Global Smart Airport Market Size By Component (Hardware, Software, Services); By Solution (Terminal Side, Air Side, Landside); By Application (Aeronautical Operations, Non-Aeronautical Operations); By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Smart Airport Market Insights Forecasts to 2033

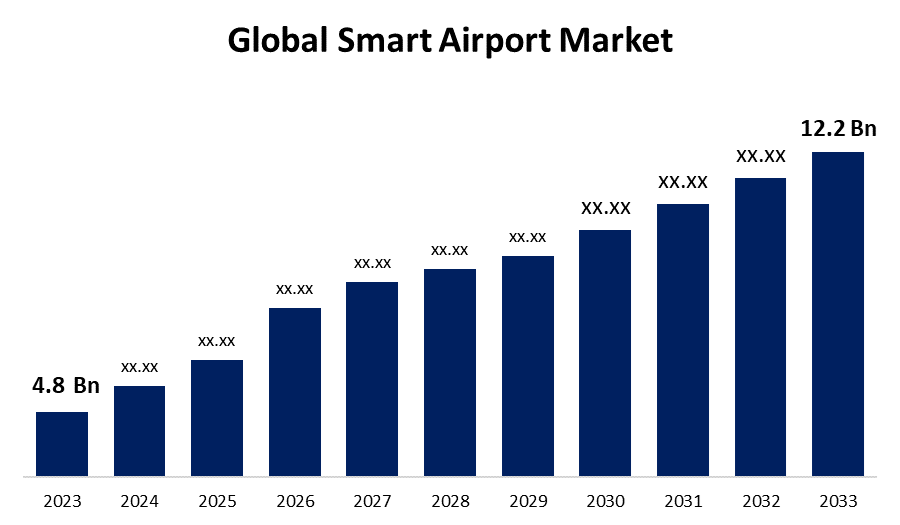

- The Global Smart Airport Market Size was valued at USD 4.8 Billion in 2023.

- The Market Size is Growing at a CAGR of 9.78% from 2023 to 2033

- The Worldwide Smart Airport Market Size is expected to reach USD 12.2 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Smart Airport Market Size is expected to reach USD 12.2 Billion by 2033, at a CAGR of 9.78% during the forecast period 2023 to 2033.

The increasing volume of air travellers across the globe has made it necessary to update airport operations and infrastructure in order to meet the growing demand while maintaining efficiency, safety, and security. Thanks to the quick development of technologies like the Internet of Things (IoT), artificial intelligence (AI), biometrics, and big data analytics, airports can now implement intelligent solutions for processing passengers, enhancing security, streamlining operations, and improving the passenger experience. In an attempt to stand out from the competition and draw in passengers, airports are placing a higher priority on passenger experience initiatives. From check-in to boarding and beyond, smart airport technologies are essential for giving travellers a smooth and personalised experience. Airports are investing in cutting-edge security systems like biometric identity, facial recognition, and video analytics in response to rising security concerns throughout the world.

Smart Airport Market Value Chain Analysis

Smart airport projects are mostly initiated and managed by airport authorities and operators. In order to execute clever solutions, they are in charge of establishing requirements, choosing technology suppliers or service providers, and establishing strategic objectives. Technology providers include businesses that focus on a variety of smart airport solutions, including biometric systems, data analytics software, IoT platforms, AI algorithms, and communication infrastructure. Integrating different hardware and software components into coherent smart airport systems is a critical task for system integrators. Consulting businesses support smart airport efforts with their skills in project management, feasibility studies, strategic planning, and execution. Because they depend on smooth airport operations to guarantee on-time departures and arrivals, airlines and ground handlers are important participants in the smart airport value chain. Travellers and passengers are the ultimate consumers of smart airport facilities and services.

Smart Airport Market Opportunity Analysis

Global air travel is steadily increasing, which creates a big market for smart airport solutions. In order to handle increasing passenger volumes, airports are under pressure to improve security, operational effectiveness, and passenger experience. Providing passengers with smooth and customised travel experiences is becoming more and more important. In order to increase customer happiness and loyalty, airports can use smart airport technologies to provide self-service alternatives, real-time information, and personalised services. Public sector airport authorities and private sector technology suppliers or service providers collaborate on numerous smart airport projects. Public-private partnerships provide a means of utilising outside knowledge, capital, and assets to efficiently execute smart airport solutions.

Global Smart Airport Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.8 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 9.78% |

| 2033 Value Projection: | USD 12.2 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Application , By Region. |

| Companies covered:: | Siemens AG, Rockwell Collins, Inc., Thales Group, IBM Corporation, Cisco Systems, Inc., International Business Machines Corporation, T Systems International GmbH, Amadeus IT Group SA, Honeywell International Inc., Indra Siestma S.A, and Other |

| Growth Drivers: | Increasing implementation of self-service kiosks |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Smart Airport Market Dynamics

Increasing implementation of self-service kiosks

Self-service kiosks cut down on lines and wait times at traditional check-in counters by enabling passengers to check-in, print boarding passes, choose seats, and even tag baggage. Higher levels of satisfaction are the result of this convenience, which improves the overall passenger experience. Self-service kiosks can assist airports in lowering labour expenses related to labor-intensive manual check-in procedures by automating check-in and other activities. By reducing the requirement for physical infrastructure and space set aside for conventional check-in counters, they can also reduce overhead costs. To provide travellers with smooth and safe self-service alternatives, self-service kiosks can be connected with mobile applications and biometric authentication technologies like fingerprint and face recognition. Passenger convenience and security are improved by this integration.

Restraints & Challenges

Adopting smart airport solutions frequently necessitates a large initial outlay of funds for systems integration, infrastructure, and technology. Securing finance for these capital-intensive projects may provide difficulties for airport operators, particularly in light of limited resources or conflicting objectives. Smart airport solutions often require integrating a variety of stakeholders, systems, and technology across many airport functions. It can be difficult to integrate and communicate across different systems in a smooth manner; this requires a lot of planning, testing, and customisation. Airport systems are becoming more digitally connected and susceptible to ransomware attacks, sabotage, and data breaches, among other cyberthreats. Smart airports are always faced with the problem of maintaining strong cybersecurity safeguards to safeguard sensitive data, vital infrastructure, and passenger safety.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Smart Airport Market from 2023 to 2033. Airports in North America are leading the way in implementing state-of-the-art technologies to enhance passenger experience and modernise airport operations. The implementation of contactless solutions, biometric authentication systems, self-service kiosks, and real-time passenger tracking technology are all included in this. Providing better passenger experiences is a top priority as airports and airlines compete more and more. In order to improve customer happiness, North American airports use smart technologies to offer smooth check-in procedures, individualised services, and digital wayfinding solutions. North American airports are expanding and renovating to handle increasing passenger numbers and upgrade infrastructure. To maximise space utilisation, expedite processes, and improve overall airport efficiency, smart airport solutions are integrated into these projects.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. Some of the world's fastest-growing economies are found in the Asia-Pacific region, which is fueling urbanisation and raising air travel demand. In order to handle the increasing number of travellers, airports throughout the region have had to expand and modernise as a result of this increase. Airports in the Asia-Pacific region are using cutting-edge technology like biometrics, artificial intelligence, the Internet of Things (IoT), and big data analytics to boost security protocols, increase operational effectiveness, and improve passenger experience. In Asia-Pacific, numerous airports are undergoing renovations and expansions to accommodate the rising demand for air travel. To maximise space utilisation, improve baggage handling procedures, and increase overall airport efficiency, smart airport solutions are incorporated into these projects.

Segmentation Analysis

Insights by Component

The hardware segment accounted for the largest market share over the forecast period 2023 to 2033. Expanding and modernising to handle growing passenger traffic and improve operational efficiency, several airports throughout the world are undertaking these projects. The implementation of new hardware infrastructure is frequently required for these projects in order to support smart airport efforts like automated baggage handling systems, biometric authentication systems, and self-service kiosks. Hardware components for smart airports are in high demand due to the growing use of sensor and Internet of Things (IoT) technology. Airports may enhance decision-making and streamline procedures by using sensors to gather real-time data on a variety of operational elements, including as asset tracking, vehicle movements, ambient conditions, and passenger flows.

Insights by Solution

The terminal side segment accounted for the largest market share over the forecast period 2023 to 2033. Passengers may check in, get boarding cards, and even tag their own luggage independently with the help of self-service kiosks and check-in counters, which cuts down on lines and wait times. This improves airport operating efficiency while increasing the passenger experience. To improve security and expedite passenger processing, biometric authentication technologies like fingerprint scanning and facial recognition are being used more frequently at boarding gates and security checkpoints. These solutions improve overall security measures, shorten wait times, and provide faster and more secure identity verification. Environmental sustainability projects like water conservation, waste recycling, and energy-efficient lighting are examples of erminal side solutions.

Insights by Application

The aeronautical segment accounted for the largest market share over the forecast period 2023 to 2033. Modern air traffic management (ATM) systems are essential for controlling aircraft movements, maximising the use of available airspace, and guaranteeing effective and safe airside operations. These systems improve air traffic control and lessen congestion by utilising technology like radar, satellite navigation, and communication systems. Runway and taxiway management systems, which keep track of and regulate aircraft movements on the airside, are examples of smart airport technologies. With the use of automated alerts and real-time monitoring, these technologies maximise runway capacity, shorten taxi times, and improve safety. Smart airports are putting UAV management systems in place to guarantee the safe integration of drones into airspace operations as the use of drones for diverse purposes grows. These systems reduce the possibility of airspace incursions and disputes by offering flight planning, airspace surveillance, and collision avoidance capabilities.

Recent Market Developments

- In May 2023, Honeywell NAVITASTM Smart Visual Docking system is one of the latest portfolio of solutions that Honeywell introduced to maximise airport efficiency and safety.

Competitive Landscape

Major players in the market

- Siemens AG

- Rockwell Collins, Inc.

- Thales Group

- IBM Corporation

- Cisco Systems, Inc.

- International Business Machines Corporation

- T Systems International GmbH

- Amadeus IT Group SA

- Honeywell International Inc.

- Indra Siestma S.A.

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Smart Airport Market, Component Analysis

- Hardware

- Software

- Services

Smart Airport Market, Solution Analysis

- Terminal Side

- Air Side

- Landside

Smart Airport Market, Application Analysis

- Aeronautical Operations

- Non-Aeronautical Operations

Smart Airport Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Smart Airport Market?The global Smart Airport Market is expected to grow from USD 4.8 billion in 2023 to USD 12.2 billion by 2033, at a CAGR of 9.78% during the forecast period 2023-2033.

-

2. Who are the key market players of the Smart Airport Market?Some of the key market players of the market are Siemens AG, Rockwell Collins, Inc., Thales Group, IBM Corporation, Cisco Systems, Inc., International Business Machines Corporation, T Systems International GmbH, Amadeus IT Group SA, Honeywell International Inc., and Indra Siestma S.A.

-

3. Which segment holds the largest market share?The aeronautical segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Smart Airport Market?North America is dominating the Smart Airport Market with the highest market share.

Need help to buy this report?