Global Smart Power Distribution Systems Market Size, Share & Trends, COVID-19 Impact Analysis Report, By Component (Hardware, Software, and Services), By Application (Residential, Commercial, Industrial, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: Construction & ManufacturingMARKET SUMMARY

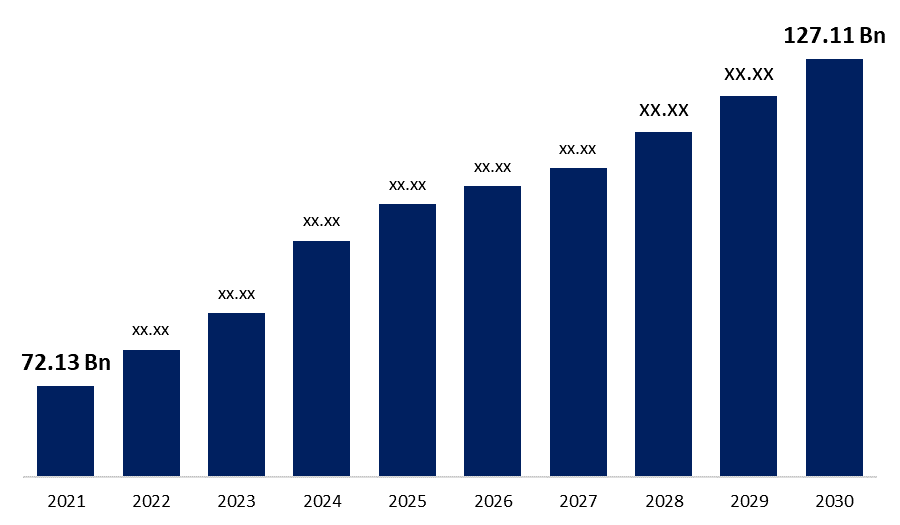

Global Smart Power Distribution Systems Market Size, is expected to be worth USD 72.13 Billion in 2021 and is estimated to reach up to USD 127.11 Billion by 2030, at a compound annual growth rate (CAGR) of 6.70% from 2021 to 2030. Due to increased need for the integration of renewable energy sources, growing grid resilience, and effective outage response, the prevalence of smart power distribution systems has increased. The market for smart power distribution systems is being driven by elements including the expansion of oil and gas firms and ongoing technological advancements. Consumers are fast adopting smart grid technologies because they enable autonomous management of electrical appliances and lower total electricity costs. The substantial presence of industry players operating in the market for smart power distribution systems during the forecast period will additionally contribute to market expansion.

Get more details on this report -

COVID-19 ANALYSIS

The COVID-19 outbreak has a negative effect on the market for smart power distribution systems worldwide. As the pandemic spreads over growing Asian nations and North America, the industrial sector is facing significant challenges. The US auto sector, one of the biggest in the world, has been at a standstill since the third quarter of 2020. Numerous automakers have reduced the size of their production facilities throughout the area, making outdated technologies like IoT, AI, and Blockchain that they had previously deployed in their factories. The automotive industry in North America primarily benefits Mexico. The drastically decreased domestic use of automobiles has, however, resulted in enormous losses for the Mexican automotive sector.

MARKET TREND

Governments' Supportive Regulatory Framework for Development of Smart Power Distribution Systems Propel Market Growth

Governments all around the world have enacted a number of beneficial laws and regulations, with an emphasis on putting in place smart grids and raising awareness of energy conservation. The adoption of smart grid technologies for industrial, commercial, and residential applications is influenced by these rules. For instance, the American Recovery and Reinvestment Act of 2009 (Recovery Act) provided USD 4.5 billion to the Department of Energy (DOE) for the modernization of electric power systems. More than 200 electric utilities and other organizations participated in 99 cost-shared projects funded by the DOE and the electricity industry's Smart Grid Investment Grant (SGIG) program, which aims to modernize the electrical grid's infrastructure, strengthen cybersecurity, enhance interoperability, and gather an unprecedented amount of data on how the smart grid works and its advantages.

MARKET DRIVERS

Increasing Demand for High-Speed Data Networks Drive Market Growth

Utility companies are using smart power distribution solutions more frequently as a result of the growing demand for operational and capital expenditure (CapEx) cost savings (OpEx). The demand for smart power distribution system solutions has increased in response to the growing consumer demand for high-speed data networks for dependable connectivity and mobility. The need for smart power distribution system solutions is predicted to increase as a result of several developments in the networking sector and different advantages offered by automation technology. The market for smart power distribution systems is predicted to be dominated by the United States.

MARKET CHALLENGE

High Installation Cost Restrain Market Growth

Capital is heavily used during the deployment phase of the smart grid. It might slow the market's expansion for smart grids worldwide. In order to alter the energy infrastructure, both the local and federal governments play a critical role. To establish up the transmission networks that enable two-way communication between the utility and its consumers, smart grid technology demands enormous initial investments.

A smart grid's successful implementation also necessitates strict governance, great adaptability toward large changes in processes, and strong collaboration across conventional organizational boundaries. Smart grid rollout requires substantial investments, which could place additional financial strain on the government. For utility providers, increased operational and maintenance expenses following the implementation of smart grid technology are another major concern.

Global Smart Power Distribution Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 72.13 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 6.70% |

| 2030 Value Projection: | USD 127.11 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 71 |

| Segments covered: | By Component, By Application, By Region, COVID-19 Impact Analysis |

| Companies covered:: | Aclara Technologies LLC, Cisco, Eaton, Fuji Electric Co., Ltd, GE, Oracle, Wipro Limited, Landis Gyr, Honeywell International Inc., Itron Inc., ABB, Siemens, Others |

| Growth Drivers: | 1) Governments Supportive Regulatory Framework for Development of Smart Power Distribution Systems Propel Market Growth 2) Increasing Demand for High-Speed Data Networks Drive Market Growth |

| Pitfalls & Challenges: | High Installation Cost Restrain Market Growth |

Get more details on this report -

MARKET SEGMENTATION

The Global Smart Power Distribution Systems Market is segmented by Component, Application, and Region. Based on the Component, the market is categorized into Hardware, Software, Services. Based on Application, the market is categorized into Residential, Industrial, Commercial, and Others. Based on the Region, the market is categorized into North America, Asia-Pacific, Europe, Middle East and Africa, South America.

By Component Insight

The hardware, software, and services segments of the global market for smart power distribution systems are based on the component segment. In 2022, the software market category will hold the greatest market share since more applications are adopting solutions. The better management of smart grid operations, improved process effectiveness, and decreased energy production costs are all factors that will likely increase demand for smart grid software solutions. The software for the smart grid helps with cost-effective energy production as well as the effective management of smart grid operations.

By Application Insight

The market for smart power distribution systems is divided into residential, commercial, industrial, retail, healthcare, transportation, and others based on the application segment. The industrial sector held the biggest market share in 2020 as a consequence of the anticipated increase in demand for smart power distribution systems solutions brought on by several advancements in the networking sector and various advantages offered by automation technology.

MARKET SEGMENTATION: BY REGION

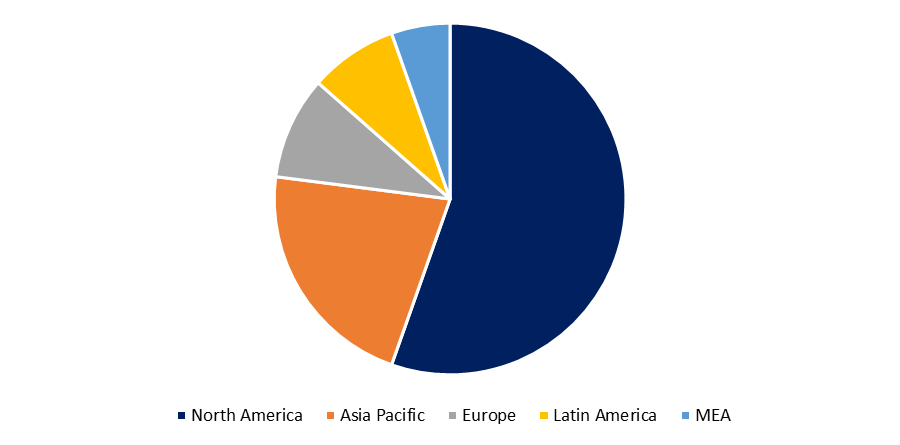

The Global Smart Power Distribution Systems Market is categorized into North America, Europe, Asia-Pacific, Latin America, the Middle East and Africa.

North America is anticipated to have the largest market share of the worldwide market for smart power distribution systems due to the technological advancements and the presence of numerous local providers of grid automation solutions power grid solutions and services. The suppliers in North America are working and concentrating on offering a variety of cutting-edge technology solutions to customers due to the rising use of power in the area. In North America, an increasing number of utilities are making investments in smart grid technologies to improve operational effectiveness and customer service. Technological advancements, rapid digitization across IoT sector applications, and rising integration of numerous linked smart devices have all fueled demand for IoT services in the North America region.

Get more details on this report -

However, Asia Pacific is anticipated to see the greatest growth rate throughout the projected period of the global smart power distribution systems market due to popularity of advanced factory automation systems is rising across the region, especially in Japan, China, and Taiwan. APAC's demand for smart power distribution systems is expected to remain concentrated on China and India due to their larger client bases. India's market is anticipated to develop at a significant CAGR among Asia Pacific countries over the forecast period due to the growing demand to enhance grid infrastructure and eliminate power outages. Many countries in APAC still rely on conventional electricity distribution networks, but as smart grid technologies proliferate, this is expected to change.

COMPETETIVE ANALYSIS

- ABB

- Aclara Technologies LLC

- Cisco

- Eaton

- Fuji Electric Co., Ltd

- GE

- Oracle

- Wipro Limited

- Landis+Gyr

- Honeywell International Inc.

- Itron Inc.

- Siemens

- Others

RECENT DEVELOPMENT

- December 2021, EcoStruxure Power, an IoT-enabled architecture and platform that provides "always-on" power for commercial buildings, healthcare facilities, data centres, industry, and infrastructure, was introduced by ABB.

- September 2020, Siemens introduced its new Unified Power Flow Controller (UPFC) PLUS and increased the choices for grid stabilization.

REPORT OVERVIEW

The scope of the report includes a detailed study of regional markets for Global Smart Power Distribution Systems Market. The Global Smart Power Distribution Systems Market is segmented by Component, Application, and Region. It discloses the state of the market and the outlook. The report also includes crucial information displayed in graphs and tables. The report covers information regarding the competitive outlook including the market share and company profiles of the key participants operating in the Global Smart Power Distribution Systems Market.

Need help to buy this report?