Singapore Probiotic Drinks Market Size, Share, and COVID-19 Impact Analysis, By Drinks Type (Fruit-Based and Dairy-Based), By Bacteria (Lactobacillus, Streptococcus, and Bifidobacterium), By Distribution Channel (Store-Based and Non-Store-Based), and Singapore Probiotic Drinks Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesSingapore Probiotic Drinks Market Insights Forecasts to 2033

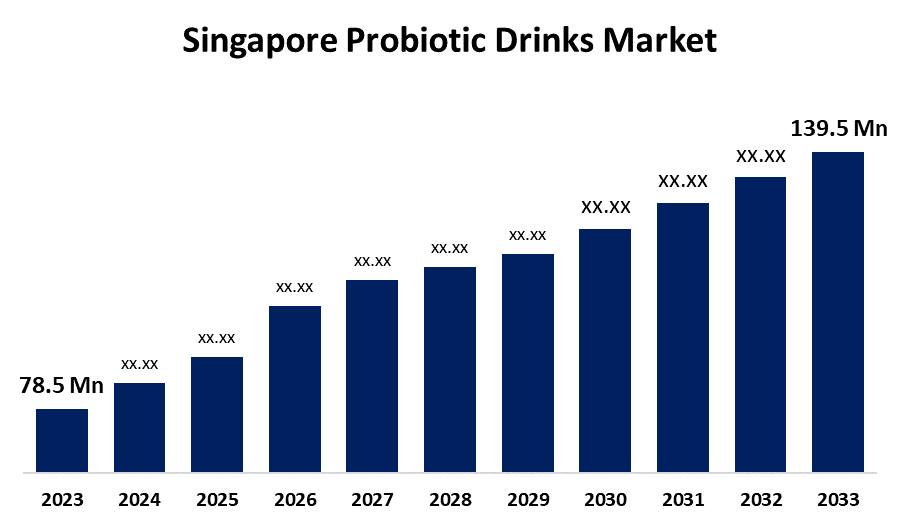

- The Singapore Probiotic Drinks Market Size was valued at USD 78.5 Million in 2023.

- The Market Size is Growing at a CAGR of 5.92% from 2023 to 2033

- The Singapore Probiotic Drinks Market Size is Expected to reach USD 139.5 Million by 2033

Get more details on this report -

The Singapore Probiotic Drinks Market Size is anticipated to Exceed USD 139.5 Million by 2033, Growing at a CAGR of 5.92% from 2023 to 2033. The increasing awareness about probiotic drinks and continuous innovations in probiotic drinks are driving the growth of the probiotic drinks market in Singapore.

Market Overview

Probiotic drinks are beverages containing live microorganisms, referred to as friendly or good bacteria that help balance the bacteria in the gut. The living microorganisms present in probiotic drinks aid in promoting health benefits. Functional drink manufacturers are promoting probiotic beverages because of their many health benefits and their accessibility to a wide range of tastes. Additionally, the industry is driven by millennials' eagerness to try new products for "quick health" advantages and the senior population's need for essential drinks and supplements. Thus, the increasing popularity of probiotic drinks as a healthy beverage among the millennial and senior population is driving the market growth opportunity. Furthermore, probiotic drinks made from yogurt are regarded as wholesome snacks in the nation since they offer a well-balanced amount of vitamins, minerals, and proteins. To provide a range of drinkable probiotic yogurts in various flavors, major firms are making significant investments in research and development (R&D).

Report Coverage

This research report categorizes the market for the Singapore probiotic drinks market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore probiotic drinks market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore probiotic drinks market.

Singapore Probiotic Drinks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 78.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.92% |

| 2033 Value Projection: | USD 139.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 161 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Drinks Type, By Bacteria, By Distribution Channel |

| Companies covered:: | Craft & Culture, Probiotics Kitchen, YOCHA Kombucha, The Grain Factory Pte Ltd., Fizzicle Kombucha & Kefir, Wild Boocha Kombucha, Tea Pulse Pte Ltd., Artisanal Yogurt, Wanting Kimchi, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

As per the recent beverage health trends, probiotics are being consumed every day by an increasing number of people in the country. The shifting consumer inclinations towards health and wellness are significantly responsible for driving the market. The launch of new probiotic drink variations by manufacturers as per different consumer preferences is promoting the market growth.

Restraining Factors

The challenges associated with stringent regulatory compliances are restraining the Singapore probiotic drinks market. Further, the maintenance of stability and shelf life of probiotic drink products are challenging the market.

Market Segmentation

The Singapore Probiotic Drinks Market share is classified into drinks type, bacteria, and distribution channel.

- The dairy-based segment accounted for the largest revenue share of the Singapore probiotic drinks market in 2023.

The Singapore probiotic drinks market is segmented by drinks type into fruit-based and dairy-based. Among these, the dairy-based segment accounted for the largest revenue share of the Singapore probiotic drinks market in 2023. Acidophilus milk, bifidus milk, acidophilus-yeast milk, and acidophilin are some of the examples of milk-based probiotic beverages. The surging focus on health & wellness, digestive health, and the introduction of various flavours & packaging are the factors contributing to driving the market growth.

- The lactobacillus segment is anticipated to grow at the fastest CAGR during the forecast period.

Based on the bacteria, the Singapore probiotic drinks market is divided into lactobacillus, streptococcus, and bifidobacterium. Among these, the lactobacillus segment is anticipated to grow at the fastest CAGR during the forecast period. Lactobacillus is commonly used for diarrhea, irritable bowel syndrome, overgrowth of bacteria in the vagina, and infection caused by H.pylori. The changing consumers drinking habits and consumption of natural food & beverage products are driving the market growth.

- The store-based segment dominated the Singapore probiotic drinks market with the largest market share in 2023.

Based on the distribution channel, the Singapore probiotic drinks market is divided into store-based and non-store-based. Among these, the store-based segment dominated the Singapore probiotic drinks market with the largest market share in 2023. Store-based segment is further bifurcated into supermarkets, hypermarkets, and convenience stores. The availability of range of probiotic drink products in physical stores is propelling the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore probiotic drinks market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Craft & Culture

- Probiotics Kitchen

- YOCHA Kombucha

- The Grain Factory Pte Ltd.

- Fizzicle Kombucha & Kefir

- Wild Boocha Kombucha

- Tea Pulse Pte Ltd.

- Artisanal Yogurt

- Wanting Kimchi

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Fonterra brand Nurture expanded its Digestion + probiotic drink range as it set sights on South East Asia.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Probiotic Drinks Market based on the below-mentioned segments:

Singapore Probiotic Drinks Market, By Drinks Type

- Fruit-Based

- Dairy-Based

Singapore Probiotic Drinks Market, By Bacteria

- Lactobacillus

- Streptococcus

- Bifidobacterium

Singapore Probiotic Drinks Market, By Distribution Channel

- Store-Based

- Non-Store-Based

Need help to buy this report?