Singapore Probiotic Cosmetics Market Size, Share, and COVID-19 Impact Analysis, By Type (Skin Care Products, Hair Care Products, and Others), By Microbiome Species (Bacteria and Yeast), By Distribution Channel (Specialty Stores, Supermarkets/Hypermarkets, Convenience Stores, Online Retail, and Others), and Singapore Probiotic Cosmetics Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsSingapore Probiotic Cosmetics Market Insights Forecasts to 2033

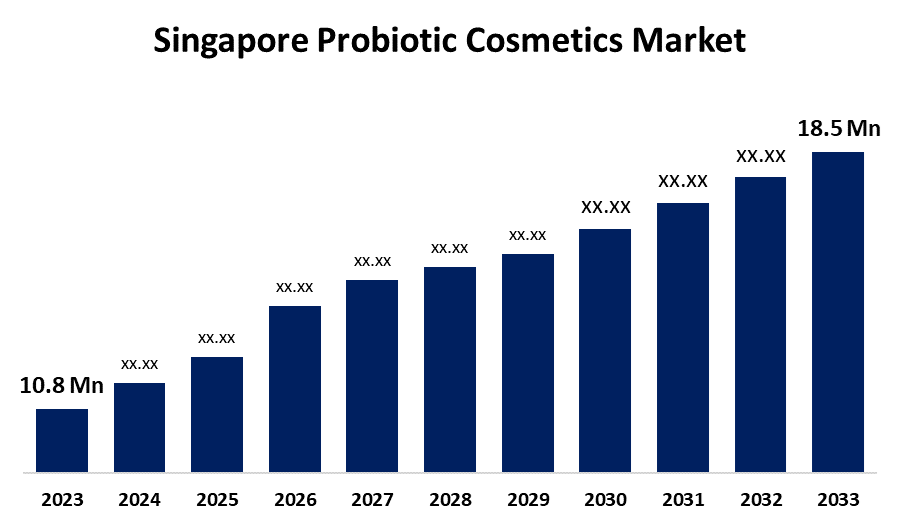

- The Singapore Probiotic Cosmetics Market Size was valued at USD 10.8 Million in 2023.

- The Market is growing at a CAGR of 5.53% from 2023 to 2033

- The Singapore Probiotic Cosmetics Market Size is expected to exceed USD 18.5 Million by 2033

Get more details on this report -

The Singapore Probiotic Cosmetics Market is anticipated to exceed USD 18.5 Million by 2033, growing at a CAGR of 5.53% from 2023 to 2033. The increasing demand for natural & skin-friendly products and the prevalence of skin conditions are driving the growth of the probiotic cosmetics market in the Singapore.

Market Overview

Probiotic cosmetics refers to the use of cosmetic products containing live microorganisms for improving skin health. By preserving a healthy microbiological balance, it can lessen the signs and symptoms of skin conditions. Probiotics have numerous advantages for the skin, according to an increasing number of research. The effects of probiotics on anti-aging, antioxidants, whitening, and anti-wrinkling have led to a rise in the use of probiotics in cosmetics products such as face creams, moisturizing lotions, tonics, body washes, hair products, and beauty masks. Market demand is being increased by the launch of novel formulations that combine probiotics with other cutting-edge products. The development of personalized and customized products that allow customers to tailor their skincare routines based on individual skin requirements is offering market opportunities.

Report Coverage

This research report categorizes the market for the Singapore probiotic cosmetics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore probiotic cosmetics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore probiotic cosmetics market.

Singapore Probiotic Cosmetics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 10.8 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.53% |

| 2033 Value Projection: | USD 18.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type, By Microbiome Species and COVID-19 Impact Analysis |

| Companies covered:: | Sigi Skin, Craft & Culture, Kew Organics, Strip Pte. Ltd., Two Lips and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing consumer preference for sustainable and eco-friendly beauty products is responsible for driving the probiotic cosmetics market. The increasing prevalence of skin disorders including dermatitis, acne vulgaris, viral skin diseases, and fungal skin diseases especially among the elderly population owing to the humid climate and urbanization is driving the market demand for probiotic cosmetics.

Restraining Factors

The high cost of raw materials required for the formulation of probiotic cosmetics is hampering the probiotic cosmetics market. Further, the stringent regulations which are a time-consuming and costly process for manufacturers are challenging the market.

Market Segmentation

The Singapore Probiotic Cosmetics Market share is classified into type, microbiome species, and distribution channel.

- The skin care products segment accounted for the largest revenue share in 2023.

Based on the type, the Singapore probiotic cosmetics market is divided into skin care products, hair care products, and others. Among these, the skin care products segment accounted for the largest revenue share in 2023. Probiotic skincare products contain live microorganisms that help maintain the beneficial balance of microbes, improving skin health. The increasing awareness of the health of skin and a demand for natural, efficient remedies are driving the market demand in the skin care products segment.

- The bacteria segment dominated the Singapore probiotic cosmetics market during the forecast period.

Based on the microbiome species, the Singapore probiotic cosmetics market is divided into bacteria and yeast. Among these, the bacteria segment dominated the Singapore probiotic cosmetics market during the forecast period. The benefits of live or lysate cultures of beneficial bacteria for skin and hair care are numerous and include anti-aging, acne prevention, scalp health, and hair strengthening, among other benefits. The emerging innovation including bacterial cellulose in the cosmetic sector is contributing to driving the market.

- The online retail segment is dominating the Singapore probiotic cosmetics market through the forecast period.

The Singapore probiotic cosmetics market is segmented by distribution channel into specialty stores, supermarkets/hypermarkets, convenience stores, online retail, and others. Among these, the online retail segment is dominating the Singapore probiotic cosmetics market through the forecast period. A wide range of cosmetic product options are available on online platforms with easy comparison of prices and reviews. The increasing tech-savvy population and smartphone usage are the factors propelling the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore probiotic cosmetics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sigi Skin

- Craft & Culture

- Kew Organics

- Strip Pte. Ltd.

- Two Lips

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2022, Singapore-based Sigi Skin care brand launched its first-ever serum with prebiotics, probiotics, and postbiotics to follow up on the success it had with its probiotic sheet mask.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Probiotic Cosmetics Market based on the below-mentioned segments:

Singapore Probiotic Cosmetics Market, By Type

- Skin Care Products

- Hair Care Products

- Others

Singapore Probiotic Cosmetics Market, By Microbiome Species

- Bacteria

- Yeast

Singapore Probiotic Cosmetics Market, By Distribution Channel

- Specialty Stores

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

Need help to buy this report?