Singapore Water Purifier Market Size, Share, and COVID-19 Impact Analysis, By Technology (RO (Reverse Osmosis) Purifiers, UV (Ultraviolet) Purifiers, Gravity-Based Purifiers, and Sediment Filter Purifiers), By Distribution Channel (Retail Distributors, Online Suppliers, and Direct-to-Consumers), By End User (Residential, Commercial, and Industrial), and Singapore Water Purifier Market Insights, Industry Trend, Forecasts to 2033

Industry: Consumer GoodsSingapore Water Purifier Market Insights Forecasts to 2033

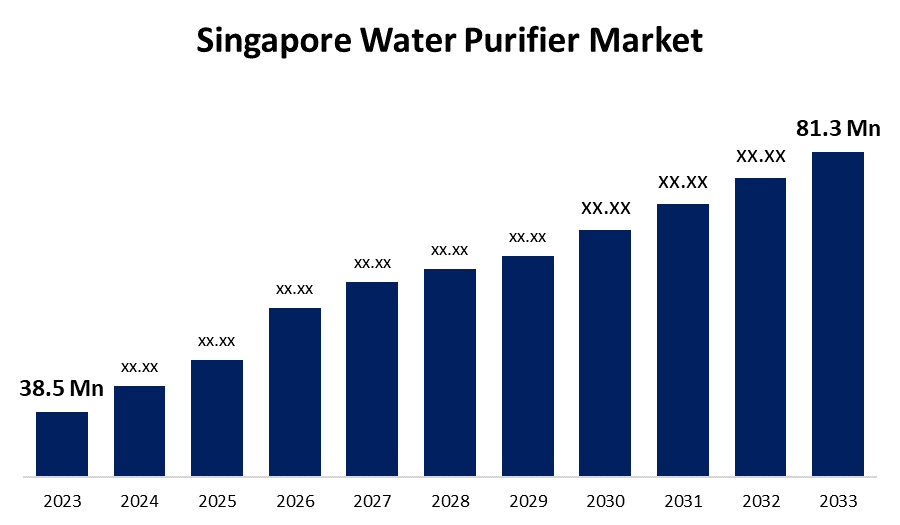

- The Singapore Water Purifier Market Size was valued at USD 38.5 Million in 2023.

- The Market Size is Growing at a CAGR of 7.76% from 2023 to 2033

- The Singapore Water Purifier Market Size is expected to reach USD 81.3 Million by 2033

Get more details on this report -

The Singapore Water Purifier Market is anticipated to exceed USD 81.3 Million by 2033, growing at a CAGR of 7.76% from 2023 to 2033. The increasing concerns about water quality are driving the growth of the water purifier market in Singapore.

Market Overview

Water purifier treats water using purification methods such as reverse osmosis (RO), distillation, and ultraviolet (UV) to make it safe. Water purifier catches contaminants much like filters, but also destroy the contaminants, thereby promoting health by preventing infections that are transmitted by water. They help to solve issues with water quality and encourage the availability of drinkable water for a healthy way of life. The nation's dedication to protecting the environment and its strict water quality regulations raise the demand for advanced water purification technologies. As a result of a general movement toward better lives and environmental consciousness, the market is propelled by the convergence of technology and consumer preferences toward effective, portable, and intelligent water purifiers. P-o-U treatment systems, which attempt to eliminate waterborne toxins at significantly lower prices, are regarded as a basic and mature technology. There is an increasing emphasis on the development and innovation of P-o-U systems. Further, the use of capacitive deionization offers significantly less water rejection, increased energy efficiency, and reduced operating expenses.

Report Coverage

This research report categorizes the market for the Singapore water purifier market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Singapore water purifier market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Singapore water purifier market.

Singapore Water Purifier Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 38.5 Million |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 7.76% |

| 023 – 2033 Value Projection: | USD 81.3 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Distribution Channel, By End User |

| Companies covered:: | Novita Singapore Pte Ltd, Sterra Tech Pte Ltd, Philips Singapore Pte Ltd, Filtech, Aqua Kent Singapore, Hydroflux Pte Ltd, 3M Singapore Pte Ltd, Cuckoo Singapore Pte Ltd, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The increasing awareness about environmental issues and health consciousness in the country is responsible for driving the market demand. Further, the growing concern about the deterioration of water quality, and the related social, economic, and environmental impacts affecting the quality of life of growing populations are contributing to driving the market demand. Further, the technological development by manufacturers for greater energy efficiency and lowering water rejection along with lowering operational costs are driving the market growth.

Restraining Factors

The high maintenance cost of water purifiers is challenging the market as the system's components such as reverse osmosis membrane and ultraviolet lights are expensive.

Market Segmentation

The Singapore Water Purifier Market share is classified into technology, distribution channel, and end user.

- The RO (reverse osmosis) purifiers dominated the market with a significant market share during the forecast period.

The Singapore water purifier market is segmented by technology into RO (reverse osmosis) purifiers, UV (ultraviolet) purifiers, gravity-based purifiers, and sediment filter purifiers. Among these, the RO (reverse osmosis) purifiers dominated the market with a significant market share during the forecast period. RO purifiers comprise advanced water purification technology such as UV purifiers, gravity-based purifiers, and sediment filter purifiers. The increased adoption of RO purifiers owing to their performance efficiency, low electricity consumption, and technological innovations are driving the market.

- The retail distributors segment accounted for the largest market share during the forecast period.

The Singapore water purifier market is segmented by distribution channel into retail distributors, online suppliers, and direct-to-consumers. Among these, the retail distributors segment accounted for the largest market share during the forecast period. Retail distributors are the offline mode of purchasing, as a primary distribution channel for water purifiers. The increased preference for retail distribution by most businesses for selling water purifiers to potential customers is propelling the market growth.

- The residential segment dominated the Singapore water purifier market during the forecast period.

Based on the end user, the Singapore water purifier market is divided into residential, commercial, and industrial. Among these, the residential segment dominated the Singapore water purifier market during the forecast period. Most people in Singapore install and use water purifiers as a double safety solution to prevent contaminants found in water due to stagnant water in service pipes, faulty water tanks, corrosion, and the formation of mineral sediments. The increasing awareness of water quality is driving the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Singapore Water Purifier market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novita Singapore Pte Ltd

- Sterra Tech Pte Ltd

- Philips Singapore Pte Ltd

- Filtech

- Aqua Kent Singapore

- Hydroflux Pte Ltd

- 3M Singapore Pte Ltd

- Cuckoo Singapore Pte Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2021, Namiton launched the First Special Water Purifier with Hollow-Fiber Nanofiltration Membrane - Pushing the Envelope with Membrane Technology Innovation from Singapore. A special water-purifier series to provide direct access to drinking water received a great response upon its launch.

Market Segment

This study forecasts revenue at Singapore, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Singapore Water Purifier Market based on the below-mentioned segments:

Singapore Water Purifier Market, By Technology

- RO (Reverse Osmosis) Purifiers

- UV (Ultraviolet) Purifiers

- Gravity-Based Purifiers

- Sediment Filter Purifiers

Singapore Water Purifier Market, By Distribution Channel

- Retail Distributors

- Online Suppliers

- Direct-to-Consumers

Singapore Water Purifier Market, By End User

- Residential

- Commercial

- Industrial

Need help to buy this report?