Global Smart Gas Meter Market Size, Share, and COVID-19 Impact Analysis, By Type (Auto Meter Reading and Advanced Metering Infrastructure), By Application (Commercial, Industrial, and Residential), By Components (Hardware and Software), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Smart Gas Meter Market Insights Forecasts to 2033

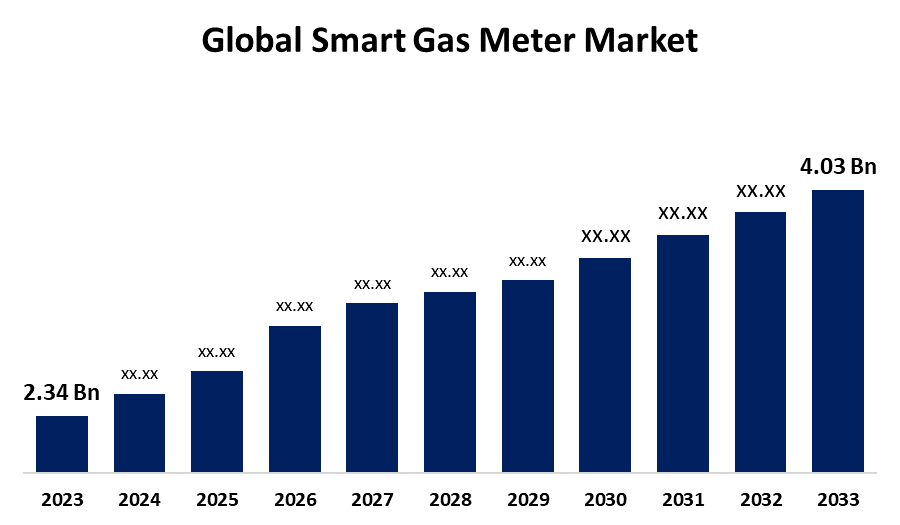

- The Global Smart Gas Meter Market Size was Valued at USD 2.34 Billion in 2023

- The Market Size is Growing at a CAGR of 5.59% from 2023 to 2033

- The Worldwide Smart Gas Meter Market Size is Expected to Reach USD 4.03 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Smart Gas Meter Market Size is Anticipated to Exceed USD 4.03 Billion by 2033, Growing at a CAGR of 5.59% from 2023 to 2033.

Market Overview

A smart gas meter is a digital device used for measuring gas consumption more accurately, reliably, and efficiently than traditional gas meters. Without the need to perform manual meter readings, these meters are made to transmit consumption data straight to the energy company, ensuring accurate and timely invoicing. The rising need for energy efficiency, the development of smart cities and households, government programs for installing smart grids, and growing public awareness of carbon footprint reduction are the main drivers of the expansion of smart gas meters. It has analytical hardware and integrated sensors to quantify the volume of gas consumed more precisely. Smart gas meters are commonly used to assess gas concentration, identify explosive and dangerous gases, and give users more insight into their consumption patterns. Consequently, it has an alarm circuit attached to it that helps with gas analysis, prevents explosions and fire threats, and provides real-time notifications regarding the quantity of hazardous gases in the atmosphere. In the upcoming years, smart gas meters might see growth opportunities due to the integration of smart home technology with gas meters, the development of advanced analytics for energy management, and the expansion into emerging markets where infrastructure modernization and efficient energy use are becoming increasingly important.

Report Coverage

This research report categorizes the market for the global smart gas meter market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global smart gas meter market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global smart gas meter market.

Global Smart Gas Meter Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.34 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.59% |

| 2033 Value Projection: | USD 4.03 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Components, By Region |

| Companies covered:: | Schneider Electric, Landis+Gyr, Aclara Technologies LLC, Xylem Inc., Badger Meter Inc., Itron Inc., Honeywell International Inc., EDMI, DIEHL Metering, Apator Group, Kamstrup A/S, Zenner, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The smart gas meter market has expanded rapidly due to the quick technological developments in smart metering systems. Presently, real-time data transmission and analytics are made possible by smart gas meters' advanced communication technologies, which include LPWAN (Low Power Wide Area Network), NB-IoT (Narrowband IoT), and IoT (Internet of Things). Utility businesses might optimize their operations and minimize energy losses by using this technology to monitor gas use in a timely and precise way. Additionally, the market for smart gas meters is expanding as a result of the expanding population and the need for energy consumption for various residential, commercial, and industrial applications. In-depth evaluation of energy use, monthly billing, fewer monthly billing cycles, and the elimination of the need for pipeline monitoring are just a few advantages that come with smart gas meters. Throughout the projection period, the growing population's need for energy is predicted to fuel the expansion of the smart gas meter sector.

Restraining Factors

Smart gas meters are often battery-powered and require a strong connection to work in a flow. A frequent issue with smart meters is that people find it hard to establish a strong connection in rural areas due to the weak signal. Gas meters require a strong enough connection to send the readings to the energy supplier. There could be technological disruption in the smart meter sector that prevents market growth. Meter failures have the potential to halt operations or produce inaccurate readings. It is thus noticed that technical disturbances serve as a growth-restraining force for the market.

Market Segmentation

The global smart gas meter market share is classified into type, application, and component.

- The advanced metering infrastructure segment dominates the market with the largest market share through the forecast period.

Based on the type, the global smart gas meter market is segmented into auto meter reading and advanced metering infrastructure. Among these, the advanced metering infrastructure segment dominates the market with the largest market share through the forecast period. The use of advanced metering infrastructure has increased recently. One of the major operational benefits of modern metering infrastructure is two-way communication between the gas provider and the customer, which has expanded its adoption across diverse regions. The trend toward renewable energy has resulted in more gas lines becoming available for residential use, which has increased the number of smart gas meter installations. The smart gas metering system's prominence has increased in line with the growing use of renewable energy. A significant benefit of smart metering infrastructure meters is the preservation of communication between the gas company and the consumer.

- The residential segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the application, the global smart gas meter market is segmented into commercial, industrial, and residential. Among these, the residential segment is anticipated to grow at the fastest CAGR growth through the forecast period. The tendency, mostly observed in the residential sector, to use gas rather than fossil fuels for home purposes. Throughout the projection period, government incentives and subsidies are also anticipated to accelerate the segment's expansion. The surge in residential installations can also be attributed to the transparency of usage charges and the capacity of smart gas meters to monitor consumption. By identifying areas of high use, these meters contribute to lowering losses and increasing public awareness of energy saving.

- The hardware segment accounted for the largest revenue share through the forecast period.

Based on the component the global smart gas meter market is segmented into hardware and software. Among these, the hardware segment accounted for the largest revenue share through the forecast period. It is anticipated that the market will be driven by the rising need for precision smart gas meter operations. Furthermore, to maintain the compact and economical features of smart gas meters, manufacturers are placing an increased emphasis on creating hardware components with a significant level of system integration and simplified design.

Regional Segment Analysis of the Global Smart Gas Meter Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global smart gas meter market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the global smart gas meter market over the predicted period. The market share of smart gas meters in Asia Pacific is dominated by China. The rollout of smart electric meters has been met with considerable success across the nation. The government of China is currently aiming to implement a similar system in smart gas meter installations across the nation. This is demonstrated by the anticipated rollout of smart gas meters in the upcoming years. The region's growing energy demand and greenhouse gas emission targets have accelerated the rollout of smart gas meters. The other key nations in the region drawing significant earnings from the smart gas metering market are South Korea, Japan, Indonesia, and India.

Europe is expected to grow at the fastest CAGR growth of the global smart gas meter market during the forecast period. To achieve long- and short-term green energy targets, there are more smart gas meter installations as shift to renewable energy sources. due to the presence of significant market participants and aggressive gas meter rollouts, Europe has been one of the target regions for growing revenues of smart gas meters.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global smart gas meter market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Schneider Electric

- Landis+Gyr

- Aclara Technologies LLC

- Xylem Inc.

- Badger Meter Inc.

- Itron Inc.

- Honeywell International Inc.

- EDMI

- DIEHL Metering

- Apator Group

- Kamstrup A/S

- Zenner

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2023, A new project by metering company Colong introduces smart meters made especially for Africa. The iDM APEX1 and iDMAPEX3, single- and triple-phase smart meters with cutting-edge functionality and cellular connectivity, are part of the project.

- In January 2022, Landis+Gyr completed the acquisition of Luna Elektrik Elektronik Sanayi ve Ticaret, a leading provider of smart metering solutions in Turkey. This acquisition enables Landis+Gyr to expand its presence in the Turkish market and strengthen its position as a global leader in smart metering solutions. The company aims to leverage Luna's expertise and customer base to offer advanced metering infrastructure (AMI) solutions to Turkish utilities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global smart gas meter market based on the below-mentioned segments:

Global Smart Gas Meter Market, By Type

- Auto Meter Reading

- Advanced Metering Infrastructure

Global Smart Gas Meter Market, By Application

- Commercial

- Industrial

- Residential

Global Smart Gas Meter Market, By Components

- Hardware

- Software

Global Smart Gas Meter Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Schneider Electric, Landis+Gyr, Aclara Technologies LLC, Xylem Inc., Badger Meter Inc., Itron Inc., Honeywell International Inc., EDMI, DIEHL Metering, Apator Group, Kamstrup A/S, Zenner, Others, and Others.

-

2. What is the size of the global smart gas meter market?The Global Smart Gas Meter Market Size is Expected to Grow from USD 2.34 Billion in 2023 to USD 4.03 Billion by 2033, at a CAGR of 5.59% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global smart gas meter market over the predicted timeframe.

Need help to buy this report?