Singapore Professional Hair Care Market Size, Share, and COVID-19 Impact Analysis, By Product (Coloring, Straightening & Perming, Shampoo & Conditioners, and Others), By Distribution Channel (Hypermarkets/Retail Chain, E-commerce, Salons, Pharmacy, Specialty Stores, and Others), and Singapore Professional Hair Care Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsSingapore Professional Hair Care Market Insights Forecasts to 2033

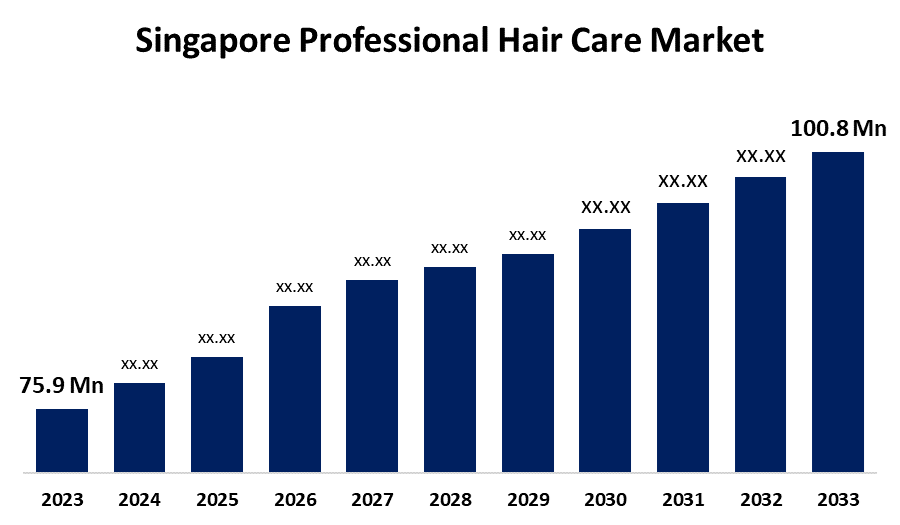

- The Singapore Professional Hair Care Market Size was valued at USD 75.9 Million in 2023.

- The Market is Growing at a CAGR of 2.88% from 2023 to 2033

- The Singapore Professional Hair Care Market Size is Expected to reach USD 100.8 Million by 2033

Get more details on this report -

The Singapore Professional Hair Care Market Size is anticipated to exceed USD 100.8 Million by 2033, Growing at a CAGR of 2.88% from 2023 to 2033. The increasing demand for chemical-free haircare products, increased consumer spending on personal care products, disposable income, and penetration of hair salons are driving the growth of the professional hair care market in Singapore.

Market Overview

Professional hair care offers a wide range of specialized products and services ranging from high-quality shampoos and conditioners to advanced styling techniques & tools to achieve desired hair looks and styles. The demand for gender-neutral and unisex products is expected to rise as luxury hair care firms shift toward unisex packaging in an effort to reach a wider audience, which is propelling the expansion of the professional hair care industry. With the growing disposable incomes, the advent of highly specialized shampoo and hair colorant products further increases demand for professional hair care. Additionally, the need for professional hair care services is anticipated to increase due to concerns about hair protection and the rising popularity of hair care services. The increased demand for organic and natural products, personalized hair care solutions, and rising e-commerce platforms are upsurging the market growth. Further, technological advancements in product formulations and sustainability efforts are enhancing innovation, especially for eco-conscious consumers.

Report Coverage

This research report categorizes the market for the Singapore professional hair care market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore professional hair care market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore professional hair care market.

Singapore Professional Hair Care Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 75.9 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 2.88% |

| 2033 Value Projection: | USD 100.8 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 211 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Distribution Channel and COVID-19 Impact Analysis. |

| Companies covered:: | L’Oreal, Unilever, Procter & Gamble, Kao Corporation, Henkel AG & Co. KGaA, Clairol Inc, Lion Corporation, Godrej Consumer Products, Oriflame Cosmetics, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The surging prioritization of sustainable and eco-friendly beauty products for personal health and planet well-being is driving the demand for chemical-free haircare products, thereby propelling the market growth. According to a 2020 Singaporean poll on beauty consumer behavior, 18.52 percent of participants said they often spend between $20 and $29 Singapore dollars each time they buy hair care items. The consumer spending on personal care products is driving the market growth. In cities, where people have more discretionary cash and are willing to spend it on high-end hair care products, are propelling the market for hair care. The penetration of hair salons from luxury, mid-range, and low-cost hair salons in Singapore each offering unique services and promotions is driving the market growth.

Restraining Factors

The high cost and limited availability of professional hair care products through the planned distribution channels are restraining the Singapore professional hair care market. The introduction of cheaper Chinese and Korean brands of hair care products is restraining the sales of professional products, thereby hampering the market growth.

Market Segmentation

The Singapore Professional Hair Care Market share is classified into product and distribution channel.

- The shampoo & conditioners segment is anticipated to hold the largest market share during the forecast period.

The Singapore professional hair care market is segmented by product into coloring, straightening & perming, shampoo & conditioners, and others. Among these, the shampoo & conditioners segment is anticipated to hold the largest market share during the forecast period. Shampoo & conditioner are hair care products that are used for cleaning and improving the texture of hair. The rising hair-related issues surge the need for hair nourishment products are driving the market demand in the shampoo & conditioners segment.

- The salons segment accounted for the largest market share during the forecast period.

The Singapore professional hair care market is segmented by distribution channel into hypermarkets/retail chain, e-commerce, salons, pharmacy, specialty stores, and others. Among these, the salons segment accounted for the largest market share during the forecast period. Franchise models have allowed salon chains to grow quickly while also drawing in new investors. The adoption of comprehensive strategies such as impactful online presence, compelling social media campaigns, and partnering with influencers to attract consumers are driving the market in the salons segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore professional hair care market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- L'Oreal

- Unilever

- Procter & Gamble

- Kao Corporation

- Henkel AG & Co. KGaA

- Clairol Inc

- Lion Corporation

- Godrej Consumer Products

- Oriflame Cosmetics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Wella Professionals, global hair care brand entered the e-commerce market in Singapore, to increase market presence, broaden customer reach, and keep ahead of stiff competition.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Professional Hair Care Market based on the below-mentioned segments:

Singapore Professional Hair Care Market, By Product

- Coloring

- Straightening & Perming

- Shampoo & Conditioners

- Others

Singapore Professional Hair Care Market, By Distribution Channel

- Hypermarkets/Retail Chain

- E-commerce

- Salons

- Pharmacy

- Specialty Stores

- Others

Need help to buy this report?