Global Small Bulldozer Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Crawler Bulldozer and Wheeled Bulldozer), By Blade Type (S-blade, U-blade, S-U-blade, and Others), By End-user (Agriculture, Construction, Mining, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Construction & ManufacturingGlobal Small Bulldozer Market Insights Forecasts to 2032

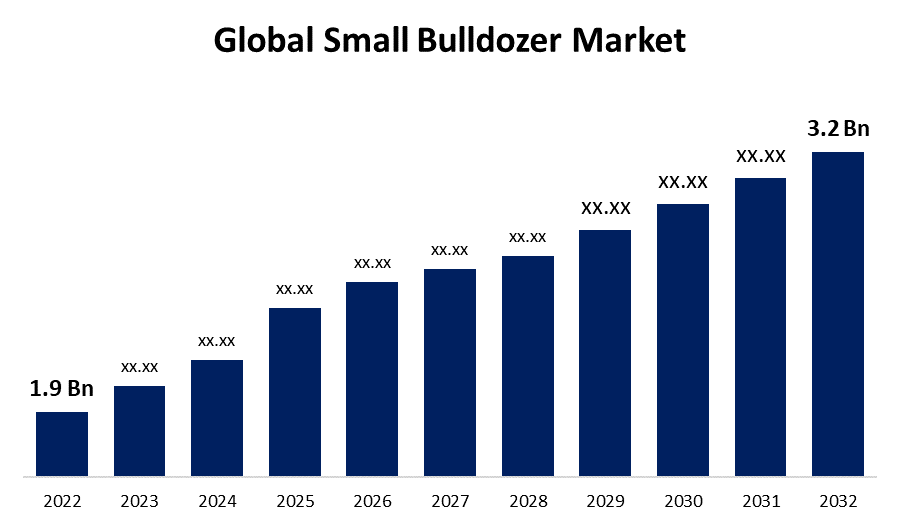

- The Global Small Bulldozer Market Size was Valued at USD 1.9 Billion in 2022.

- The Market Size is Growing at a CAGR of 5.3% from 2022 to 2032

- The Worldwide Small Bulldozer Market Size is Expected to Reach USD 3.2 Billion by 2032

- North America is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Small Bulldozer Market Size is Anticipated to Exceed USD 3.2 Billion by 2032, Growing at a CAGR of 5.3% from 2022 to 2032.

Growing government spending on infrastructure development and an increase in construction activities worldwide are factors propelling the small bulldozer market. Manufacturers can gain market share by using growing markets, eco-friendly initiatives, and advancements in technology.

Market Overview

An off-road earthmoving tool often used for construction, farming, road building, and wrecking is called a bulldozer. This heavy-duty tractor has tracks to carry the weight of the vehicle, a blade connected to the front end for clearing garbage, and hydraulic arms to raise the bulldozer above the ground. Additionally, a torque divider is installed to convert and utilize engine power for improved dragging performance. These bulldozers can be equipped with a variety of blades, such as hybrid angular blades, sigma-4 and straight blades for leveling the ground, and universal and semi-universal blades for pushing, hauling, and scooping items. The need for compact bulldozers has increased due to the growing requirement for the development of urban infrastructure, which includes roads, highways, residential areas, and commercial spaces. These devices are ideal for narrow spaces and for clearing soil, grading, and preparing sites for construction in urban settings.

Report Coverage

This research report categorizes the market for the global small bulldozer market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global small bulldozer market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global small bulldozer market.

Global Small Bulldozer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.9 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.3% |

| 2032 Value Projection: | USD 3.2 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Blade Type, By End-user, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | BEML Limited, Caterpillar Inc., Cummins Inc., Deere & Company, DEUTZ AG, Shantui Construction Machinery (Shantui Heavy Industry Machinery Co.), J. C. Bamford Excavators Ltd., Komatsu Ltd., Kubota Corporation, CNH Industrial N.V., Hitachi Construction Machinery Co. Ltd., Volvo Construction Equipment AB, Doosan Infracore Co. Ltd., Liebherr Machines Bulle SA, Liugong Machinery Co. Ltd., Zoomlion Heavy Industry And Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is seeing an increase in the use of small bulldozers as a result of companies using bulldozers to finish jobs faster. The market for small bulldozers is expanding due in large part to the increasing automation and usage of machines to facilitate human labor in sectors like infrastructure, mining, agriculture, and construction. Furthermore, more funding for infrastructure and transportation is projected to support the growth of the small bulldozer industry. Concerns over how construction projects affect the environment are becoming more and more prevalent. Because they consume less fuel and produce fewer pollutants than huge bulldozers, small bulldozers are a more environmentally friendly choice.

Restraining Factors

An organization must go through a difficult and drawn-out process to obtain a permit following multiple necessary inspections. Government laws that are specific to a given area that dictate when building can begin are one of the main things holding back the bulldozer market's expansion. Bulldozers can be expensive to buy initially, which presents a problem for smaller contractors or construction firms. Bulldozers need frequent maintenance, and their high fuel consumption raises the expense of operation as a whole. Older bulldozer models could become antiquated as technology advances, necessitating ongoing improvements to stay competitive.

Market Segmentation

The Global Small Bulldozer Market share is classified into product type, blade type, and end-user.

- The crawler bulldozer segment is expected to grow at the fastest pace in the global small bulldozer market during the forecast period.

The small bulldozer market is categorized by product type into crawler bulldozers and wheeled bulldozers. Among these, the crawler bulldozer segment is expected to grow at the fastest pace in the small bulldozer market during the forecast period. The crawler bulldozers are heavy vehicles with lots of traction for navigating through rough terrain and dense foliage. Their tracks facilitate balanced weight distribution, resulting in machines that are strong and steady. The crawler bulldozer is perfect for grading, clearing soil, and getting sites ready for building in metropolitan areas, as well as cramped locations which are contributing to the market's expansion.

- The S-U-blade segment is expected to grow at the highest pace in the global small bulldozer market during the forecast period.

Based on the blade type, the global small bulldozer market is divided into S-blade, U-blade, S-U-blade, and Others. Among these, the S-U-blade segment is expected to grow at the highest pace in the small bulldozer market during the forecast period. By virtue of its flatter surface, which makes it a popular choice among users and ideal for handling materials like sand and gravel. However, because more customers are expected to require customized S-U-blades, the S-U-blade segment is expected to grow at the greatest pace in the global small bulldozer market.

- The construction segment is expected to hold the largest share of the global small bulldozer market during the forecast period.

Based on the end-user, the global small bulldozer market is divided into agriculture, construction, mining, and others. Among these, the construction segment is expected to hold the largest share of the global small bulldozer market during the forecast period. The growing demand for the development of urban infrastructure has raised the need for small bulldozers in the construction industry. The global market for compact bulldozers is growing as a result of governments taking the initiative to establish enough road connections and infrastructure. These machines are perfect for confined places and for clearing soil, grading, and preparing sites for construction.

Regional Segment Analysis of the Global Small Bulldozer Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

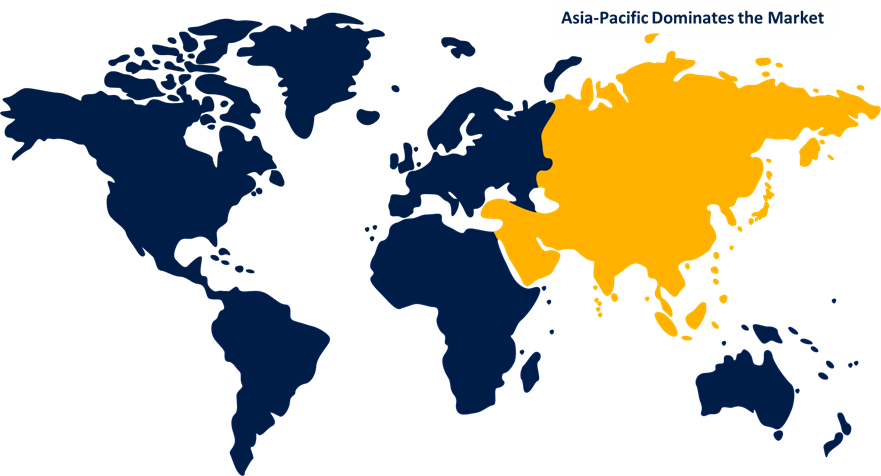

Asia-Pacific is anticipated to hold the largest share of the global small bulldozer market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is projected to hold the largest share of the global small bulldozer market over the predicted years. Countries such as China and India are fueling this expansion through significant expenditures in road, rail, and urban infrastructure. In particular, China's strong urbanization demand has led to a rise in the use of mini bulldozers and other compact construction equipment. The demand for effective earthmoving in congested urban areas has made this equipment indispensables, driving the industry's growth in the Asia-Pacific region.

North America is expected to grow at the fastest pace in the global small bulldozer market during the forecast period. The market is anticipated to grow as a result of the rising requirement for construction equipment in developing nations, the expanding need for effective and adaptable equipment in agriculture, and the growing concern about the environment. Increased government spending on infrastructure development and the expansion of the residential sector are two factors driving the small bulldozer market in this region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global small bulldozer along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BEML Limited

- Caterpillar Inc.

- Cummins Inc.

- Deere & Company

- DEUTZ AG

- Shantui Construction Machinery (Shantui Heavy Industry Machinery Co.)

- J. C. Bamford Excavators Ltd.

- Komatsu Ltd.

- Kubota Corporation

- CNH Industrial N.V.

- Hitachi Construction Machinery Co. Ltd.

- Volvo Construction Equipment AB

- Doosan Infracore Co. Ltd.

- Liebherr Machines Bulle SA

- Liugong Machinery Co. Ltd.

- Zoomlion Heavy Industry

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2022, A brand-new class of construction machinery, the CASE Minotaur DL550 compact dozer loader, was unveiled by CNH Industrial N.V. With a weight of over 18,000 pounds and 114 horsepower, this brand-new, one-of-a-kind apparatus offers exceptional grading and sleeping performance in addition to strong site loading capabilities and compatibility with hundreds of attachments.

- In June 2022, The DD100 was created by Doosan Corp. and has characteristics including enhanced visibility for both the front and rear of the vehicle, a standard rearview camera, a 122-hp engine, a 10-metric-ton weight, and a brand-new, high-power design.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Small Bulldozer Market based on the below-mentioned segments:

Global Small Bulldozer Market, By Product Type

- Crawler Bulldozer

- Wheeled Bulldozer

Global Small Bulldozer Market, By Blade Type

- S-blade

- U-blade

- S-U-blade

- Others

Global Small Bulldozer Market, End-user

- Agriculture

- Construction

- Mining

- Others

Global Small Bulldozer Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within market?The key companies that are currently operating market such as BEML Limited, Caterpillar Inc., Cummins Inc., Deere & Company, DEUTZ AG, Shantui Construction Machinery (Shantui Heavy Industry Machinery Co.), J. C. Bamford Excavators Ltd., Komatsu Ltd., Kubota Corporation, CNH Industrial N.V., Hitachi Construction Machinery Co. Ltd.

-

2. How big is the small bulldozer market?The Global Small Bulldozer Market is expected to grow from USD 1.9 Billion in 2022 to USD 3.2 Billion by 2032, at a CAGR of 5.3% during the forecast period 2023-2033.

-

3. What is the leading application of small bulldozer market?Construction industry is the leading application of small bulldozer market.

Need help to buy this report?