e-learning market in 2023. E-learning content formats are developed as well as individually modified to meet each learner’s needs using a variety of tools. The increasing remote learning, demand for perpetual learning, and advancements in educational technologies are anticipated to drive market growth.

- The academic segment dominated the Singapore e-learning market with the largest market share in 2023.

Based on the application, the Singapore e-learning market is divided into corporate, academic, and government. Among these, the academic segment dominated the Singapore e-learning market with the largest market share in 2023. In the academic sector, e-learning provides a range of programs and activities for enhancing the educational experience for students. Various educational resources including interactive courses, multimedia content, and online tests are provided. The increasing use of e-learning by a number of academic institutes is driving market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore e-learning market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Antoree Pte. Ltd.

- Gem Learning

- Gnowbe Group Ltd.

- Inchone Pte Ltd.

- Coursepad Pte Ltd.

- KooBits Learning Pte Ltd.

- Marshall Cavendish Education

- Kydon

- Xiamen Phoenix OneSoft CO., LTD.

- Wizlearn Technologies

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, Lightware Visual Engineering announced the opening of its new Experience and Training Centres in Madrid, Singapore, and Warsaw. Lightware would launch its first Southeast Asia Training Center in Singapore. This center would serve as a regional hub for AV professionals seeking customized training sessions and hands-on learning experiences.

- In February 2023, Moodle Certified Premium Partner e-learning Co., Ltd. Japan, announced that it is expanding its operations in Singapore through its entity E-LEARNING LMS PTE. LTD. The entity was established as the first wholly-owned overseas subsidiary of e-learning Co., Ltd. to provide Moodle LMS and Moodle Workplace as Software-as-a-Service (SaaS) in Singapore.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore E-Learning Market based on the below-mentioned segments:

Singapore E-Learning Market, By Technology

- Online

- LMS

- Mobile

- Others

Singapore E-Learning Market, By Provider

- Service

- Content

Singapore E-Learning Market, By Application

- Corporate

- Academic

- Government

Need help to buy this report?