Singapore Gastrointestinal Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Biologics, Antidiarrheal & Laxatives, Acid Neutralizers, Anti-Inflammatory Drugs, Antiemetic & Antinauseants, and Others), By Route of Administration (Oral and Parenteral), By Application (Irritable Bowel Syndrome, Ulcerative Colitis, Crohn’s Disease, Gastroenteritis, Celiac Disease, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and Singapore Gastrointestinal Drugs Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareSingapore Gastrointestinal Drugs Market Insights Forecasts to 2033

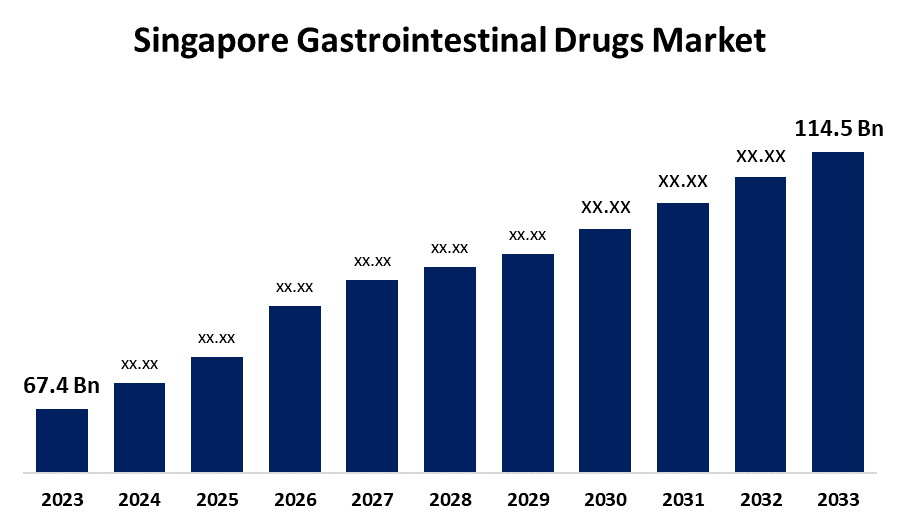

- The Singapore Gastrointestinal Drugs Market Size was valued at USD 67.4 Million in 2023.

- The Market Size is Growing at a CAGR of 5.44% from 2023 to 2033

- The Singapore Gastrointestinal Drugs Market Size is expected to reach USD 114.5 Million by 2033

Get more details on this report -

The Singapore Gastrointestinal Drugs Market Size is anticipated to Exceed USD 114.5 Million by 2033,Growing at a CAGR of 5.44% from 2023 to 2033. The increasing prevalence of gastrointestinal disorders, the aging population, and changing lifestyle & dietary habits are driving the growth of the gastrointestinal drugs market in Singapore.

Market Overview

Gastrointestinal drugs used to treat gastrointestinal disorders are intended to reduce symptoms, enhance the general health of the gastrointestinal system, and improve the lives of those who are impacted. The commonly used drugs for treating gastrointestinal disorders include antiemetics, promotility drugs, laxatives, and antimotility drugs, which are prescribed in various outpatient clinics, emergency departments, and intensive care units. The market growth is attributed to the rising prevalence of gastrointestinal disorders, such as inflammatory bowel disease (IBD) and irritable bowel syndrome (IBS). Further, the market demand for these medications is bolstered by the expanding public health concerns of acute gastrointestinal sickness (AGI), which has multiple pathogen origins and routes of transmission. The increasing research and development for creating novel and innovative drug therapies for the treatment of gastrointestinal disorders is providing lucrative market opportunities for gastrointestinal drugs.

Report Coverage

This research report categorizes the market for the Singapore gastrointestinal drugs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore gastrointestinal drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore gastrointestinal drugs market.

Singapore Gastrointestinal Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.44% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 167 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Drug Class, By Route of Administration, By Application, By Distribution Channel |

| Companies covered:: | Pfizer Inc., Johnson & Johnson, AbbVie Inc., Takeda Pharmaceutical Company Limited, AstraZeneca PLC, GlaxoSmithKline plc, Eli Lilly and Company, Merck & Co., Inc., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Gastroesophageal reflux disease (GERD), inflammatory bowel disease (IBD), irritable bowel syndrome (IBS), and gastrointestinal malignancies are among the gastrointestinal illnesses that are driving the market growth. Environmental causes, sedentary lifestyles, and poor diets all contribute to the rise in prevalence, which fuels the market expansion by generating a persistent need for efficient therapies. Further, the larger percentage of senior people who are more prone to gastrointestinal disorders contributes to driving the market demand.

Restraining Factors

The stringent regulatory policies that are responsible for delaying the approval and launch of new gastrointestinal drugs are restraining the Singapore gastrointestinal drugs market. Further, the potential side effects and safety concerns regarding gastrointestinal drug medications may negatively affect the market growth.

Market Segmentation

The Singapore Gastrointestinal Drugs Market share is classified into drug class, route of administration, application, and distribution channel.

- The biologics segment is anticipated to hold the largest market share during the forecast period.

The Singapore gastrointestinal drugs market is segmented by drug class into biologics, antidiarrheal & laxatives, acid neutralizers, anti-inflammatory drugs, antiemetic & antinauseants, and others. Among these, the biologics segment is anticipated to hold the largest market share during the forecast period. Biologics treatment offers an alternative standard treatment and lowers the risk of surgery. The increasing prescription of biological medications and innovation in gastrointestinal therapeutic medications are driving the market growth.

- The oral segment dominated the Singapore gastrointestinal drugs market with the largest market share in 2023.

Based on the route of administration, the Singapore gastrointestinal drugs market is divided into oral and parenteral. Among these, the oral segment dominated the Singapore gastrointestinal drugs market with the largest market share in 2023. Oral administration is the patient-friendly route and is intended for localized action within the gastrointestinal tract. The simplicity of use, accessibility, and affordability of oral gastrointestinal drugs are driving the market in the oral segment.

- The irritable bowel syndrome segment accounted for the largest market share during the forecast period.

The Singapore gastrointestinal drugs market is segmented by application into irritable bowel syndrome, ulcerative colitis, Crohn’s disease, gastroenteritis, celiac disease, and others. Among these, the irritable bowel syndrome segment accounted for the largest market share during the forecast period. Some of the medications used to treat irritable bowel syndrome are dicyclomine, hyocyamine, lubiprostone, linaclotide, and rifaximin. The increasing consumption of unhealthy food and rising stress levels among consumers are responsible for driving the market demand in the irritable bowel syndrome.

- The hospital pharmacies segment held the largest revenue share of the Singapore gastrointestinal drugs market in 2023.

Based on the distribution channel, the Singapore gastrointestinal drugs market is divided into hospital pharmacies, retail pharmacies, and online pharmacies. Among these, the hospital pharmacies segment held the largest revenue share of the Singapore gastrointestinal drugs market in 2023. The surging personalized healthcare services in hospitals are propelling the market growth in the hospital pharmacies segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore gastrointestinal drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pfizer Inc.

- Johnson & Johnson

- AbbVie Inc.

- Takeda Pharmaceutical Company Limited

- AstraZeneca PLC

- GlaxoSmithKline plc

- Eli Lilly and Company

- Merck & Co., Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Singapore-based Strides Pharma Global Pte. Ltd. received approval for the generic version of Sucralfate Oral Suspension, 1gm/10 mL, from the US Food & Drug Administration (USFDA), the drug firm said in a statement.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Gastrointestinal Drugs Market based on the below-mentioned segments:

Singapore Gastrointestinal Drugs Market, By Drug Class

- Biologics

- Antidiarrheal & Laxatives

- Acid Neutralizers

- Anti-Inflammatory Drugs

- Antiemetic & Antinauseants

- Others

Singapore Gastrointestinal Drugs Market, By Route of Administration

- Oral

- Parenteral

Singapore Gastrointestinal Drugs Market, By Application

- Irritable Bowel Syndrome

- Ulcerative Colitis

- Crohn’s Disease

- Gastroenteritis

- Celiac Disease

- Others

Singapore Gastrointestinal Drugs Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Need help to buy this report?