Singapore Foodservice Market Size, Share, and COVID-19 Impact Analysis, By Foodservice Type (Cafes & Bars, Cloud Kitchen, Full Service Restaurants, and Quick Service Restaurants), By Outlet (Chained and Independent), and Singapore Foodservice Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesSingapore Foodservice Market Insights Forecasts to 2033

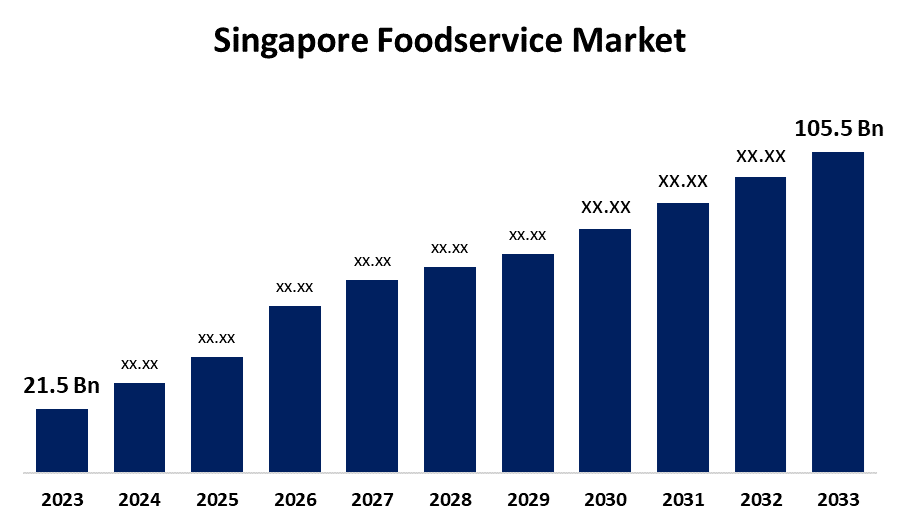

- The Singapore Foodservice Market Size was valued at USD 21.5 Billion in 2023.

- The Market is growing at a CAGR of 17.24% from 2023 to 2033

- The Singapore Foodservice Market Size is expected to reach USD 105.5 Billion by 2033

Get more details on this report -

The Singapore Foodservice Market is anticipated to exceed USD 105.5 Billion by 2033, growing at a CAGR of 17.24% from 2023 to 2033. The increasing affluence & dining out culture, tourism growth, internationalization, and food delivery services are driving the growth of the foodservice market in the Singapore.

Market Overview

Foodservice industry refers to the businesses, institutions, and companies that prepare meals and deliver them to a consumer. It includes restaurants, grocery stores, school and hospital cafeterias, catering operations, and others. Consumer tastes, food trends, health laws, and economic issues all have an impact on this industry. Foodservice businesses serve to a wide range of demographics and events, from informal dinners to elaborate parties, and vary greatly in size and design. This dynamic industry consistently adjusts to changing consumer demands and tastes while making a substantial economic contribution. The incorporation of technology such as digital menus and advanced point-of-sale systems, which are streamlining processes and enhancing the overall dining experience is escalating the market opportunities. Further, the growing use of online food delivery services by Singaporeans which is more increasingly among the GenZ and millennials is anticipated to bolster the market growth.

Report Coverage

This research report categorizes the market for the Singapore foodservice market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore foodservice market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore foodservice market.

Singapore Foodservice Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 21.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 17.24% |

| 2033 Value Projection: | USD 105.5 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 107 |

| Segments covered: | By Foodservice Type, By Outlet, COVID-19 Empact, Challenges, Future, Growth, & Analysis |

| Companies covered:: | Doctor’s Associates Inc., Domino’s Pizza Enterprises Ltd, Hanbaobao Pte Ltd, Jollibee Foods Corporation, Starbucks Corporation, Paradise Group Holdings Pte Ltd, Nandos Chickenland Singapore Pte Ltd, Restaurant Brands International Inc., Sakae Holdings Ltd, Soup Restaurant Group Ltd, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

As per the National Nutrition survey conducted in 2018 by DBS Bank, about 55% of Singaporeans eat out at out-of-home dining weekly, and about 24% dine out daily. The growing frequency of eating out with the increasing number of fast-food outlets is contributing to driving the market growth. The growth in food-related events, food festivals, and culinary experiences that highlight multicultural gastronomy and the city-state's modern eating scene in the country are propelling the market. The increasing popularity of international food trends such as Korean BBQ, Japanese ramen, and Mexican tacos in Singapore restaurants like Kko Kko Nara (Korean) and Guzman y Gomez (Mexican) are promoting market growth. The rising reliance on cell phones and the desire for convenient eating options with improved network connectivity and continuous software advancements for online meal delivery apps are contributing to driving the market.

Restraining Factors

The increasing food and labor costs are restraining the market. Further, the escalating geopolitical tensions including disruption of supply chains are negatively affecting the Singapore foodservice market.

Market Segmentation

The Singapore Foodservice Market share is classified into foodservice type and outlet.

- The full service restaurants segment dominates the Singapore foodservice market during the forecast period.

The Singapore foodservice market is segmented by foodservice type into cafes & bars, cloud kitchen, full service restaurants, and quick service restaurants. Among these, the full service restaurants segment dominates the Singapore foodservice market during the forecast period. Full service restaurants refer to complete dining facilities that offer full meal menus and table service in physical locations. The increase in consumer preference for dining out experience and interest in gourment and ethnic cuisines are driving the market in the full service restaurants segment.

- The chained segment is anticipated to grow at the fastest CAGR during the forecast period.

The Singapore foodservice market is segmented by outlet into chained and independent. Among these, the chained segment is anticipated to grow at the fastest CAGR during the forecast period. Chain restaurants frequently exist in one of two verticals: franchised or company-owned. A chain restaurant is a business that operates under its own name and menu in several locations under the same ownership typically a master franchise corporation or single-parent business. They possess the advantage of having a fixed menu while maintaining uniformity of food at every location.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore foodservice market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Doctor's Associates Inc.

- Domino's Pizza Enterprises Ltd

- Hanbaobao Pte Ltd

- Jollibee Foods Corporation

- Starbucks Corporation

- Paradise Group Holdings Pte Ltd

- Nandos Chickenland Singapore Pte Ltd

- Restaurant Brands International Inc.

- Sakae Holdings Ltd

- Soup Restaurant Group Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, SATS in Singapore, a foodservice caterer for the airline industry and airport lounges, plans to enter into a new partnership with Japan’s Mitsui & Co. This partnership is a significant step towards enhancing the parties’ food-value chain footprints across Asia said by the company.

- In July 2024, Singapore-based food delivery and ride-hailing company Grab announced the acquisition of the home-grown restaurant reservation platform Chope. The strategic move bolsters Grab’s online-to-offline value proposition for merchants and users across Southeast Asia, including Singapore, according to an internal email viewed by The Business Times.

- In November 2023, Tim Hortons made its debut in the Singaporean coffee shop market by opening its first outlet at VivoCity mall, Bloomberg has reported. The initiative was led by Marubeni Growth Capital Asia, a subsidiary of Marubeni Corporation.

- In May 2023, Starbucks Singapore Opens A New Rustic, Hut-Like Outlet At Bird Paradise.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Foodservice Market based on the below-mentioned segments:

Singapore Foodservice Market, By Foodservice Type

- Cafes & Bars

- Cloud Kitchen

- Full Service Restaurants

- Quick Service Restaurants

Singapore Foodservice Market, By Outlet

- Chained

- Independent

Need help to buy this report?