Singapore Facility Management Market Size, Share, and COVID-19 Impact Analysis, By Offerings (In-House and Outsourced), By Service Type (Hard Services and Soft Services), By Industry Vertical (Healthcare, Business & Corporate, Manufacturing, Government, Education, Military & Defense, Construction (Real Estate), Hospitality, and Others), and Singapore Facility Management Market Insights, Industry Trend, Forecasts to 2033

Industry: Electronics, ICT & MediaSingapore Facility Management Market Insights Forecasts to 2033

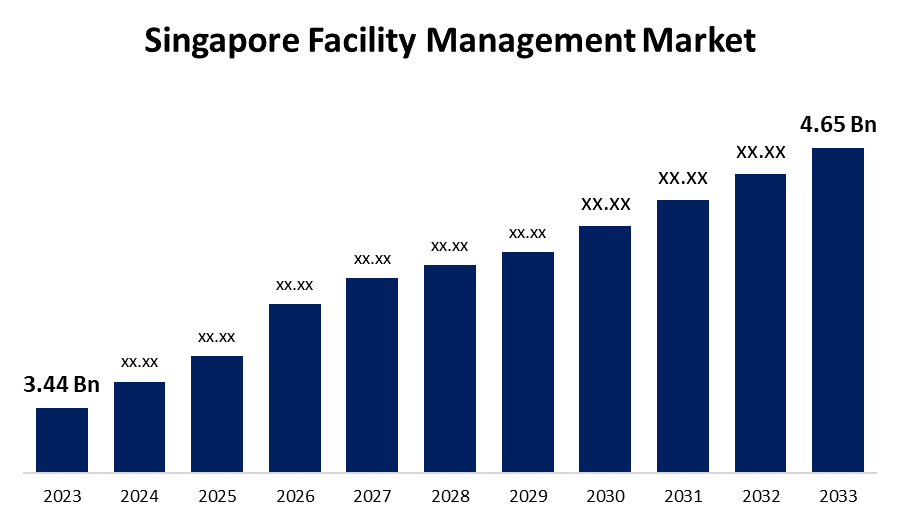

- The Singapore Facility Management Market Size was valued at USD 3.44 Billion in 2023.

- The Market Size is growing at a CAGR of 3.06% from 2023 to 2033

- The Singapore Facility Management Market Size is expected to exceed USD 4.65 Million by 2033

Get more details on this report -

The Singapore Facility Management Market Size is anticipated to exceed USD 4.65 Billion by 2033, growing at a CAGR of 3.06% from 2023 to 2033. The increasing focus on outsourcing of non-core operations and investments in infrastructure development are driving the growth of the facility management market in the Singapore.

Market Overview

Facility management refers to the maintenance of an organization’s buildings and equipment, ensuring functionality, comfort, safety, and efficiency of buildings and grounds, infrastructure, and real estate. Flexible work schedules and the need for better workspaces have led to the widespread adoption of facility management solutions, which give users the means to keep updated on conditions in real-time and guarantee maximum productivity and occupant satisfaction. The increasing use of facilities management systems (CMMS software) such as FacilityBot, IBM Maximo, Planon, and eMaint to digitalize and automate workflows is augmenting the market growth opportunities for facility management. By implementing CMMS software, facilities managers can automate many previously manual processes and concentrate on value-added monitoring and data-driven decision-making. The FM market is growing because facility managers are increasingly utilizing IoT, BIM, AI, and other cutting-edge technologies to increase operational performance, reduce costs, and provide higher-quality services.

Report Coverage

This research report categorizes the market for the Singapore facility management market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore facility management market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore facility management market.

Singapore Facility Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.44 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.06% |

| 2033 Value Projection: | USD 4.65 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Offerings, By Service Type, By Industry Vertical |

| Companies covered:: | CBRE Group Inc., ENGIE Services Singapore (ENGIE SA), Sodexo Singapore Pte. Ltd (Sodexo Group), Abacus Property Management Pte. Ltd, ACMS Facilities Management Pte. Ltd, Certis CISCO Security Pte. Ltd (Temasek Holdings (Private) Limited), Compass Group PLC, Exceltec Property Management Pte. Ltd, Jones Lang LaSalle Incorporated (JLL Incorporated), Savills Singapore (Savills), Vinci Facilities Limited, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing pressure to lower operating expenses, prioritize patient care, and enhance service quality is driving the trend of outsourcing FM services. Hospitals can reduce overhead costs and get access to specialized knowledge and cutting-edge technologies through outsourcing. Thus, the increasing focus on outsourcing facility management by healthcare organizations is driving the market demand. Singapore’s rapid urbanization and infrastructure development including the construction of new commercial buildings, residential complexes, industrial parks, and healthcare facilities necessitates efficient facility management is driving the market demand. Under a proposed law known as the Significant Infrastructure Government Loan Act, the government would issue new bonds totaling $68 billion (S$90 billion) to finance significant long-term infrastructure projects over the next 15 years. The investment in infrastructure development is expected to drive the market growth.

Restraining Factors

The operational limitations and service quality issues faced by businesses are challenging the Singapore facility management market. Further, the rising skills gap and the scarcity of qualified personnel may hamper the market growth.

Market Segmentation

The Singapore Facility Management Market share is classified into offerings, service type, and industry vertical.

- The in-house segment is anticipated to hold the largest market share during the forecast period.

The Singapore facility management market is segmented by offerings into in-house and outsourced. Among these, the in-house segment is anticipated to hold the largest market share during the forecast period. In order to keep direct control over operations and ensure accordance with corporate goals, large organizations that require a lot of facility management are increasingly adopting internal solutions. The high level of control and organization oversight for maintaining facilities are responsible for driving the market in the in-house segment.

- The hard services segment accounted for the largest market share during the forecast period.

The Singapore facility management market is segmented by service type into hard services and soft services. Among these, the hard services segment accounted for the largest market share during the forecast period. Contracting with the building management provides the hard services, which encompass everything from personnel to services associated with them. The expanding infrastructure industry and rapidly growing building & construction sector are contributing to driving the market in the hard services segment.

- The healthcare segment dominated the Singapore facility management market with the largest market share during the forecast period.

Based on the industry vertical, the Singapore facility management market is divided into healthcare, business & corporate, manufacturing, government, education, military & defense, construction (real estate), hospitality, and others. Among these, the healthcare segment dominated the Singapore facility management market with the largest market share during the forecast period. Facility management ensures that hospitals, clinics, and other healthcare facilities are sanitary, secure, and effective. The growing healthcare infrastructure and construction, healthcare expenditure, and growing prevalence of chronic diseases are driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore facility management market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CBRE Group Inc.

- ENGIE Services Singapore (ENGIE SA)

- Sodexo Singapore Pte. Ltd (Sodexo Group)

- Abacus Property Management Pte. Ltd

- ACMS Facilities Management Pte. Ltd

- Certis CISCO Security Pte. Ltd (Temasek Holdings (Private) Limited)

- Compass Group PLC

- Exceltec Property Management Pte. Ltd

- Jones Lang LaSalle Incorporated (JLL Incorporated)

- Savills Singapore (Savills)

- Vinci Facilities Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, SATS in Singapore, a food service caterer for the airline industry and airport lounges, plans to enter into a new partnership with Japan’s Mitsui & Co. As part of a previous memorandum of understanding (MoU) between SATS and Mitsui, the proposed partnership will aim to “develop and grow their respective food and retail solutions businesses”.

- In February 2024, Singapore-based cleaning firm Conrad Maintenance welcomed its new shareholder SoftBank Robotics Singapore (SBRSG), the Asia-Pacific Headquarters of SoftBank Robotics Group Corp, as one of the first Singapore partnerships to transform the cleaning services into a smart facility management service in Singapore as (Smart Business Transformation (SmartBX TM).

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Facility Management Market based on the below-mentioned segments:

Singapore Facility Management Market, By Offerings

- In-House

- Outsourced

Singapore Facility Management Market, By Service Type

- Hard Services

- Soft Services

Singapore Facility Management Market, By Industry Vertical

- Healthcare

- Business & Corporate

- Manufacturing

- Government

- Education

- Military & Defense

- Construction (Real Estate)

- Hospitality

- Others

Need help to buy this report?