Singapore Oral Care Market Size, Share, and COVID-19 Impact Analysis, By Product (Toothbrush, Toothpaste, Mouthwash/Rinse, Denture Products, and Dental Accessories), By Distribution Channel (Hypermarkets/Supermarkets, Pharmacies & drug stores, Convenience Stores, Online retail stores, and Others), and Singapore Oral Care Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareSingapore Oral Care Market Insights Forecasts to 2033

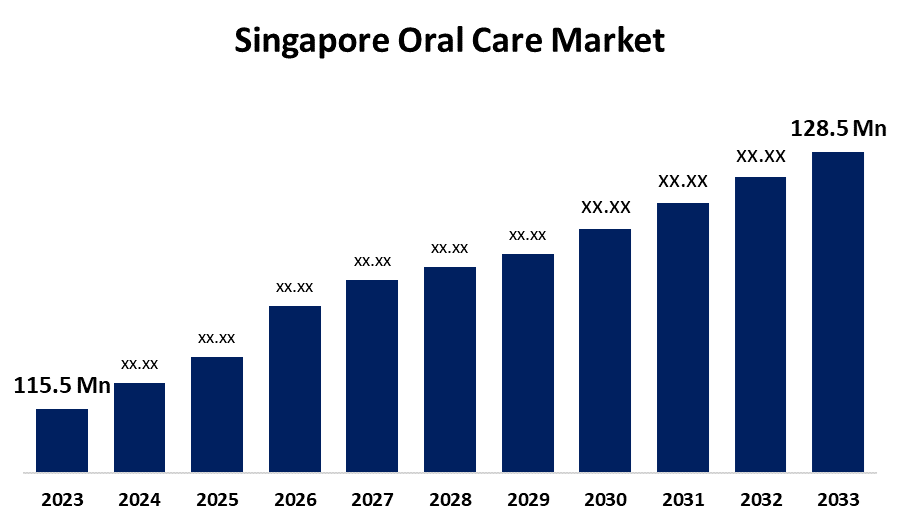

- The Singapore Oral Care Market Size was valued at USD 115.5 Million in 2023.

- The Market is growing at a CAGR of 1.07% from 2023 to 2033

- The Singapore Oral Care Market Size is expected to reach USD 128.5 Million by 2033

Get more details on this report -

The Singapore Oral Care Market is anticipated to exceed USD 128.5 Million by 2033, growing at a CAGR of 1.07% from 2023 to 2033. The increasing prevalence of dental diseases, the rising number of dentists, and technological advancements in oral care products are driving the growth of the oral care market in the Singapore.

Market Overview

Oral care refers to the maintenance of oral hygiene & health, reducing tissue irritation, and controlling dental plaque levels, thereby keeping the mouth clean and disease-free. All items used for everyday oral hygiene, including toothpastes, mouth washes, manual toothbrushes, and floss, are included in the oral care segment as a personal care. As the market's demand for sustainable and environmentally friendly products grows, there is an increasing need for oral care products made with natural and organic ingredients. Additionally, Singapore's burgeoning tourist sector has been contributing to the industry's overall growth by increasing the availability of international brands at retail shops, which draw customers to them because of their superior quality and cutting-edge features. Sales figures for these product categories have benefited from easy accessibility through e-commerce websites, opening the door for increased revenue from both domestic and international clients.

Report Coverage

This research report categorizes the market for the Singapore oral care market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore oral care market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore oral care market.

Singapore Oral Care Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 115.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 1.07% |

| 2033 Value Projection: | USD 128.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Product, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Procter & Gamble, Johnson & Johnson, Colgate-Palmolive and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

As per the report by National dental Centre Singapore, oral conditions like tooth caries and periodontal disease are also very common in Singapore. 31 per cent of Singaporeans over 60 were fully edentulous, according to a recent research. The rapidly ageing population and higher prevalence of chronic oral conditions are significantly contributing to driving the market demand. By the end of 2022, roughly 540 dentists were working in the public healthcare system, up from about 400 in 2013. Thus, the increasing number of dentists to meet Singaporeans’ dental care needs is expected to propel the market. The technological advancements in oral care including digital X-rays and the advent of 3D printing in dental treatment are driving the market growth.

Restraining Factors

The occurrence of product recalls is hampering the Singapore oral care market. For instance, in december 2022, a batch of Vusimide (Furosemide) Oral Solution 10 mg/ml was recalled due to microbial contamination. Further, the adverse effects associated with teeth whitening products may be responsible for hindering the market growth.

Market Segmentation

The Singapore Oral Care Market share is classified into product and distribution channel.

- The toothbrush segment accounted for the largest revenue share of the Singapore oral care market in 2023.

The Singapore oral care market is segmented by product into toothbrush, toothpaste, mouthwash/rinse, denture products, and dental accessories. Among these, the toothbrush segment accounted for the largest revenue share of the Singapore oral care market in 2023. There is a surging emphasis on producing brushes of varied shapes and bristle sizes as per the consumer teeth brushing needs. The increasing use of electric toothbrushes and replacement toothbrush heads among Singaporeans is driving the market growth.

- The hypermarkets/supermarkets segment dominated the Singapore oral care market with the largest market share in 2023.

Based on the distribution channel, the Singapore oral care market is divided into hypermarkets/supermarkets, pharmacies & drug stores, convenience stores, online retail stores, and others. Among these, the hypermarkets/supermarkets segment dominated the Singapore oral care market with the largest market share in 2023. Hypermarkets/supermarkets are self-service store, providing a wide variety of oral care products. The presence of consumer stores and accessibility of oral care products are contributing to driving the market in the hypermarkets/supermarkets segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore oral care market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Procter & Gamble

- Johnson & Johnson

- Colgate-Palmolive

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, The National University Centre for Oral Health, Singapore (NUCOHS) shared its long-term plan for dental care innovations through digital technologies during its fifth-anniversary event.

- In February 2021, BDA Partners announced that its client, Kim Dental, Vietnam’s largest private dental care platform, has raised US$24m in a Series B round.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Oral Care Market based on the below-mentioned segments:

Singapore Oral Care Market, By Product

- Toothbrush

- Toothpaste

- Mouthwash/Rinse

- Denture Products

- Dental Accessories

Singapore Oral Care Market, By Distribution Channel

- Hypermarkets/Supermarkets

- Pharmacies & drug stores

- Convenience Stores

- Online retail stores

- Others

Need help to buy this report?