Singapore Online Insurance Market Size, Share, and COVID-19 Impact Analysis, By Insurance type (Life Insurance, Motor Insurance, Health Insurance), By Enterprise Size (Large Enterprises, SMEs), By End User (Insurance Companies, Aggregators, Third Party Administrators and Brokers), and Singapore Online Insurance Market Insights, Industry Trend, Forecasts to 2032

Industry: Banking & FinancialSingapore Online Insurance Market Insights Forecasts to 2032

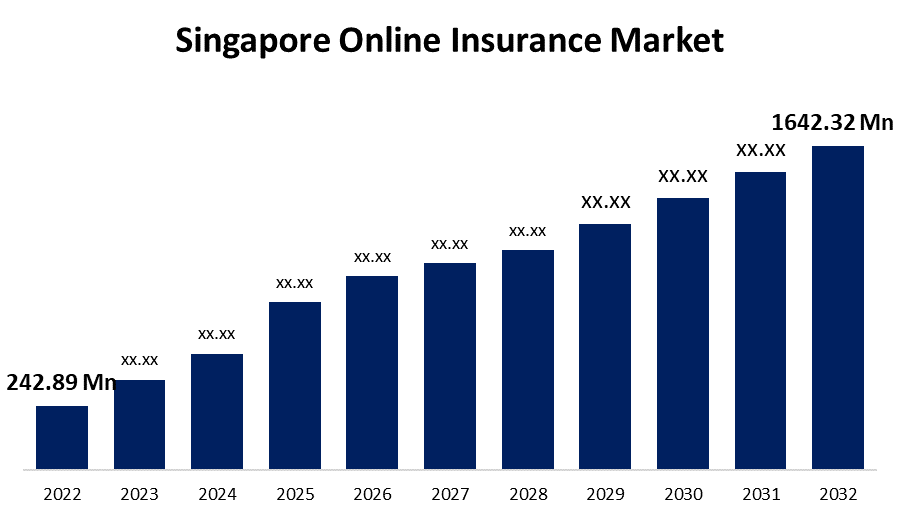

- The Singapore Online Insurance Market Size was valued at USD 242.89 Million in 2022.

- The Market is Growing at a CAGR of 21.06% from 2022 to 2032

- The Singapore Online Insurance Market Size is expected to reach USD 1642.32 Million by 2032

Get more details on this report -

The Singapore Online Insurance Market Size is anticipated to exceed USD 1642.32 Million by 2032, Growing at a CAGR of 21.06% from 2022 to 2032.

Market Overview

The Singapore online insurance market has experienced significant growth and transformation, reflecting the broader global trend towards digitalization in the financial services sector. As a hub for technological innovation and financial services in Southeast Asia, Singapore has become a focal point for the evolution of online insurance solutions. The market is characterized by a diverse range of insurance products and services offered through digital platforms, catering to the evolving needs of consumers and businesses. Insurtech companies, traditional insurers, and intermediaries have embraced online channels to streamline the insurance process, enhance customer experience, and leverage data analytics for more personalized offerings. In recent years, the Singapore online insurance market has witnessed a surge in demand for various coverage types, including life insurance, health insurance, motor insurance, and property insurance. The convenience of online platforms has played a pivotal role in driving customer adoption, allowing users to compare policies, obtain quotes, and purchase coverage seamlessly.

Report Coverage

This research report categorizes the market for the Singapore online insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the online insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the online insurance market.

Singapore Online Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 242.89 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 21.06% |

| 2032 Value Projection: | USD 1642.32 Million |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Insurance type, By Enterprise Size, By End User |

| Companies covered:: | FWD Insurance, AXA Insurance, AIA Singapore, Prudential Assurance Company, Singlife with Aviva, Manulife Singapore, HSBC Singapore, Singapore Life, St. James's Place, Swiss Life (Singapore) Pte Ltd, and Others Key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Singapore boasts a highly tech-savvy population with widespread internet access and high smartphone penetration. This technological proficiency among consumers has fueled the adoption of online insurance platforms, as individuals seek the convenience of digital channels for policy research, comparison, and purchase. The Singaporean government has actively supported the growth of the fintech and insurtech sectors, fostering a conducive environment for innovation. Regulatory frameworks have adapted to accommodate digital advancements, ensuring a balance between promoting technological innovation and safeguarding consumer interests. This support encourages both traditional insurers and startups to invest in online platforms.

Restraining Factors

As the online insurance market expands, ensuring the security of sensitive personal and financial information becomes paramount. Concerns about data breaches, cyber-attacks, and the misuse of customer data may hinder the full-scale adoption of online insurance platforms, particularly among individuals who are cautious about online transactions.

Market Segmentation

The Singapore Online Insurance Market share is classified into insurance type and enterprise size.

- The Life Insurance segment is expected to account for largest share of the Singapore online insurance market during the forecast period.

The Singapore online insurance market is segmented by type into Life Insurance, Motor Insurance, Health Insurance. Among these, the life insurance segment is expected to account for largest share of the Singapore online insurance market during the forecast period. In the Singapore online insurance market, life insurance products are prominently featured due to the growing awareness of financial planning and the need for protection. Online platforms offer a range of life insurance products, including term life, whole life, and investment-linked plans. The ease of comparing policies, obtaining quotes, and completing the application process online appeals to consumers seeking comprehensive coverage for themselves and their families.

- The Large Enterprises segment accounted for a significant share of the Singapore online insurance market in 2022.

Based on the offering, the Singapore online insurance market is divided into Large Enterprises, SMEs. Among these, the Large Enterprises segment accounted for a significant share of the Singapore online insurance market in 2022. In the Singapore online insurance market, large enterprises represent a significant segment, especially for corporate insurance solutions. Large companies often seek comprehensive insurance coverage for various risks, including property, liability, employee benefits, and business interruption. Online platforms provide these enterprises with the convenience of managing multiple insurance policies in a centralized manner. Additionally, large enterprises may leverage online tools for risk assessment, policy customization, and efficient claims processing. The digitalization of corporate insurance enhances transparency, facilitates compliance, and streamlines communication between insurers and large businesses.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore online insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- FWD Insurance

- AXA Insurance

- AIA Singapore

- Prudential Assurance Company

- Singlife with Aviva

- Manulife Singapore

- HSBC Singapore

- Singapore Life

- St. James's Place

- Swiss Life (Singapore) Pte Ltd

- Others key vendors

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Singapore Online Insurance Market based on the below-mentioned segments:

Singapore Online Insurance Market, By Insurance Type

- Life Insurance

- Motor Insurance

- Health Insurance

Singapore Online Insurance Market, By Enterprise Size

- Life Insurance

- Motor Insurance

- Health Insurance

Singapore Online Insurance Market, By End User

- Insurance Companies

- Aggregators

- Third Party Administrators & Brokers

Need help to buy this report?