Singapore Self Storage Market Size, Share, and COVID-19 Impact Analysis, By Unit Size (Small, Medium, and Large), By Application (Personal and Business), and Singapore Self Storage Market Insights, Industry Trend, Forecasts to 2033

Industry: Information & TechnologySingapore Self Storage Market Insights Forecasts to 2033

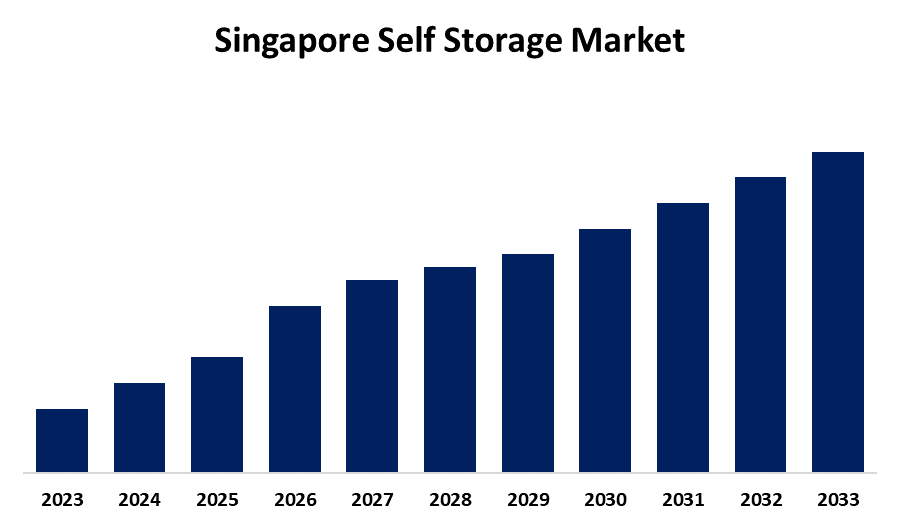

- The Market is Growing at a CAGR of 6.25% from 2023 to 2033

- The Singapore Self Storage Market Size is Expected to hold a significant share by 2033

Get more details on this report -

The Singapore Self Storage Market Size is anticipated to hold a significant share by 2033, Growing at a CAGR of 6.25% from 2023 to 2033. The increasing urbanization, smaller living spaces, evolving business models, and favorable market conditions are driving the growth of the self-storage market in Singapore.

Market Overview

Self storage is a system where individuals rent containers or units of space within a large warehouse to store their belongings. It is a flexible and affordable way to store personal belongings, household furniture & furnishings, business stock, business archives, tools and equipment, and other commercial items. There is a surging consumer requirement for more space as a result of growing urbanization and the steadily decreasing size and rising cost of apartments in major Singaporean towns. Self-storage concepts have emerged to satisfy this expanding consumer need with the continuously increasing quantity of units. The incorporation of technological advancements in self-storage facilities includes security systems, gate access & automation, unit security options, and wifi & connectivity for enhancing security, accessibility, and the overall customer experience in self storage are evolving self-storage facilities in the coming year.

Report Coverage

This research report categorizes the market for the Singapore self storage market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore self storage market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore self storage market.

Singapore Self Storage Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.25% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Unit Size, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Store Friendly Management Pte Ltd, StorHub Self Storage, Spaceship Singapore (Astore Pte. Ltd.), Store Room Pte Limited, D Storage Pte Limited, Work+Store (Work Plus Store Pte Ltd), Lock+Store (General Storage Company Pte Ltd), Beam Storage Pte Ltd., Far East Organization (Store-Y Self-Storage), Urban Space Self Storage, U-Store@SG (Singapore G Pte Ltd), and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Due to the nation’s massive urban population, the majority of apartments in the country have fewer large rooms which is driving the market demand for self storage. The expanding middle class and the popularity of Internet shopping are driving the use of self-storage to meet their demands. Further, the lower cost of self-storage than hiring stores or warehouses is responsible for driving the market growth. Furthermore, favorable market conditions such as high density, per capita income, and the presence of an affluent population of the country are contributing to driving the market growth.

Restraining Factors

The relatively high rental rates and shrinking lettable space are the factors responsible for restraining the Singapore self storage market.

Market Segmentation

The Singapore Self Storage Market share is classified into unit size and application.

- The medium segment is anticipated to hold the largest market share during the forecast period.

The Singapore self storage market is segmented by unit size into small, medium, and large. Among these, the medium segment is anticipated to hold the largest market share during the forecast period. The size of medium-size self-storage ranges from 5'x15' to 10'x10' which is used in two or three-room apartments. Medium-sized units are ideally used for storing household items, furniture, and business inventory for both individual and business customers.

- The personal segment dominated the Singapore self storage market with the largest market share in 2023.

Based on the application, the Singapore self storage market is divided into personal and business. Among these, the personal segment dominated the Singapore self storage market with the largest market share in 2023. Personal storage refers to facilities that are small and typically require clients to use individual lockers or stalls for storage. The rapid urbanization, smaller living spaces, and lifestyle changes are propelling the market in the personal segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore self storage market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Store Friendly Management Pte Ltd

- StorHub Self Storage

- Spaceship Singapore (Astore Pte. Ltd.)

- Store Room Pte Limited

- D Storage Pte Limited

- Work+Store (Work Plus Store Pte Ltd)

- Lock+Store (General Storage Company Pte Ltd)

- Beam Storage Pte Ltd.

- Far East Organization (Store-Y Self-Storage)

- Urban Space Self Storage

- U-Store@SG (Singapore G Pte Ltd)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, StorHub Self Storage Group (StorHub), Asia Pacific’s leading self storage platform, announced that the company has achieved certification in Arc Skoru and is on track to achieve Leadership in Energy and Environmental Design v4.1 Operation and Maintenance (“LEED v4.1 O+M” or “LEED”) certification for the largest collection of self storage facilities in Singapore.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Self Storage Market based on the below-mentioned segments:

Singapore Self Storage Market, By Unit Size

- Small

- Medium

- Large

Singapore Self Storage Market, By Application

- Personal

- Business

Need help to buy this report?