Singapore Nutritional Supplements Market Size, Share, and COVID-19 Impact Analysis, By Product (Sports Nutrition, Dietary Supplements, and Functional Foods & Beverages), By Consumer Group (Infants, Children, Adults, Pregnant, and Geriatric), By Formulation (Tablets, Capsules, Powder, Softgels, Liquid, and Others), By Sales Channel (Brick & Mortar and E-commerce), and Singapore Nutritional Supplements Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareSingapore Nutritional Supplements Market Insights Forecasts to 2033

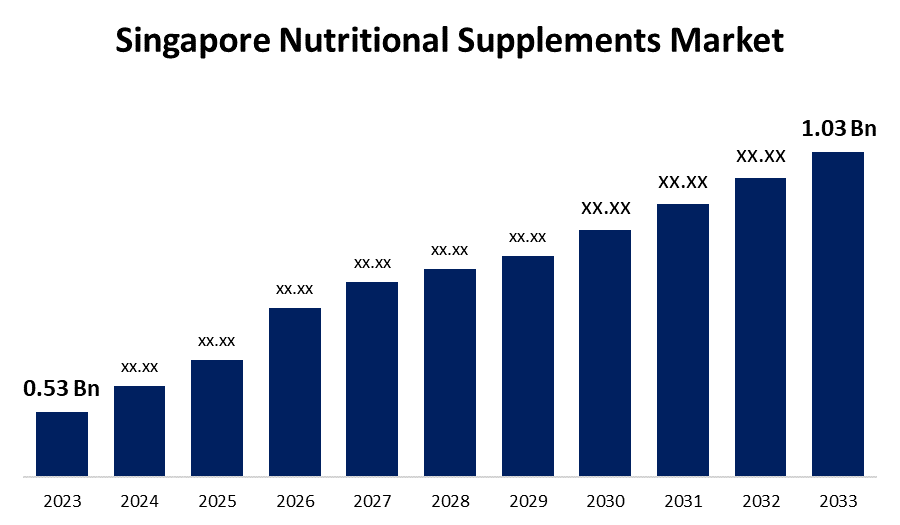

- The Singapore Nutritional Supplements Market Size was valued at USD 0.53 Billion in 2023.

- The Market Size is Growing at a CAGR of 6.87% from 2023 to 2033

- The Singapore Nutritional Supplements Market Size is expected to reach USD 1.03 Billion by 2033

Get more details on this report -

The Singapore Nutritional Supplements Market Size is anticipated to exceed USD 1.03 Billion by 2033, Growing at a CAGR of 6.87% from 2023 to 2033. The increasing health consciousness, spending on nutrition & dietary supplements, and growing focus on wellness are driving the growth of the nutritional supplements market in Singapore.

Market Overview

Nutritional supplements are dietary supplements that contain vitamins, minerals, herbs, or amino acids. These are taken to complement a healthy diet, promote wellness, and reduce the risk of some health conditions. There are various forms of nutritional supplements, including pills, capsules, liquids, gummies, and soft gels. These are safe, affordable, and natural methods of getting the body back to its normal functioning. The increasing consumer consciousness about health and the environment is responsible for driving the demand for sustainable sourcing. Thus, there is rising demand for supplements derived from natural or organic ingredients, free of chemical additives, and produced sustainably. Furthermore, athletes and fitness enthusiasts are served with sports nutrition items, such as energy bars and protein supplements. The growing demand for nutritional assistance among active individuals and more health consciousness is driving the market's expansion.

Report Coverage

This research report categorizes the market for the Singapore nutritional supplements market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore nutritional supplements market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore nutritional supplements market.

Singapore Nutritional Supplements Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.53 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.87% |

| 2033 Value Projection: | USD 1.03 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Consumer Group, By Formulation, By Sales Channel. |

| Companies covered:: | Eu Yan Sang International, Bio-Life Science Group, Best World International, Blackmores, Amway, GNC, Nestle, Vitacare, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing prioritization on health and wellness among the millennial population upsurging market demand for nutritional supplements. The sales value of the vitamins and dietary supplements industry in Singapore was 531.4 million Singapore dollars in 2017 which was estimated to increase to 612.7 million Singapore dollars by 2022. The rising awareness about the significance of fitness and a balanced nutrient among Singapore people is contributing to propelling the market demand for nutritional supplements. The upsurging wellness sector in Singapore is enhanced by government interventions to nurture healthier nations and a flourishing economy is responsible for propelling the market for nutritional supplements.

Restraining Factors

The growing consumer skepticism about these supplements brought on by a lack of experimental data, deceptive advertising, and strict regulations are challenging the nutritional supplements market.

Market Segmentation

The Singapore Nutritional Supplements Market share is classified into product, consumer group, formulation, and sales channel.

- The functional foods & beverages segment accounted for the largest revenue share of the Singapore nutritional supplements market in 2023.

The Singapore nutritional supplements market is segmented by product into sports nutrition, dietary supplements, and functional foods & beverages. Among these, the functional foods & beverages segment accounted for the largest revenue share of the Singapore nutritional supplements market in 2023. Functional foods & beverages are abundant providers of proteins, carbs, vitamins, and dietary fiber, providing possible health advantages beyond simple nourishment. Certain nutrients offered by functional foods & beverages to fill up nutritional deficiencies and promote health and fitness are driving the market in the functional foods & beverages segment.

- The adults segment dominated the market with the largest market share in 2023.

Based on the consumer group, the Singapore nutritional supplements market is divided into infants, children, adults, pregnant, and geriatric. Among these, the adults segment dominated the market with the largest market share in 2023. In March 2022, Rakuten Insight conducted a poll in Singapore on dietary supplements and found that 58% of participants in the 35–44 age group said they consumed supplements. Regular gyming activities and sports among adults segment are responsible for driving the market growth in the adults segment.

- The powder segment dominated the Singapore nutritional supplements market with the largest market share in 2023.

Based on the formulation, the Singapore nutritional supplements market is divided into tablets, capsules, powder, softgels, liquid, and others. Among these, the powder segment dominated the Singapore nutritional supplements market with the largest market share in 2023. Protein powders, food flavorings, and vitamin supplements are the various powered forms of nutritional supplements. Powdered supplements are one of the most popular types of nutritional supplements, aside from pill-based ones. The increased use of powdered supplements due to their longer shelf life is responsible for driving the market.

- The brick & mortar segment held the largest revenue share of the Singapore nutritional supplements market in 2023.

The Singapore nutritional supplements market is segmented by sales channel into brick & mortar and e-commerce. Among these, the brick & mortar segment held the largest revenue share of the Singapore nutritional supplements market in 2023. The increased retail locations are marketing and selling nutritional supplements. To access a larger consumer base, the players have been making large investments in constructing physical storefronts. The ease of availability of a range of products under one roof is driving the market in the brick & mortar segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore nutritional supplements market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eu Yan Sang International

- Bio-Life Science Group

- Best World International

- Blackmores

- Amway

- GNC

- Nestle

- Vitacare

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2024, Health and beauty retailer Watsons Singapore partnered with GNC to respond to the growing demand for premium health supplements amongst health-conscious consumers.

- In June 2023, Webuy Global Ltd., a Southeast Asian community e-commerce retailer, announced its entry into the nutraceutical and longevity markets with the launch of NEONE, a premium health supplement brand committed to delivering high-quality nutritional supplements and health products.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Nutritional Supplements Market based on the below-mentioned segments:

Singapore Nutritional Supplements Market, By Product

- Sports Nutrition

- Dietary Supplements

- Functional Foods & Beverages

Singapore Nutritional Supplements Market, By Consumer Group

- Infants

- Children

- Adults

- Pregnant

- Geriatric

Singapore Nutritional Supplements Market, By Formulation

- Tablets

- Capsules

- Powder

- Softgels

- Liquid

- Others

Singapore Nutritional Supplements Market, By Sales Channel

- Brick & Mortar

- E-commerce

Need help to buy this report?