Singapore Enteral Feeding Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Giving Set, Enteral Feeding Pump, Percutaneous Endoscopic Gastrostomy Device, Low Profile Gastrostomy Device, Nasogastric Tube, and Gastrostomy Tube), By Age Group (Adults and Pediatrics), By Indication (Alzheimer’s, Nutrition Deficiency, Cancer Care, Diabetes, Chronic Kidney Diseases, Dysphagia, Pain Management, Malabsorption/GI Disorder/Diarrhea, and Others), By End-use (Hospitals and Home Care), and Singapore Enteral Feeding Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareSingapore Enteral Feeding Devices Market Insights Forecasts to 2033

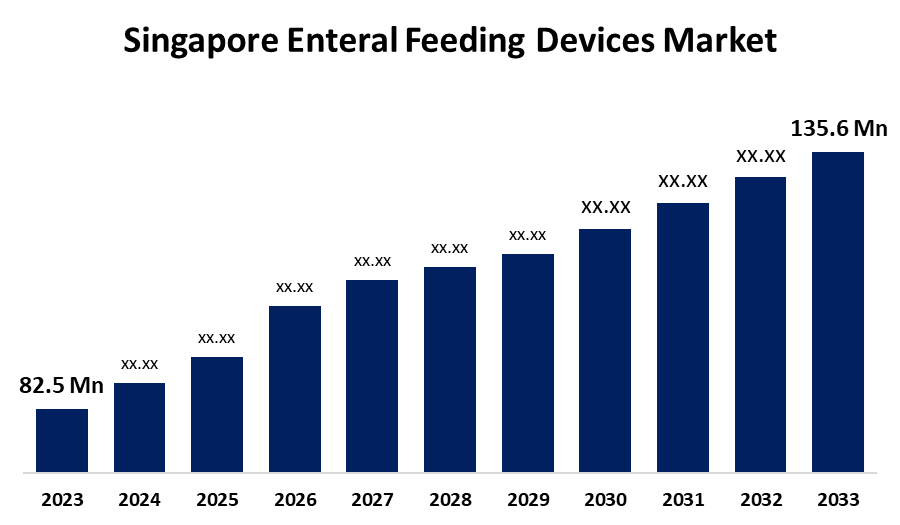

- The Singapore Enteral Feeding Devices Market Size was valued at USD 82.5 Million in 2023.

- The Market Size is growing at a CAGR of 5.09% from 2023 to 2033

- The Singapore Enteral Feeding Devices Market Size is expected to exceed USD 135.6 Million by 2033

Get more details on this report -

The Singapore Enteral Feeding Devices Market Size is anticipated to exceed USD 135.6 Million by 2033, growing at a CAGR of 5.09% from 2023 to 2033. The increasing healthcare expenditure, surging number of preterm births, rising aging population, prevalence of chronic diseases, and awareness of enteral nutrition benefits are driving the growth of the enteral feeding devices market in the Singapore.

Market Overview

Enteral feeding devices are used to supply nutrients and fluids to the patient’s body who can’t safely chew or swallow. These are soft, flexible plastic tubes through which liquid nutrition travels through the gastrointestinal (GI) tract. These devices provide a reliable and safe method for delivering essential nutrients to patients who are not able to consume food orally. Technological developments, such as the advent of tri-funnel replacement G-tubes and J-tubes with reverse balloon designs, are expected to aid market expansion. Enteral feeding equipment including quieter pumps, disposable feeding sets, and remote monitoring capabilities is becoming more dependable, portable, and easy to use at home. The healthcare industry is shifting toward home-based treatment, which offers patients and healthcare systems more comfort and cost-effectiveness.

Report Coverage

This research report categorizes the market for the Singapore enteral feeding devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore enteral feeding devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore enteral feeding devices market.

Singapore Enteral Feeding Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 82.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.09% |

| 2033 Value Projection: | USD 135.6 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Age Group, By End-use |

| Companies covered:: | Boston Scientific Corporation,, Abbott Nutrition., ConMed Corporation, Kimberly-Clark Corporation, Fresenius Kabi Singapore, Cook Medical, Cardinal Health Inc., B. Braun Melsungen AG, C.R.Bard, Danone, Avanos Medical Inc., Moog Inc., Vygon SA, And Other Key Vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The percentage of Singapore's GDP that went toward health spending in the fiscal year 2021 was 2.9%. The Ministry of Health estimates that by 2030, Singapore's national health spending could reach $43 billion. The increasing healthcare expenditure owing to the rising government spending and the local population’s consumption of healthcare services, attributed largely to an aging population and a trend towards early chronic disease diagnosis is propelling the market growth. The surging number of preterm births necessitates enteral feeding devices for safe feeding practices for preterm infants, thereby driving the market demand. As Singapore's population ages, more people are experiencing dysphagia, which in turn is leading to a rise in the prevalence of enteral feeding. Further, the awareness about the benefits associated with enteral nutrition including lower risk of aspiration, more physiological, maintaining intestinal motility, and less risk of digestive bleeding is responsible for propelling the market.

Restraining Factors

The lack of awareness about enteral feeding devices hinders its adoption which leads to restraining the Singapore enteral feeding devices market. Further, the lack of endoscopy specialists is hampering the enteral feeding devices market.

Market Segmentation

The Singapore Enteral Feeding Devices Market share is classified into product, age group, indication, and end-use.

- The enteral feeding pump segment is anticipated to hold the largest market share during the forecast period.

The Singapore enteral feeding devices market is segmented by product into giving set, enteral feeding pump, percutaneous endoscopic gastrostomy device, low profile gastrostomy device, nasogastric tube, and gastrostomy tube. Among these, the enteral feeding pump segment is anticipated to hold the largest market share during the forecast period. Delivering nutrition straight to the stomach using a tube that is attached to an electric pump is known as enteral feeding. The increasing technological developments including compact, dependable, and user-friendly devices like Covidien's Kangaroo ePump are driving the market.

- The adults segment accounted for the largest revenue share of the Singapore enteral feeding devices market in 2023.

The Singapore enteral feeding devices market is segmented by age group into adults and pediatrics. Among these, the adults segment accounted for the largest revenue share of the Singapore enteral feeding devices market in 2023. In addition to offering sufficient nutritional support, enteral feeding using a nasogastric tube appears to be successful in treating intractable nausea and vomiting including hyperemesis gravidarum (in pregnant women) alternative to complete parenteral nutrition. The increasing prevalence of chronic diseases among the adult population is responsible for driving the market demand.

- The cancer care segment dominated the Singapore enteral feeding devices market with the largest market share in 2023.

Based on the indication, the Singapore enteral feeding devices market is divided into Alzheimer's, nutrition deficiency, cancer care, diabetes, chronic kidney diseases, dysphagia, pain management, malabsorption/GI disorder/diarrhea, and others. Among these, the cancer care segment dominated the Singapore enteral feeding devices market with the largest market share in 2023. Enteral feeding devices are used for providing nutrition to head and neck cancer patients during chemotherapy and or radiotherapy. The increased cases of cancer cases including nasopharyngeal cancer in the country is contributing to drive the market demand.

- The hospitals segment dominated the market with the largest revenue share in 2023.

Based on the end-use, the Singapore enteral feeding devices market is divided into hospitals and home care. Among these, the hospitals segment dominated the market with the largest revenue share in 2023. The rising number of intensive care unit admissions and readmissions, the growing demand for enteral foods and formulations among critically or severely ill patients, and the rising prevalence of various chronic disorders like diabetes, cancer, and many others are responsible for driving the market in the hospitals segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore enteral feeding devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Boston Scientific Corporation,

- Abbott Nutrition., ConMed Corporation

- Kimberly-Clark Corporation

- Fresenius Kabi Singapore

- Cook Medical

- Cardinal Health Inc.

- B. Braun Melsungen AG

- C.R.Bard

- Danone

- Avanos Medical Inc.

- Moog Inc.

- Vygon SA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Enteral Feeding Devices Market based on the below-mentioned segments:

Singapore Enteral Feeding Devices Market, By Product

- Giving Set

- Enteral Feeding Pump

- Percutaneous Endoscopic Gastrostomy Device

- Low Profile Gastrostomy Device

- Nasogastric Tube

- Gastrostomy Tube

Singapore Enteral Feeding Devices Market, By Age Group

- Adults

- Pediatrics

Singapore Enteral Feeding Devices Market, By Indication

- Alzheimer's

- Nutrition Deficiency

- Cancer Care

- Diabetes, Chronic Kidney Diseases

- Dysphagia

- Pain Management

- Malabsorption/GI Disorder/Diarrhea

- Others

Singapore Enteral Feeding Devices Market, By End-use

- Hospitals

- Home Care

Need help to buy this report?