Singapore Ready-To-Eat (RTE) Food Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Instant Breakfast/Cereals, Instant Soups & Snacks, Ready Meals, Baked Goods, Meat Products, and Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Food Specialty Stores, Department Stores, Online Retailers, and Others), and Singapore Ready-To-Eat (RTE) Food Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesSingapore Ready-To-Eat (RTE) Food Market Insights Forecasts to 2033

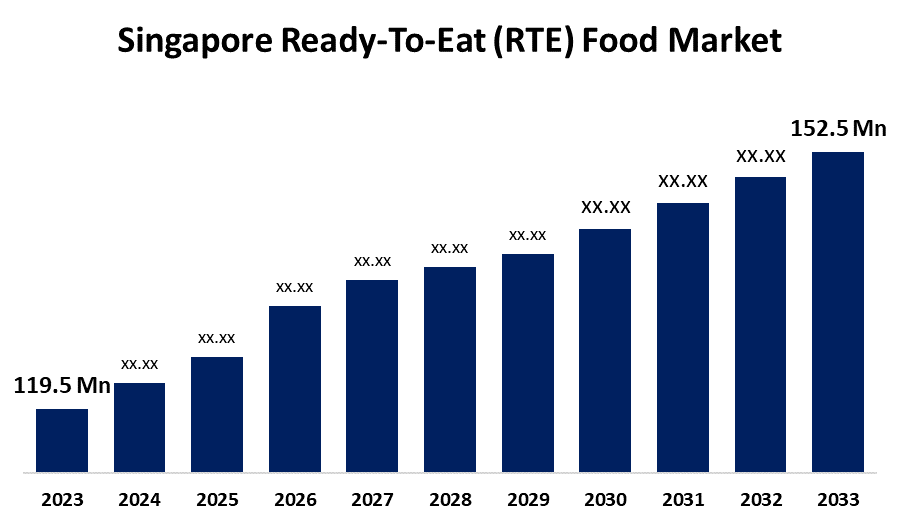

- The Singapore Ready-To-Eat (RTE) Food Market Size was valued at USD 119.5 Million in 2023.

- The Market Size is Growing at a CAGR of 2.47% from 2023 to 2033

- The Singapore Ready-To-Eat (RTE) Food Market Size is expected to reach USD 152.5 Million by 2033

Get more details on this report -

The Singapore Ready-To-Eat (RTE) Food Market Size is anticipated to Exceed USD 152.5 Million by 2033, Growing at a CAGR of 2.47% from 2023 to 2033. The increasing urbanization and shifting consumer preferences are driving the growth of the ready-to-eat (RTE) food market in the Singapore.

Market Overview

Ready-to-eat (RTE) food is a food products that are precooked and prepacked, requiring no further preparation or cooking. In the fast paced lifestyle of Singaporeans, there is surging need for pre-packaged, fully cooked, and conveniently consumable food products that are available at wide range in various channels including supermarkets, convenience stores, and online platforms. The growing number of youths, working-class people, and hostel occupants are responsible for driving the market demand as they are increasingly substituting ready to eat meals for traditional meals. The vegan based ready to eat meals are in trend. Singapore is known to be the second most vegan friendly city in Asia with more than one in every 20 people follow vegan diet. The increasing preference for vegetarian is due to ethical dietary preferences. In addition, there is increasing demand for high protein RTE food products among the fitness enthusiasts in order to increase protein intake.

Report Coverage

This research report categorizes the market for the Singapore ready-to-eat (RTE) food market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore ready-to-eat (RTE) food market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore ready-to-eat (RTE) food market.

Singapore Ready-To-Eat (RTE) Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 119.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.47% |

| 2033 Value Projection: | USD 152.5 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product Type, By Distribution Channel and COVID-19 Impact Analysis. |

| Companies covered:: | PepsiCo Inc., Nestle, Kellogg Co., General Mills Inc., Prima Taste, Gozen Pte. Ltd., JR Foods Pte. Ltd., Pondok Abang, Food Box, Health Food Matters, McCain Foods, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Due to shifting social and economic trends as well as rising food and beverage costs, there is a growing need for quick and easy meals, especially instant pasta, rice, snacks, and meat items. Further, the rising number of working individuals and urbanization with the significant increase in middle-class population are responsible for driving the market.

Restraining Factors

The stringent regulations on food and beverages for maintaining the safety and quality of RTE foods is challenging the Singapore ready-to-eat (RTE) food market.

Market Segmentation

The Singapore Ready-To-Eat (RTE) Food Market share is classified into product type and distribution channel.

- The ready meals segment dominated the market with the largest market share during the forecast period.

The Singapore ready-to-eat (RTE) food market is segmented by product type into instant breakfast/cereals, instant soups & snacks, ready meals, baked goods, meat products, and others. Among these, the ready meals segment dominated the market with the largest market share during the forecast period. Ready meals are the pre-cooked meals that are available in supermarket and are only need to heat, thus require less time. The convenient use and time saving preparation of these meals are driving the market.

- The hypermarkets/supermarkets segment dominated the Singapore ready-to-eat (RTE) food market during the forecast period.

Based on the distribution channel, the Singapore ready-to-eat (RTE) food market is divided into hypermarkets/supermarkets, convenience stores, food specialty stores, department stores, online retailers, and others. Among these, the hypermarkets/supermarkets segment dominated the Singapore ready-to-eat (RTE) food market during the forecast period. Hypermarkets/supermarkets are one stop shopping experience that combines convenience, variety, ad competitive pricing. The availability of wide range of consumer needs in hypermarkets/ supermarkets drive the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore ready-to-eat (RTE) food market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PepsiCo Inc.

- Nestle

- Kellogg Co.

- General Mills Inc.

- Prima Taste

- Gozen Pte. Ltd.

- JR Foods Pte. Ltd.

- Pondok Abang

- Food Box

- Health Food Matters

- McCain Foods

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2022, Food manufacturing group OTS Holdings has launched a new plant-based, ready-to-eat food brand ANEW, which aims to deliver quality, nutrition, and convenience to consumers with a taste of heritage, coupled with the tagline ’Better Food Forward’.

- In November 2021, 7-Eleven has partnered with Andes by Astons to exclusively launch their all-new range of ready-to-eat meals.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Ready-To-Eat (RTE) Food Market based on the below-mentioned segments:

Singapore Ready-To-Eat (RTE) Food Market, By Product Type

- Instant Breakfast/Cereals

- Instant Soups & Snacks

- Ready Meals

- Baked Goods

- Meat Products

- Others

Singapore Ready-To-Eat (RTE) Food Market, By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Food Specialty Stores

- Department Stores

- Online Retailers

- Others

Need help to buy this report?