Singapore Retail Market Size, Share, and COVID-19 Impact Analysis, By Product (Food & Beverages, Personal & Household Care, Apparel, Footwear & Accessories, Furniture, Toys & Hobby, Electronic & Household Appliances, and Others), By Distribution Channel (Hypermarkets, Supermarkets & Convenience Stores, Specialty Stores, Department Stores, E-commerce, and Others), and Singapore Retail Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsSingapore Retail Market Insights Forecasts to 2033

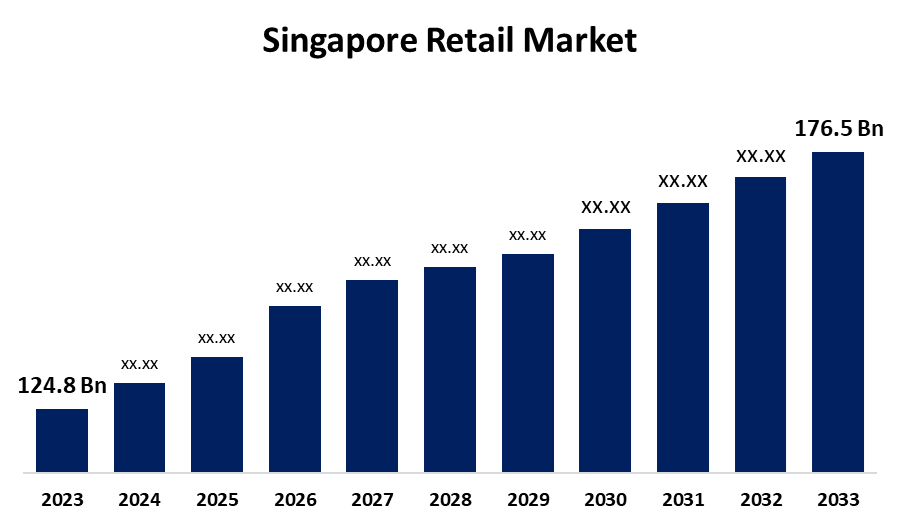

- The Singapore Retail Market Size was valued at USD 124.8 Billion in 2023.

- The Market is Growing at a CAGR of 3.53% from 2023 to 2033

- The Singapore Retail Market Size is Expected to Reach USD 176.5 Billion by 2033

Get more details on this report -

The Singapore Retail Market is Anticipated to Reach USD 176.5 Billion by 2033, growing at a CAGR of 3.53% from 2023 to 2033.

Market Overview

Singapore's retail market involves selling goods and services through various channels, including physical stores, e-commerce platforms, and direct sales. The market caters to a diverse range of consumers, including residents and tourists. The country's high economic performance and living standards support consumer spending, while the growth of e-commerce and omnichannel retailing expands businesses' reach. The rise in disposable income and the tech-savvy population has led to an increase in digital retail platforms. Tourist inflow, particularly from neighboring countries, generates significant retail sales, mainly in high-end products and fashion sectors. The government supports the retail market through programs like the Retail Industry Transformation Map (ITM) and the Smart Nation strategy, which promote digital technology integration and e-commerce. These initiatives, along with regulatory measures ensuring consumer protection, have ensured continued growth and competitiveness in Singapore's retail sector.

Report Coverage

This research report categorizes the market for the Singapore retail market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore retail market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore retail market.

Singapore Retail Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 124.8 Billion |

| Forecast Period: | 2023 – 2033. |

| Forecast Period CAGR 2023 – 2033. : | 3.53% |

| 023 – 2033. Value Projection: | USD 176.5 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Japan Foods Holding Ltd, Sheng Siong Group Ltd, Watsons, RedMart Ltd, ABR Holdings Ltd, NTUC, QAF Limited, U Stars, Dairy Farm International Holdings (DFI), Font Creative Pte Ltd., and Other Key Players |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis, |

Get more details on this report -

Driving Factors

A high-income populace, rising consumer spending, and solid economic fundamentals are the main drivers of the Singapore retail market's expansion. As a global financial hub, Singapore attracts both foreign visitors and expatriates who want to shop for luxury goods, fashion, and technology. Digital technologies have also enhanced shopping options by providing access to multiple platforms and making retail more convenient and accessible for customers. By enabling customers to purchase both online and offline, omnichannel commerce has further fueled industry growth. People in Singapore are digitally savvy, and the country's digital infrastructure supports the growing desire for easy, customized purchasing experiences.

Restraining Factors

The retail market faces challenges due to rising operating costs, particularly in prime retail space, and stiff competition from global online platforms. Local retailers must innovate and improve value propositions, while global events like pandemics and financial crises can negatively impact consumer confidence and spending patterns. Despite government initiatives supporting sector growth, these external factors may impede the overall pace of expansion in the retail market.

Market Segmentation

The Singapore retail market share is classified into product and distribution channel.

- The food & beverages segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Singapore retail market is segmented by product into food & beverages, personal & household care, apparel, footwear & accessories, furniture, toys & hobby, electronic & household appliances, and others. Among these, the food & beverages segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The food retail sector in Singapore is driven by high demand for convenience and diverse consumer preferences. As a global trade hub, locals and visitors contribute to market growth, with Singaporeans prioritizing food, dining options, groceries, and beverages across various price ranges.

- The e-commerce segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the Singapore retail market is divided into hypermarkets, supermarkets & convenience stores, specialty stores, department stores, e-commerce, and others. Among these, the e-commerce segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Singapore's online shopping market has grown significantly due to its technologically savvy population, high internet penetration, and strong digital infrastructure. The market covers electronics, fashion, food, and personal care, with both local and international e-commerce platforms experiencing significant growth in various product categories.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore retail market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Japan Foods Holding Ltd

- Sheng Siong Group Ltd

- Watsons

- RedMart Ltd

- ABR Holdings Ltd

- NTUC

- QAF Limited

- U Stars

- Dairy Farm International Holdings (DFI)

- Font Creative Pte Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, for S$1.85 billion, CapitaLand Integrated Commercial Trust consented to purchase a 50% share in ION Orchard Mall, expanding its footprint in the upscale retail market.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore retail market based on the below-mentioned segments:

Singapore Retail Market, By Product

- Food & Beverages

- Personal & Household Care

- Apparel

- Footwear & Accessories

- Furniture

- Toys & Hobby

- Electronic & Household Appliances

- Others

Singapore Retail Market, By Distribution Channel

- Hypermarkets

- Supermarkets & Convenience Stores

- Specialty Stores

- Department Store

- E-commerce

- Others

Need help to buy this report?