Global Smart Kitchen Appliances Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Smart Cookware & Cooktops, Smart Refrigerators, Smart Dishwashers, Smart Ovens, and Others), By Connectivity Technology (Wi-Fi, Near Field Communication, Bluetooth, and Others), By End-user (Residential, Commercial, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Industry: Consumer GoodsGlobal Smart Kitchen Appliances Market Insights Forecasts to 2033.

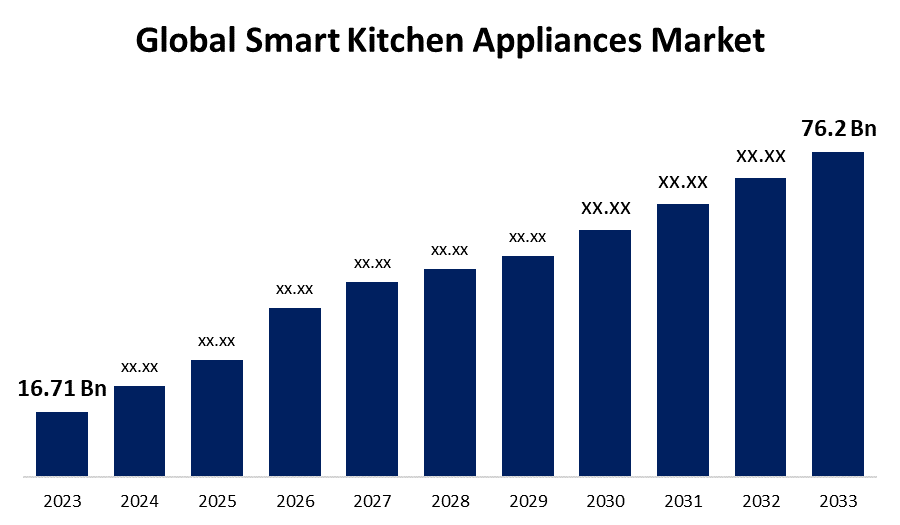

- The Global Smart Kitchen Appliances Market Size was Valued at USD 16.71 Billion in 2023.

- The Market Size is Growing at a CAGR of 16.3% from 2023 to 2033.

- The Worldwide Smart Kitchen Appliances Market Size is Expected to Reach USD 76.2 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Smart Kitchen Appliances Market Size is Anticipated to Exceed USD 76.2 Billion by 2033, Growing at a CAGR of 16.3% from 2023 to 2033.

Market Overview

A space with kitchen appliances connected by Bluetooth or Wi-Fi is called a smart kitchen. Since they are networked to other gadgets, like tablets and phones, smart kitchen appliances can control remotely. To improve productivity, accuracy, and safety, smart kitchens provide more control and data. The implementation of a smart kitchen also has the benefit of increased productivity, fewer accidents, and lower operating costs. Smart kitchen equipment makes cooking easier, faster, more accurate, and more pleasant by fusing traditional appliances with technology. They include cutting-edge technologies that save time and increase observation, such as smart controls, remote monitoring, and automatic cooking. These gadgets serve as an example of how technology is enhancing daily living and improving culinary convenience and comfort. Moreover, smart refrigerator screens could be utilized as notepads, to track temperature and energy consumption trends, and for other purposes. Owners of intelligent refrigerators can regulate the refrigerators based on how well they work by just using their cellphones to select between many settings. These advantages make smart refrigerators affordable for both residential and commercial usage, which is fueling the growth of the market for smart kitchen appliances.

Report Coverage

This research report categorizes the market for the global smart kitchen appliances market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global smart kitchen appliances market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global smart kitchen appliances market.

Global Smart Kitchen Appliances Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 16.71 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 16.3% |

| 2033 Value Projection: | USD 76.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Connectivity Technology, By End-user, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Whirlpool Corporation, LG Electronics, Samsung Electronics, Panasonic Corporation, Haier Group Corporation, Hitachi, Ltd., General Electric Company, Siemens AG, BSH Hausgeräte GmbH, Midea Group Co., Ltd., Robert Bosch GmbH, Toshiba Corporation, Arcelik A.S., Sharp Corporation, Vestel Elektronik Sanayi ve Ticaret AS, Smarter Applications Ltd., June Life, Inc., AB Electrolux, Koninklijke Philips N.V., Hestan Commercial Corporation. and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing popularity of the Internet of Things (IoT) has raised consumer interest in Internet-connected household appliances. Smart kitchen appliances' improved connection enables users to manage and keep an eye on their appliances from any location in the globe. When compared to traditional options, smart kitchen appliances are more energy-efficient and allow for better energy conservation, which increases adoption rates. Because they are more affordable, this increases their client appeal. The ability to monitor and manage smart kitchen appliances remotely using voice commands or a mobile app is an advantage for consumers. In busy homes, the adoption of smart kitchen gadgets is being driven by convenience. Additionally, the on-fridge display allows users to log the food that is kept inside and connect that data to a smartphone. As a result, it is projected that wireless connectivity solutions would have a major impact on the market expansion for smart kitchen appliances.

Restraining Factors

The growing connection and data-sharing capabilities of smart appliances have raised worries about security and privacy. Sensitive information, including use trends, personal preferences, and audio or video recordings, is collected and sent by smart kitchen equipment. Customers are concerned about their security and privacy because of the possibility of data breaches, hacking, or unauthorized access. These issues have the potential to deter prospective buyers from purchasing smart kitchen equipment and to limit the growth of the global smart kitchen appliances market.

Market Segmentation

The Global Smart Kitchen Appliances Market share is classified into product type, connectivity technology, end-user

- The smart refrigerators segment is expected to hold the largest share of the global smart kitchen appliances market during the forecast period.

Based on the product type, the global smart kitchen appliances market is divided into smart cookware & cooktops, smart refrigerators, smart dishwashers, smart ovens, and others. Among these, the smart refrigerators segment is expected to hold the largest share of the global smart kitchen appliances market during the forecast period. As smart cities and smart infrastructure gain traction, smart refrigerators are becoming more typical. The Internet of Things (IoT) industry has expanded significantly over the years as smart home appliances and gadgets like Google Nest, Ring, and Alexa increase the intelligence of houses. As a result, the smart refrigerator segment is holding a large share of the global smart kitchen appliances market.

- The Wi-Fi segment is expected to grow at the fastest pace in the global smart kitchen appliances market during the forecast period.

Based on the connectivity technology, the global smart kitchen appliances market is divided into Wi-Fi, near-field communication, Bluetooth, and others. Among these, the Wi-Fi segment is expected to grow at the fastest pace in the global smart kitchen appliances market during the forecast period. Controlling kitchen appliances from any location with an internet connection is made possible via Wi-Fi connections. Customers who appreciate the ease of remotely checking the status of a refrigerator, brewing coffee, or preheating an oven will find this function very tempting. To remain competitive, manufacturers in the kitchen appliance sector are always coming up with new ideas. To expand at the highest rate in the global smart kitchen appliances market during the projected period, firms are investing in the development and marketing of appliances with these cutting-edge technologies, such as Wi-Fi connection, which has emerged as a major differentiator.

- The commercial segment is expected to grow at the greatest pace in the global smart kitchen appliances market during the forecast period.

Based on the end-user, the global smart kitchen appliances market is divided into residential, commercial, and others. Among these, the commercial segment is expected to grow at the greatest pace in the global smart kitchen appliances market during the forecast period. This is because restaurants and other dining establishments have grown significantly as a result of rising consumer expenditure on eating out. This has accelerated the adoption of smart kitchen equipment in the commercial sector by incentivizing restaurant owners to make investments in cutting-edge, effective kitchen gadgets that can provide delicious meals much more rapidly. Cooktops, ovens, fryers, and grills are among the appliances that are being used more frequently because they increase uniformity in food preparation, lessen reliance on human labor, and lower the risk of human mistakes. Food companies all across the world are consequently investing more in appliances and kitchenware.

Regional Segment Analysis of the Global Smart Kitchen Appliances Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global smart kitchen appliances market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global smart kitchen appliances market over the predicted timeframe. This is due to several variables; it is projected that North America will have the highest share of the global smart kitchen appliances market. The region's strong industry presence, high consumer demand, wealthy customer base, sophisticated retail infrastructure, innovation-driven culture, and regulatory environment all contribute to its supremacy. The market for smart kitchen appliances has expanded in the area as a result of the notable increase in smart home device adoption, particularly in the United States. Its dominance is further reinforced by the fact that numerous major companies in the global smart kitchen appliances market are based in North America.

Asia Pacific is expected to grow at the fastest pace in the global smart kitchen appliances market during the forecast period. Asia Pacific's rising middle class has increased disposable money, allowing customers to purchase smart kitchen equipment as the area experiences fast urbanization and a rise in the number of homes. There is a growing need for smart kitchen appliances that can be connected to home automation systems in the region due to the increased usage of these systems. The global smart kitchen appliances market is expanding as a result of the increasing integration of the Internet of Things (IoT) into home appliances, particularly smart kitchen appliances.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global smart kitchen appliances along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Whirlpool Corporation

- LG Electronics

- Samsung Electronics

- Panasonic Corporation

- Haier Group Corporation

- Hitachi, Ltd.

- General Electric Company

- Siemens AG

- BSH Hausgeräte GmbH

- Midea Group Co., Ltd.

- Robert Bosch GmbH

- Toshiba Corporation

- Arcelik A.S.

- Sharp Corporation

- Vestel Elektronik Sanayi ve Ticaret AS

- Smarter Applications Ltd.

- June Life, Inc.

- AB Electrolux

- Koninklijke Philips N.V.

- Hestan Commercial Corporation.

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2023, the InstaView refrigerator was introduced by LG Electronics in Australia. Customers may select from 190,000 color options thanks to its MoodUP feature, which uses LED panels to enable various colors on the refrigerator doors. InstaView Door-in-Door technology allows customers to see inside the refrigerator without opening the door, and the refrigerator also features built-in Bluetooth speakers.

- In January 2023, Samsung Electronics Co. showcased its innovations at the Kitchen & Bath Industry Show 2023 in the United States, focusing on sustainable, smart, and customized living. With its expanding line of smart appliances, the business hopes to continue developing technologies that will enhance SmartThings' linked services in novel ways, allow for more customized experiences, and make energy conservation a way of life.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Smart Kitchen Appliances Market based on the below-mentioned segments:

Global Smart Kitchen Appliances Market, By Product Type

- Smart Cookware & Cooktops

- Smart Refrigerators

- Smart Dishwashers

- Smart Ovens

- Others

Global Smart Kitchen Appliances Market, By Connectivity Technology

- Wi-Fi

- Near Field Communication

- Bluetooth

- Others

Global Smart Kitchen Appliances Market, By End-user

- Residential

- Commercial

- Others

Global Smart Kitchen Appliances Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Whirlpool Corporation, LG Electronics, Samsung Electronics, Panasonic Corporation, Haier Group Corporation, Hitachi, Ltd., General Electric Company, Siemens AG, BSH Hausgeräte GmbH, Midea Group Co., Ltd., Robert Bosch GmbH, Toshiba Corporation, Arcelik A.S., Sharp Corporation, Vestel Elektronik Sanayi ve Ticaret AS, Smarter Applications Ltd., June Life, Inc., AB Electrolux, Koninklijke Philips N.V., Hestan Commercial Corporation., and others.

-

2. What is the size of the global smart kitchen appliances market?The Global Smart Kitchen Appliances Market is expected to grow from USD 16.71 Billion in 2023 to USD 76.2 Billion by 2033, at a CAGR of 16.3% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global smart kitchen appliances market over the predicted timeframe.

Need help to buy this report?