Singapore Soft Drinks Market Size, Share, and COVID-19 Impact Analysis, By Product (Carbonated and Non-carbonated), By Distribution Channel (Hypermarkets & Supermarkets, Convenience Store, Online, and Others), and Singapore Soft Drinks Market Insights, Industry Trends, Forecasts to 2033

Industry: Food & BeveragesSingapore Soft Drinks Market Insights Forecasts to 2033

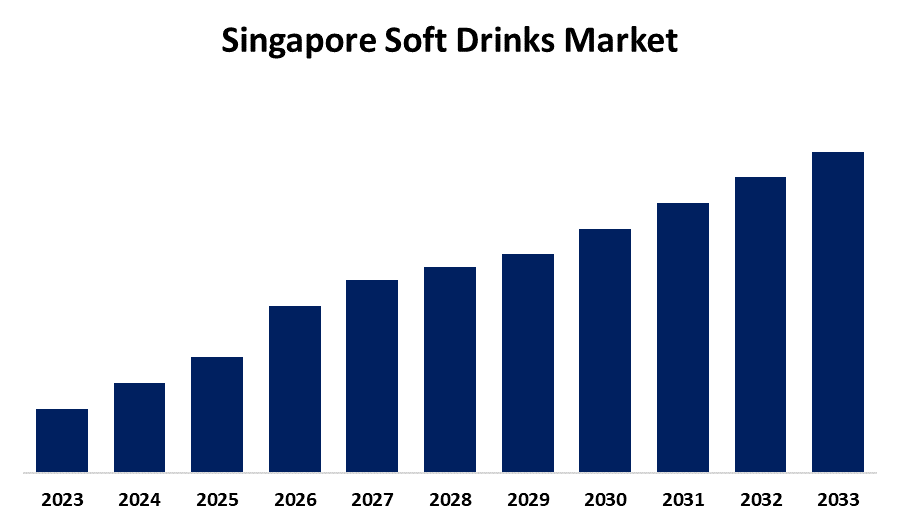

- The Market Size is Growing at a CAGR of 4.55% from 2023 to 2033

- The Singapore Soft Drinks Market Size is Expected to hold a significant share by 2033

Get more details on this report -

The Singapore Soft Drinks Market Size is anticipated to hold a significant share by 2033, Growing at a CAGR of 4.55% from 2023 to 2033. The increasing disposable income, changing lifestyles, and trend of e-commerce are driving the growth of the soft drinks market in Singapore.

Market Overview

Soft drinks are non-alcoholic beverages normally containing a natural or artificial sweetening agent, edible acids, flavors, and sometimes juice. To differentiate flavor-infused beverages from hard liquor, or distilled alcohol, the term "soft drink" was coined. New soft drink categories are emphasizing low-calorie, low-sodium, caffeine-free, and "all-natural" ingredients in response to current customers' health concerns. Soft drinks can be served at room temperature, chilled, or over ice cubes and are available in a variety of container shapes, including glass bottles, plastic bottles, and cans. A soft drink may include smaller levels of alcohol, however, in many regions, the alcohol concentration must not exceed 0.5% of the drink's total volume. Additionally, soft drinks are widely available via soda fountain machines at bars, restaurants, convenience stores, movie theaters, vending machines, and casual dining establishments. The increasing trend of customizable soft drinks as per the choices of consumers is attracting customers, thereby providing market growth opportunities. The increasing initiatives to limit the high sugar beverage in order to reduce sugar intake among consumers which leads to the development of sugar-free soft drinks are offering market growth opportunity.

Report Coverage

This research report categorizes the market for the Singapore soft drinks market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore soft drinks market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore soft drinks market.

Singapore Soft Drinks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.55% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 158 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Distribution Channel |

| Companies covered:: | Coca-Cola Singapore Beverages Pte Ltd, F&N Foods (S) Pte Ltd, PepsiCo, Red Bull, Keurig Dr Pepper, Suntory, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Singapore's per capita household disposable income is expected to reach US$45.82k in 2024. In the same year, the country’s per capita consumer spending on food and non-alcoholic beverages is expected to reach US$1.56k. The increasing disposable income of consumers in the country is anticipated to propel the market growth. Further, the changing lifestyle and high frequency of consumption of soft drinks among people is significantly contributing to driving the market. E-commerce platform promotions rank second in terms of attraction (26%), followed by TV commercials (21%), and social media promos (17%). The increasing online purchasing of soft drinks especially during festive seasons contributes to boosting the market.

Restraining Factors

The rising obesity rates and associated disorders restrict the adoption of soft drinks, thereby restraining the market. Further, the concerns over the use of sugar and high-calorie foods and beverages among consumers negatively impacting the sales of carbonated soft drinks lead to challenging the soft drinks market.

Market Segmentation

The Singapore Soft Drinks Market share is classified into product and distribution channel.

- The carbonated segment accounted for the largest revenue share of the Singapore soft drinks market in 2023.

The Singapore soft drinks market is segmented by product into carbonated and non-carbonated. Among these, the carbonated segment accounted for the largest revenue share of the Singapore soft drinks market in 2023. Carbonated soft drinks give a refreshing taste and flavoured sodas as per the diverse consumer preferences. The continuous development and improvement in the taste and other qualities including sugar, coloring, and sweeteners of this drink are propelling the market growth.

- The hypermarkets & supermarkets segment dominated the Singapore soft drinks market with the largest market share in 2023.

Based on the distribution channel, the Singapore soft drinks market is divided into hypermarkets & supermarkets, convenience store, online, and others. Among these, the hypermarkets & supermarkets segment dominated the Singapore soft drinks market with the largest market share in 2023. Many consumers choose to buy soft drinks from supermarkets and general merchandisers because of the shopping experiences they provide. The emergence of modern supermarkets and hypermarkets along with the rising disposable income of customers are contributing to driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore soft drinks market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Coca-Cola Singapore Beverages Pte Ltd

- F&N Foods (S) Pte Ltd

- PepsiCo

- Red Bull

- Keurig Dr Pepper

- Suntory

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Coca-Cola introduced the newest addition to the Coca-Cola Creations line-up, Coca-Cola K-Wave Zero Sugar.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Soft Drinks Market based on the below-mentioned segments:

Singapore Soft Drinks Market, By Product

- Carbonated

- Non-carbonated

Singapore Soft Drinks Market, By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Store

- Online

- Others

Need help to buy this report?