Singapore Water and Wastewater Treatment Market Size, Share, and COVID-19 Impact Analysis, By Type (Chemicals, Equipment, and Services), By Application (Municipal, Industrial, and Others), and Singapore Water and Wastewater Treatment Market Insights, Industry Trend, Forecasts to 2033

Industry: Chemicals & MaterialsSingapore Water and Wastewater Treatment Market Insights Forecasts to 2033

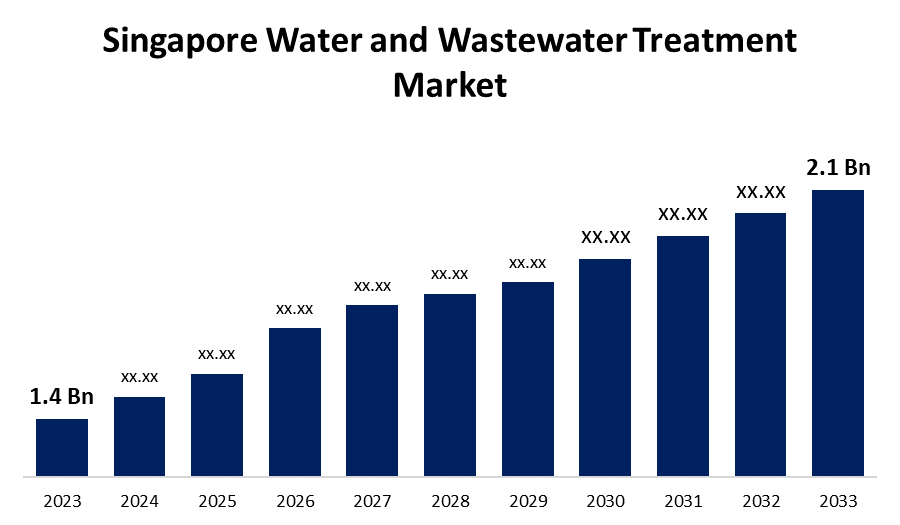

- The Singapore Water and Wastewater Treatment Market Size was valued at USD 1.4 Billion in 2023.

- The Market Size is Growing at a CAGR of 4.14% from 2023 to 2033

- The Singapore Water and Wastewater Treatment Market Size is expected to reach USD 2.1 Billion by 2033

Get more details on this report -

The Singapore Water and Wastewater Treatment Market Size is anticipated to exceed USD 2.1 Billion by 2033, growing at a CAGR of 4.14% from 2023 to 2033. The increasing population, urbanization, regulatory pressures, freshwater scarcity, and health concerns are driving the growth of the water and wastewater treatment market in Singapore.

Market Overview

Water and wastewater treatment refers to the process of improving water quality for serving end-use including drinking water, industrial water supply, water recreation, and for replenishing environmental sources, such as rivers and lakes. The process aids in improving wastewater quality and turning it into an effluent that can be recycled or released back into the environment with little environmental impact. The increasing health concerns, growing urbanization, and inadequate infrastructure are expected to drive market demand for water and wastewater treatment in the country. Advanced wastewater treatment systems have already been implemented in nations, which encourage the use of cutting-edge technologies in these services. Furthermore, the increasing demand for green infrastructure for providing water in environmentally friendly and sustainable ways is expected to provide market opportunities for water and wastewater treatment.

Report Coverage

This research report categorizes the market for the Singapore water and wastewater treatment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore water and wastewater treatment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore water and wastewater treatment market.

Singapore Water and Wastewater Treatment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.4 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.14% |

| 2033 Value Projection: | USD 2.1 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 178 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application. |

| Companies covered:: | Suez, Veolia, Ion Exchange Asia Pacific Pte Ltd, Sembcorp Industries, Kurita (Singapore), Kemp Singapore Pte Ltd, BioKube A/S, W.O.G. Technologies, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The threat of water stress in Singapore due to increasing climate crises and extreme weather events like droughts has led to drive the demand for water and wastewater treatment in the country. The wastewater generated from domestic activities, households, industries, and rainwater outflows in urban areas contains hazardous materials that need to be disinfected to protect public health and the environment. Thus, the country’s rapid urbanization along with regulatory pressure for wastewater management are contributing to propel the market growth. The initiatives and government support for water and wastewater treatment for the overall socio-development significantly contributed to market growth.

Restraining Factors

The initial investment required in water and wastewater treatment for the installation of equipment and chemicals is challenging the water and wastewater treatment market. Further, compliance with the stringent regulations is contributing to restraining the market.

Market Segmentation

The Singapore Water and Wastewater Treatment Market share is classified into type and application.

- The equipment segment dominated the Singapore water and wastewater treatment market during the forecast period.

Based on the type, the Singapore water and wastewater treatment market is divided into chemicals, equipment, and services. Among these, the equipment segment dominated the Singapore water and wastewater treatment market during the forecast period. Equipment including reverse osmosis systems, ultrafiltration systems, vacuum evaporation and distillation systems, and tramp oil is used by the industrial sector. Further, integrated advanced technologies like advanced oxidation, ultrafiltration and reverse osmosis, photocatalytic oxidation, ultrasonic reactors, naturally or genetically enhanced microorganisms, electrocoagulation, and electrooxidation in wastewater management are used for efficient management of wastewater.

- The municipal segment is dominating the Singapore water and wastewater treatment market during the forecast period.

The Singapore water and wastewater treatment market is segmented by application into municipal, industrial, and others. Among these, the municipal segment is dominating the Singapore water and wastewater treatment market during the forecast period. To ensure that water that is returned to the environment or utilized again meets the necessary quality standards, wastewater treatment plants treat municipal effluent by eliminating dissolved or suspended materials. The municipal component provides safe drinking water and handles wastewater from homes, businesses, and public buildings. The increased community awareness of clean water and water management techniques is driving the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore water and wastewater treatment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Suez

- Veolia

- Ion Exchange Asia Pacific Pte Ltd

- Sembcorp Industries

- Kurita (Singapore)

- Kemp Singapore Pte Ltd

- BioKube A/S

- W.O.G. Technologies

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, SUEZ, a global leader in circular solutions for water and waste management, announced three new projects in Asia at the Singapore International Water Week (SIWW), demonstrating its innovative approach to water management in both municipal and industrial sectors.

- In April 2024, Nalco Water, an Ecolab company, and ITE are joining forces through the signing of a memorandum of understanding to solidify a collaborative partnership that would advance knowledge transfer, education and hands-on experience in the field of water management and sustainable operations.

- In March 2024, Nalco Water, Ecolab’s water brand, announced the opening of a wastewater treatment plant in Shell Jurong Island, Singapore. This facility is designed to handle variable bio-treater wastewater. The plant utilizes Ecolab’s ultrafiltration and reverse osmosis (RO) membrane system and is almost 100% automated.

- In August 2023, Gradiant, a global solutions provider for advanced water and wastewater treatment, announced it has established its digital and AI technology business into a wholly owned independent subsidiary, named Turing.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Water and Wastewater Treatment Market based on the below-mentioned segments:

Singapore Water and Wastewater Treatment Market, By Type

- Chemicals

- Equipment

- Services

Singapore Water and Wastewater Treatment Market, By Application

- Municipal

- Industrial

- Others

Need help to buy this report?