Global Smart Food Logistics Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware and Software), By Technology (Cold Chain Monitoring, Asset Tracking, Fleet Management, and Transportation Management System), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Food & BeveragesGlobal Smart Food Logistics Market Insights Forecasts to 2033

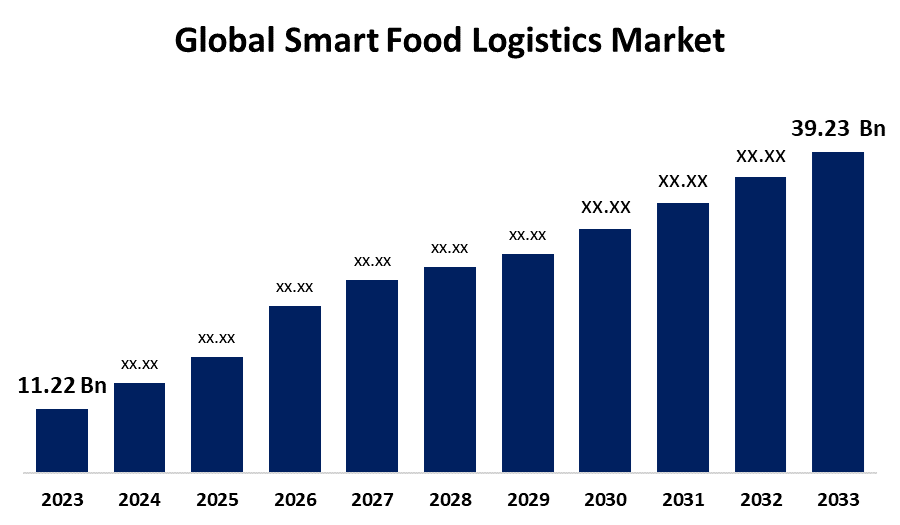

- The Global Smart Food Logistics Market Size was Valued at USD 11.22 Billion in 2023

- The Market Size is Growing at a CAGR of 13.33% from 2023 to 2033

- The Worldwide Smart Food Logistics Size is Expected to Reach USD 39.23 Billion by 2033

- Asia-Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Smart Food Logistics Market Size is Anticipated to Exceed USD 39.23 Billion by 2033, Growing at a CAGR of 13.33% from 2023 to 2033. The high-tech technological usage has increased the efficiency of the logistics supply chain which will drive the growth of the smart food logistics market. For instance, a blockchain-based, IoT-enabled system for secure and efficient logistics management in the era of IR 4.0.

Market Overview:

Smart food logistics is the part of the food supply chain that can help food producers, vendors, and other food logistics to organize shipment. The smart food supply chain can enable high optimal production and distribution of the food which will drive the growth of the smart food logistics market. The use of automation technologies such as robotics and AI-powered systems facilitates operations like harvesting, sorting, packing, and distribution, lowering labor costs and increasing efficiency. This will lead to an increase in the growth of the smart food logistics market.

The increased investment in better logistic facilities is expected to drive the growth of the smart food logistics market. For instance, McDonald's has partnered with four bakeries and food suppliers, including Bimbo and Tyson Foods, to establish a food supply base in central China's Hubei Province. Food Supply Chain (FSC) strives to reduce logistics and production costs by integrating and controlling capital and information flows, which is the primary driving force behind the growth of the worldwide smart food logistics market.

Opportunities: Cold chain surveillance

Food manufacturers use a cold chain monitoring system to properly manage the distribution, transportation, and storage of commodities that must be kept at a specific temperature. This will help to provide lucrative opportunities for the growth of the smart food logistics market.

Report Coverage:

This research report categorizes the market for the global smart food logistics market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global smart food logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global smart food logistics market.

Global Smart Food Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 11.22 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 13.33% |

| 2033 Value Projection: | USD 39.23 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Technology, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Kii Corporation, Hacobu Co., Ltd., Teletrac Navma, Monnit Corporation, Controlant, Samsara Networks, Inc., Seaos, Nippon Express co. ltd, YUSEN LOGISTICS CO. LTD, Orbcomm, Sensitech, Berlinger & Co. AG, Geotab Inc, and Others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors:

There has been an increasing shift toward efficiency in all areas as a result of higher costs associated with maintaining logistical capacities, cold chain capabilities, or engaging several middlemen when transporting food products. As consumer environmental concerns developed, an effective strategy focusing on minimizing carbon footprints to increase profitability became necessary. This will lead to increased market growth during the forecast period.

Restraining Factors:

Food supply chain management is hampered by a lack of openness, with both vendors and producers unsure of the cause of price increases and supply shortages. With their vast interconnection and frequently insufficient security procedures, worldwide supply chains have become particularly appealing targets. Furthermore, it is more profitable for a hacker to exploit extensive supply chain vulnerabilities than those that harm simply a single device.

Market Segmentation:

The global smart food logistics market share is classified into components and technology.

- The software segment has the largest share of the market over the forecast period.

Based on the components, the global smart food logistics market is categorized into hardware and software. Among these, the software segment has the largest share of the market over the forecast period. Software adoption allows businesses to operate more flexibly and mass-customize their products and services. As the number of data analysis and management specialists grows, the supply chain could transform into a service. IoT-enabled transportation management software has emerged as a critical factor in the segment's growth.

- The cold chain monitoring segment has the largest share of the market over the forecast period.

Based on the technology, the global smart food logistics market is categorized into cold chain monitoring, asset tracking, fleet management, and transportation management systems. Among these, the cold chain monitoring segment has the largest share of the market over the forecast period. It entails managing a temperature-controlled supply chain, which is commonly used to assist ensure and extend the shelf life of items that require extensive transportation. Cold chain monitoring is the process of regulating and tracking the temperature and humidity of temperature-sensitive commodities during storage and transit. A cold chain monitoring system sends real-time temperature data from commodities to a centralized software platform.

Regional Segment Analysis of the Global Smart Food Logistics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global smart food logistics market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global smart food logistics market over the forecast period. North America's AI in supply chains is growing due to the presence of developed economies such as the United States and Canada, which are focusing on improving existing supply chain solutions, the high adoption of advanced technologies, and the presence of major players. Furthermore, the government's push for the usage of technologies to manage supply chain waste, as well as the growing concern for waste reduction and resource optimization, are driving market growth in the region.

Asia-Pacific region is also expected to fastest CAGR growth during the forecast period. The government's initiatives to strengthen the nation's logistics system are driving market growth. The central government announced the creation and advancement of a modern logistics system to strongly support a new development pattern.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global smart food logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies:

- Kii Corporation

- Hacobu Co., Ltd.

- Teletrac Navma

- Monnit Corporation

- Controlant

- Samsara Networks, Inc.

- Seaos

- Nippon Express co. ltd

- YUSEN LOGISTICS CO. LTD

- Orbcomm

- Sensitech

- Berlinger & Co. AG

- Geotab Inc

- Others

Key Market Developments:

- In July 2024, Dubai announced to development of the world's largest food trade logistics center, which helps to strengthen the UAE's food security. The center supports the UAE's efforts to increase food security and grow the whole food value chain, both locally and globally.

- In February 2024, SulleX-TRC, Egypt's first integrated metropolis for logistics and refrigerated manufacturing services, is a $150 million project that aims to transform the agricultural and pharmaceutical industries.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global smart food logistics market based on the below-mentioned segments:

Global Smart Food Logistics Market, By Component

- Hardware

- Software

Global Smart Food Logistics Market, By Technology

- Cold Chain Monitoring

- Asset Tracking

- Fleet Management

- Transportation Management System

Global Smart Food Logistics Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global smart food logistics market over the forecast period?The global smart food logistics market size is expected to grow from USD 11.22 Billion in 2023 to USD 39.23 Billion by 2033, at a CAGR of 13.33 % during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global smart food logistics market?North America is projected to hold the largest share of the global smart food logistics market over the forecast period.

-

3. Who are the top key players in the smart food logistics market?Kii Corporation, Hacobu Co., Ltd, Teletrac Navma, Monnit Corporation, Controlant, Samsara Networks, Inc, Seaos, Nippon Express co. ltd, YUSEN LOGISTICS CO. LTD, Orbcomm, Sensitech, Berlinger & Co. AG, Geotab Inc, and Others.

Need help to buy this report?