Singapore Infant Formula Market Size, Share, and COVID-19 Impact Analysis, By Form (Ready to Feed, Powder, and Liquid Concentrate), By Formulation (Cow’s Milk Based, Soy Based, Hypoallergenic, and Others), By Distribution Channel (Hypermarkets/Supermarkets, Pharmacy/Medical Stores, Specialty Stores, and Others), and Singapore Infant Formula Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesSingapore Infant Formula Market Insights Forecasts to 2033

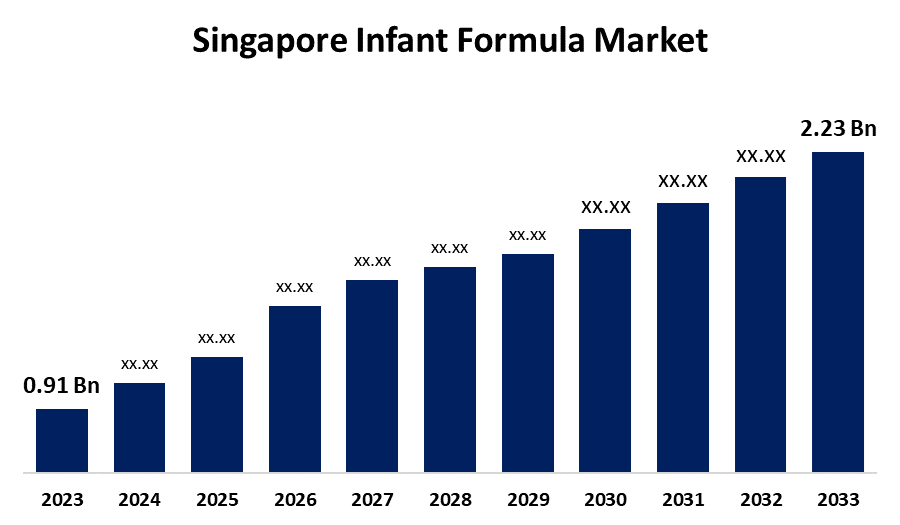

- The Singapore Infant Formula Market Size was valued at USD 0.91 Billion in 2023.

- The Market is growing at a CAGR of 9.38% from 2023 to 2033

- The Singapore Infant Formula Market Size is expected to reach USD 2.23 Billion by 2033

Get more details on this report -

The Singapore Infant Formula Market is anticipated to exceed USD 2.23 Billion by 2033, growing at a CAGR of 9.38% from 2023 to 2033. The increasing female workforce and high disposable income are driving the growth of the infant formula market in Singapore.

Market Overview

Infant formula is a human milk alternative intended for feeding infants (i.e. children up to 12 months of age). The nutritional composition of infant formula is specifically created to nearly resemble that of breast milk as feasible. The WHO has recommended that the nutritional value of infant formula sold in Singapore be followed. There are various forms that baby milk and infant formula can be purchased in, including powdered, liquid concentrate, and ready-to-feed forms. Carbohydrates, protein, fat as well as vitamins and minerals are the essential ingredients of infant formula that meet the needs of a growing infant. The advancements in the development of infant formula that better nourishes babies include synthetically engineered human milk oligosaccharides by using bioengineering new techniques, new extraction technologies for milk fat globule membranes, and the use of sophisticated processing technology are driving the lucrative market growth.

Report Coverage

This research report categorizes the market for the Singapore infant formula market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore infant formula market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore infant formula market.

Singapore Infant Formula Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.91 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.38% |

| 2033 Value Projection: | USD 2.23 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Form, By Formulation, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Little Etoile, Bellamy’s Organic, Similac, Enfamil, Nan Nestle, Friso Gold, Karihome, Little Oak, Dumex, Hipp, and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing female workforce surges the need for convenient packaged infant feed as they are easy to prepare, thereby driving the market demand. Further, the growing dual-income households and rising disposable incomes are responsible for propelling the market growth. In addition, the rising awareness about baby nutrition is driving the market demand for infant formula.

Restraining Factors

The stringent regulations associated with product quality, labeling, and advertising are challenging the Singapore infant formula market as these factors lead to increased operational costs for product manufacturing.

Market Segmentation

The Singapore Infant Formula Market share is classified into form, formulation, and distribution channel.

- The powder segment is anticipated to hold the largest market share during the forecast period.

The Singapore infant formula market is segmented by form into ready to feed, powder, and liquid concentrate. Among these, the powder segment is anticipated to hold the largest market share during the forecast period. Powdered form of infant formula is most preferably used by parents due to its ease of storage, affordability, and convenience. Accurate amount of infant formula can be controlled and measured. The increasing urbanization and rising disposable income are contributing to driving the market growth.

- The cow’s milk based segment accounted for the largest market share during the forecast period.

The Singapore infant formula market is segmented by formulation into cow’s milk based, soy based, hypoallergenic, and others. Among these, the cow’s milk based segment accounted for the largest market share during the forecast period. The cow’s milk containing infant formula are most commonly used infant formula containing whey protein and casein as a protein source. The country’s increased number of birth rates is responsible for driving market demand for infant formula.

- The hypermarkets/supermarkets segment dominated the Singapore infant formula market with the largest market share during the forecast period.

Based on the distribution channel, the Singapore infant formula market is divided into hypermarkets/supermarkets, pharmacy/medical stores, specialty stores, and others. Among these, the hypermarkets/supermarkets segment dominated the Singapore infant formula market with the largest market share during the forecast period. Hypermarkets/Supermarkets provide a single shopping experience. The availability of a large range of infant formula milk powders in supermarkets for accommodating various needs and preferences is driving the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore infant formula market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Little Etoile

- Bellamy’s Organic

- Similac

- Enfamil

- Nan Nestle

- Friso Gold

- Karihome

- Little Oak

- Dumex

- Hipp

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, The Singapore Food Agency (SFA) proposed amendments to federal regulations that would allow the use of new ingredients in infant formula, and would also extend the use of permitted food ingredients.

- In October 2023, Nestle launched a new proprietary blend for infant nutrition combination of probiotic strain with six human milk oligosaccharides (HMOs) for the development of an infant through its life stages.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Infant Formula Market based on the below-mentioned segments:

Singapore Infant Formula Market, By Form

- Ready to Feed

- Powder

- Liquid Concentrate

Singapore Infant Formula Market, By Formulation

- Cow’s Milk Based

- Soy Based

- Hypoallergenic

- Others

Singapore Infant Formula Market, By Distribution Channel

- Hypermarkets/Supermarkets

- Pharmacy/Medical Stores

- Specialty Stores

- Others

Need help to buy this report?