Singapore Pharmaceutical Solvent Market Size, Share, and COVID-19 Impact Analysis, By Product (Alcohol, Amine, Esters, Ethers, Aromatic Hydrocarbons, Chlorinated Solvents, Ketones, and Others), By Application (Active Pharmaceutical Ingredients (APIs), Formulations, Research & Development, and Others), and Singapore Pharmaceutical Solvent Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsSingapore Pharmaceutical Solvent Market Insights Forecasts to 2033

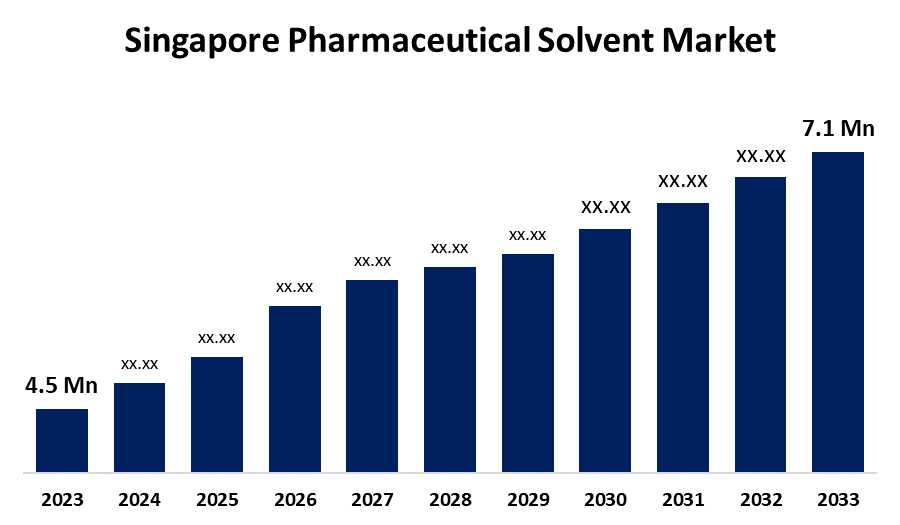

- The Singapore Pharmaceutical Solvent Market Size was valued at USD 4.5 Million in 2023.

- The Market Size is Growing at a CAGR of 4.67% from 2023 to 2033

- The Singapore Pharmaceutical Solvent Market Size is Expected to reach USD 7.1 Million by 2033

Get more details on this report -

The Singapore Pharmaceutical Solvent Market Size is anticipated to Exceed USD 7.1 Million by 2033, Growing at a CAGR of 4.67% from 2023 to 2033. The increasing demand for pharmaceuticals, rising incidences of chronic diseases, and demand for efficient & safe drug delivery systems are driving the growth of the pharmaceutical solvent market in the Singapore.

Market Overview

Pharmaceutical solvent is a liquid that is used for dissolution and dilution in pharmaceutical production such as solubilizing APIs for a wide range of delivery routes such as parenteral, oral, topical, ophthalmic, and optic delivery. These solvents are important in pharmaceutical processes performing a variety of functions, including the synthesis, extraction, purification, and formulation of medications and pharmaceutical products as they allow active pharmaceutical ingredients (API) and other excipients to dissolve, making it easier to create prescription formulations and preserve product stability. Further, they are also employed in purification and extraction processes. Based on their chemical property and intended use, pharmaceutical solvents can be divided into several types, including water, organic solvents, co-solvents, and solvent combinations. The increasing initiatives for promoting sustainability for pharmaceuticals and fine chemicals and the introduction of green solvents are providing lucrative market growth opportunities for pharmaceutical solvents. Further, the designing of a continuous solvent recovery system for end-to-end integrated continuous manufacturing in the pharmaceutical industry in order to achieve the goal of sustainable manufacturing promotes the pharmaceutical solvent market growth.

Report Coverage

This research report categorizes the market for the Singapore pharmaceutical solvent market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore pharmaceutical solvent market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore pharmaceutical solvent market.

Singapore Pharmaceutical Solvent Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 4.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.67% |

| 2033 Value Projection: | USD 7.1 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 158 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Royal Dutch Shell Plc, BASF SE, Brenntag SE, Merck KGaA, Dow, LyondellBasell Industries Holdings B.V., Exxon Mobil Corporation, DuPont, Clariant AG, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The evolving pharmaceutical industry in the country owing to the strong healthcare infrastructure and favorable government policies is responsible for driving the pharmaceutical solvent market. For instance, in August 2024, US drug giant Pfizer opened a 1 billion Singapore dollar ($740 million) facility to produce key ingredients for oncology medicines and others. In May, AstraZeneca pledges $1.5 billion to build its first Singapore site producing targeted chemotherapy drugs. The increasing demand for designing modern drug delivery systems with enhanced efficiency and safety is propelling the market demand for pharmaceutical solvent. In addition, the increasing prevalence and awareness of chronic diseases including cancer, diabetes, and others contribute to driving the market demand for pharmaceutical solvent.

Restraining Factors

The stringent environmental regulations in order to reduce the environmental and health risks associated with some hazardous solvents are challenging the market. The price fluctuations of materials like petrochemicals, alcohols, and other intermediates of pharmaceutical solvents may be responsible for hampering the market growth.

Market Segmentation

The Singapore Pharmaceutical Solvent Market share is classified into product and application.

- The alcohol segment is anticipated to hold the largest market share during the forecast period.

The Singapore pharmaceutical solvent market is segmented by product into alcohol, amine, esters, ethers, aromatic hydrocarbons, chlorinated solvents, ketones, and others. Among these, the alcohol segment is anticipated to hold the largest market share during the forecast period. Alcohol is a widely used solvent in various pharmaceutical processes. Ethanol, denatured ethanol, 1-propanol, and isopropyl alcohol are types of alcohol used in the pharmaceutical industry. The rising pharmaceutical industry with the growing use of industrial alcohol as a chemical intermediate is driving the market demand.

- The active pharmaceutical ingredients (APIs) segment accounted for the largest market share during the forecast period.

Based on the application, the Singapore pharmaceutical solvent market is divided into active pharmaceutical ingredients (APIs), formulations, research & development, and others. Among these, the active pharmaceutical ingredients (APIs) segment accounted for the largest market share during the forecast period. Several solvents are used in API manufacturing from synthesis to purification processes in the pharmaceutical industry. The increasing pharmaceutical R&D initiatives and production of active pharmaceutical ingredients with the increasing cases of chronic diseases are driving the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore pharmaceutical solvent market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Royal Dutch Shell Plc

- BASF SE

- Brenntag SE

- Merck KGaA

- Dow

- LyondellBasell Industries Holdings B.V.

- Exxon Mobil Corporation

- DuPont

- Clariant AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Pharmaceutical Solvent Market based on the below-mentioned segments:

Singapore Pharmaceutical Solvent Market, By Product

- Alcohol

- Amine

- Esters

- Ethers

- Aromatic Hydrocarbons

- Chlorinated Solvent

- Ketones

- Others

Singapore Pharmaceutical Solvent Market, By Application

- Active Pharmaceutical Ingredients (APIs)

- Formulations

- Research & Development

- Others

Need help to buy this report?