Singapore Smart Home Appliances Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Washing Machine, Refrigerator, Dishwasher, Air Conditioner, Air Purifier, and Smart TV), By Technology (Wi-Fi, Radio Frequency Identification (RFID), Cellular Technology, ZigBee, and Bluetooth), By Distribution Channel (Online and Offline), and Singapore Smart Home Appliances Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsSingapore Smart Home Appliances Market Insights Forecasts to 2033

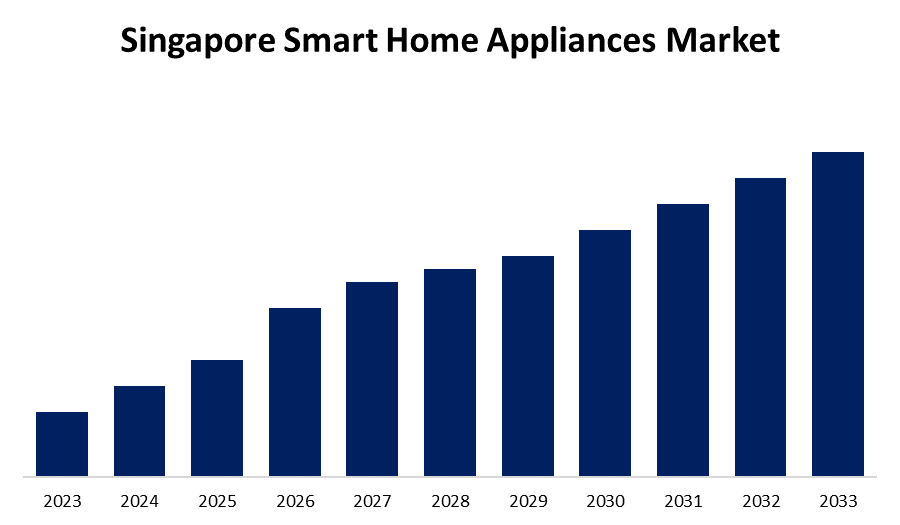

- The Market is growing at a CAGR of 13.25% from 2023 to 2033

- The Singapore Smart Home Appliances Market Size is expected to hold a significant share by 2033

Get more details on this report -

The Singapore Smart Home Appliances Market Size is anticipated to hold a significant share by 2033, growing at a CAGR of 13.25% from 2023 to 2033. The increasing adoption of the 5G network, integration of AI, and demand for smart home appliances among the rising aging population are driving the growth of the smart home appliances market in the Singapore.

Market Overview

Smart home appliances are internet-enabled appliances and devices in the home setup that can be controlled remotely from anywhere using networked devices. The system aids in the automation of specific tasks by being remotely controlled. A smart home offers the simplicity of automating and managing every appliance and device in the house. The cutting-edge home technologies are expanding quickly due to rising improvements in automation and lifestyle in the country. In addition to meeting consumers' growing desires for luxury and leisure, smart home appliances also meet their needs for security and safety. A growing number of new homes are investing in smart appliances and other household products due to the consumers' constantly expanding living standards. There is an increased use of AI-enabled visual display products and digital appliances. The increasing focus on in-built AI technology for consumer convenience and personalization is offering market opportunities.

Report Coverage

This research report categorizes the market for the Singapore smart home appliances market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore smart home appliances market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore smart home appliances market.

Singapore Smart Home Appliances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2033 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 13.25% |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 154 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Technology, By Distribution Channel. |

| Companies covered:: | Xiaomi, Aztech, Philips, Schneider Electric, Honeywell, Samsung, Fibaro, Koble, Smart Home Solutions, LG Electronics, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

In Singapore, a continuous increase in 5G mobile subscriptions has been observed since July 2022 by consumers, and is the first country to be fully by a standalone 5G network worldwide. A peak of 1.32 million subscriptions was attained in March 2023. The increasing use of 5G technology in the country across a range of industries, including smart buildings is significantly contributing to market growth. AI integration brings a level of customization and provides personalized experiences, making the home more responsive and intuitive. The increased popularity of smart home appliances among tech-savvy consumers is driving market growth. There is increasing market demand for smart home appliances among the aging population to improve their quality of life and independence, thereby positively impacting their health, safety, and comfort.

Restraining Factors

The increased concerns about data privacy among consumers are challenging the Singapore smart home appliances market.

Market Segmentation

The Singapore Smart Home Appliances Market share is classified into product type, technology, and distribution channel.

- The air conditioner segment is anticipated to hold the largest market share during the forecast period.

The Singapore smart home appliances market is segmented by product type into washing machine, refrigerator, dishwasher, air conditioner, air purifier, and smart TV. Among these, the air conditioner segment is anticipated to hold the largest market share during the forecast period. Because of the nation's tropical weather and heavy humidity, most homes need smart and energy-efficient air conditioning systems. The driving trend of smart home automation owing to convenience, efficiency, and control over home appliances is driving the market growth.

- The Wi-Fi segment dominated the Singapore smart home appliances market with a significant market share during the forecast period.

Based on the technology, the Singapore smart home appliances market is divided into Wi-Fi, radio frequency identification (RFID), cellular technology, zigbee, and bluetooth. Among these, the Wi-Fi segment dominated the Singapore smart home appliances market with a significant market share during the forecast period. Wi-Fi has long-range operation capabilities. Wi-Fi-enabled appliances are connected and set up via mobile phone or tablet accessing a range of advanced device features and partner services. The increasing use of Wi-Fi in smart home appliances is driving the market growth.

- The offline segment is anticipated to witness the fastest CAGR growth during the forecast period.

The Singapore smart home appliances market is segmented by distribution channel into online and offline. Among these, the offline segment is anticipated to witness the fastest CAGR growth during the forecast period. Customers can inspect the products directly from the source, helping to guarantee their quality and standards. The availability of a variety of products and convenience for deciding appropriate purchases by the customers due to in-store product demonstrations drive the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore smart home appliances market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Xiaomi

- Aztech

- Philips

- Schneider Electric

- Honeywell

- Samsung

- Fibaro

- Koble

- Smart Home Solutions

- LG Electronics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Samsung Electronics Co., Ltd. showcased its latest home appliance lineup at the press conference held in the global launch event, ‘Welcome to ‘BESPOKE AI’. Samsung shared its vision for how connectivity amongst them can improve the overall experience at home and how artificial intelligence (AI) enhances the performance of appliances.

- In November 2023, ECOVACS Group, a global leading manufacturer of service robotics and smart household appliances, opened its first office in Singapore. The establishment of the Singapore office marks a new milestone in ECOVACS Group's globalization strategy, which aims to enhance its market presence and competitive edge in Southeast Asia as well as in global markets.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Smart Home Appliances Market based on the below-mentioned segments:

Singapore Smart Home Appliances Market, By Product Type

- Washing Machine

- Refrigerator

- Dishwasher

- Air Conditioner

- Air Purifier

- Smart TV

Singapore Smart Home Appliances Market, By Technology

- Wi-Fi

- Radio Frequency Identification (RFID)

- Cellular Technology

- ZigBee

- Bluetooth

Singapore Smart Home Appliances Market, By Distribution Channel

- Online

- Offline

Need help to buy this report?