Global Smart Energy Meters Market Size, Share, and COVID-19 Impact Analysis, By Type (Advanced Metering Infrastructure, and Auto Meter Reading), By Application (Residential, Industrial, Commercial, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Energy & PowerGlobal Smart Energy Meters Market Insights Forecasts to 2033

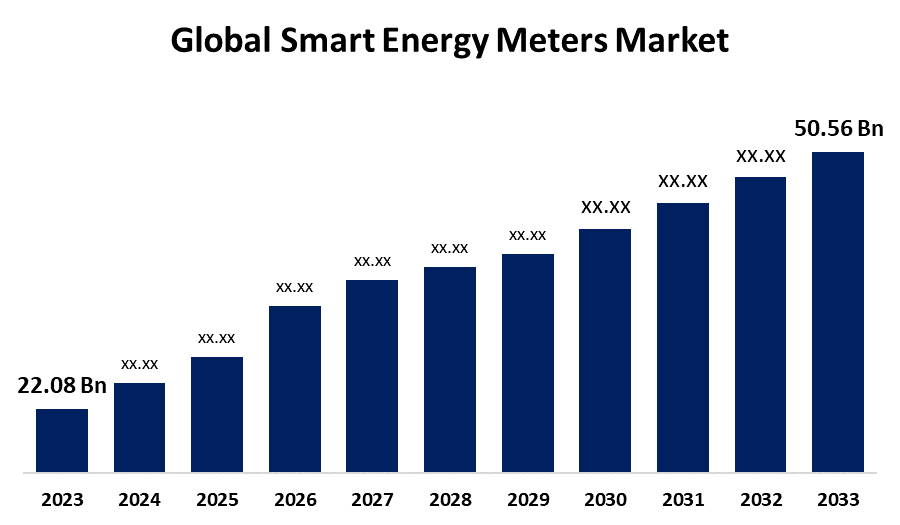

- The Global Smart Energy Meters Market Size was Valued at USD 22.08 Billion in 2023

- The Market Size is Growing at a CAGR of 8.64% from 2023 to 2033

- The Worldwide Smart Energy Meters Market Size is Expected to Reach USD 50.56 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Smart Energy Meters Market Size is Anticipated to Exceed USD 50.56 Billion by 2033, Growing at a CAGR of 8.64% from 2023 to 2033.

Market Overview

A smart energy meter is a computerized gadget that tracks and monitors how much water, gas, or electricity is used in real time. It has the ability to automatically transmit readings to an energy source. Smart meters are becoming a vital instrument in contemporary energy management and are a crucial part of sophisticated metering infrastructure. Smart gas, smart water, and smart electricity meters are all part of the smart energy meter business. Electronic devices known as "smart energy meters" are used in homes and businesses to monitor and measure energy use. Data like current, voltage levels, power factor, and electric energy usage can all be recorded by them. Through a wireless link, smart meters may then transmit this data to power providers and customers.

According to U.S. Energy Information Administration, Approximately 119 million advanced (smart) metering infrastructure (AMI) installations, or almost 72% of all electric meter installations, were reported by U.S. electric utilities in 2022. Approximately 88% of AMI installations were for residential consumers, while AMI meters made up 73% of all residential electric meters. Meters that detect and record power use at least hourly intervals and provide the data to the utility company and the utility customer at least once a day are included in AMI. AMI installations come in a variety of forms, from straightforward hourly interval meters to real-time meters with integrated two-way communication that can record and send data instantly.

According to the UK Government, at the end of March 2024, 35.5 Million smart and advanced meters were in homes and small businesses across Great Britain sixty-two percent of all meters are now smart and advanced meters. During Q1, 2024, approximately 78,0800 smart and advanced meter were installed by large energy suppliers across Great Britain, a 10 % decrease on the previous quarter quarter and an 11% decrease on the same quarter in 2023.

Report Coverage

This research report categorizes the market for smart energy meters based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the smart energy meters market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the smart energy meters market.

Global Smart Energy Meters Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 22.08 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.64% |

| 2033 Value Projection: | USD 50.56 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Aclara, GE, Itron, Inc., Landis+Gyr, Kamstrup, Honeywell, Siemens, Sensus, ABB, ZPA Smart Energy, Secure Meter Limited, Holley Technology Ltd, Jabil, Xemex, EDMI Limited, EMH Metering GmbH & Co KG, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The smart energy meters market is experiencing growth due to several key driving factors. One of the primary drivers is the increasing focus on energy efficiency and conservation, as governments and utilities seek to reduce energy consumption and carbon emissions. Smart meters provide real-time data on energy usage, allowing consumers to better understand and optimize their energy consumption. Additionally, the deployment of smart grid infrastructure, which integrates smart meters, enhances grid efficiency, reliability, and the integration of renewable energy sources. Regulatory mandates and incentives in various countries to promote the adoption of smart meters have also contributed to the market's expansion. Furthermore, the growing awareness of the benefits of smart meters, such as improved billing accuracy, reduced energy losses, and enhanced customer engagement, is driving the demand for these technologies across the residential, commercial, and industrial sectors.

Restraining Factors

The smart energy meters market also faces several restraining factors, one of the primary challenges is the high initial cost associated with the deployment of smart meter infrastructure, including the cost of hardware, software, and installation. This can be a significant barrier, especially for smaller utilities and developing regions with limited financial resources. Additionally, concerns over data privacy and cybersecurity risks related to the transmission and storage of consumer energy usage data have slowed the adoption of smart meters in some regions. There are also technical and interoperability challenges, as the integration of smart meters with existing legacy systems and the need for standardization across different manufacturers and communication protocols can be complex and costly.

Market Segmentation

The smart energy meters market share is classified into type and application.

- The advanced metering infrastructure segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the smart energy meters market is classified into advanced metering infrastructure and auto meter reading. Among these, the advanced metering infrastructure segment is estimated to hold the highest market revenue share through the projected period. This is due to the growing emphasis on modernizing power grid infrastructure and the increased adoption of smart grid technologies. AMI systems integrate smart meters, communication networks, and data management systems, enabling two-way communication between utilities and consumers. This bidirectional flow of information allows for real-time monitoring, remote meter reading, and the implementation of dynamic pricing and demand response programs. The benefits of AMI, such as improved grid efficiency, reduced energy losses, and enhanced customer engagement, have driven utilities and policymakers to invest heavily in the deployment of these advanced metering systems. Additionally, the integration of AMI with other smart grid components, such as distributed energy resources and energy management platforms, further enhances the market's revenue potential in the forecast period.

- The residential segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the smart energy meters market is divided into residential, industrial, commercial, and others. Among these, the residential segment is anticipated to hold the largest market share through the forecast period. This is primarily driven by the increasing emphasis on energy efficiency and conservation among homeowners, coupled with government initiatives and utility programs that incentivize the adoption of smart meters. Residential consumers are becoming more aware of the benefits of smart meters, such as the ability to monitor and manage their energy consumption in real-time, leading to potential cost savings and reduced environmental impact. Additionally, the growing adoption of smart home technologies and the integration of smart meters with these systems further drive the demand for smart energy meters in the residential sector. Factors such as the rising need for accurate billing, the reduction of energy losses, and the integration of renewable energy sources at the household level also contribute to the dominance of the residential segment in the smart energy meters market.

Regional Segment Analysis of the Smart Energy Meters Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the smart energy meters market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the smart energy meters market over the predicted timeframe. This growth is primarily driven by the rapid urbanization and infrastructure development occurring in countries like China, India, and Japan. Governments in the region are increasingly investing in modernizing their power grid infrastructure and promoting the adoption of energy-efficient technologies, including smart energy meters. The large population and the rising demand for electricity in the residential, commercial, and industrial sectors in Asia Pacific further contribute to the region's market dominance. Additionally, favorable regulatory frameworks and initiatives to improve energy efficiency and reduce carbon emissions have accelerated the deployment of smart energy meters in the region. Key factors such as the need to manage peak loads, integrate renewable energy sources, and provide consumers with better control over their energy usage have also fuelled the growth of the smart energy meters market in the Asia Pacific region.

North America expected to grow at the fastest CAGR growth of the smart energy meters market during the forecast period. The primary factor driving the growth in the region is the replacement of the existing electric meter along with the roll-outs of new smart meter planned in huge numbers. In the past years, North America has seen a significant rise in the deployment of smart meters. U.S. has been the dominant country in the region, followed by Canada. Growth in North America includes the adoption of smart grid technologies, regulatory mandates for utilities to deploy advanced metering infrastructure, and the increasing focus on energy efficiency and the integration of renewable energy sources.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the smart energy meters market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aclara

- GE

- Itron, Inc.

- Landis+Gyr

- Kamstrup

- Honeywell

- Siemens

- Sensus

- ABB

- ZPA Smart Energy

- Secure Meter Limited

- Holley Technology Ltd

- Jabil

- Xemex

- EDMI Limited

- EMH Metering GmbH & Co KG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, UK-headquartered CyanConnode reports being the first smart meter supplier in India to reach the 2 million communication endpoint milestone.

- In March 2024, EASYMETERING reported the US Federal Communications Commission approved its smart meter for use on Private LTE with the Anterix 900MHz spectrum.

- In January 2024, Adani Energy Solutions Limited (AESL), a private transmission and distribution company, formed a 49:51 joint venture with Esyasoft Holdings to implement smart metering projects in India and other countries.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the smart energy meters market based on the below-mentioned segments:

Global Smart Energy Meters Market, By Type

- Advanced Metering Infrastructure

- Auto Meter Reading

Global Smart Energy Meters Market, By Application

- Residential

- Industrial

- Commercial

- Others

Global Smart Energy Meters Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the smart energy meters market over the forecast period?The smart energy meters market is projected to expand at a CAGR of 8.64% during the forecast period.

-

2. What is the market size of the smart energy meters market?The Global Smart Energy Meters Market Size is Expected to Grow from USD 22.08 Billion in 2023 to USD 50.56 Billion by 2033, at a CAGR of 8.64% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the smart energy meters market?Asia Pacific is anticipated to hold the largest share of the smart energy meters market over the predicted timeframe.

Need help to buy this report?