Global Smart Water Metering Market Size, Share, and COVID-19 Impact Analysis, By Application (Residential, Commercial, and Utility), By Technology (AMI and AMR), By Product (Hot Water Meter and Cold Water Meter), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Energy & PowerGlobal Smart Water Metering Market Insights Forecasts to 2033

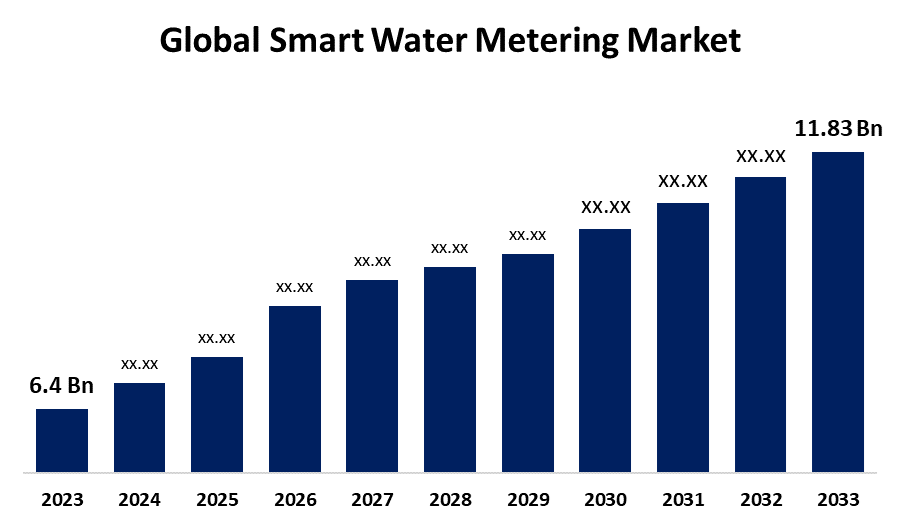

- The Global Smart Water Metering Market Size was Valued at USD 6.4 Billion in 2023

- The Market Size is Growing at a CAGR of 6.34% from 2023 to 2033

- The Worldwide Smart water metering Market Size is Expected to Reach USD 11.83 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Smart Water Metering Market Size is Anticipated to Exceed USD 11.83 Billion by 2033, Growing at a CAGR of 6.34% from 2023 to 2033.

Market Overview

Smart water metering is an improved electronic application intended to enable facilities to automatically gather consumption data, enhance effectiveness, eradicate physical meter readings, and save costs. Smart water meters are innovative devices that are used to measure and monitor water consumption in housing and industrial areas. These meters are prepared with integrated expertise that allows real-time data gathering, interaction, and study of water usage. Smart water meters have other characteristics and abilities, including automated meter reading, isolated monitoring, outflow recognition, consumption study, and many others, which balance the smart water meter market saturation, unlike conventional mechanical water meters. Furthermore, smart water metering systems depend on wired and wireless interaction technology such as Wi-Fi water meters to link LAN or wide area networks, allowing remote location observing and infrastructure protection through leak recognition. Moreover, the smart water metering system can be utilized for billing water and energy consumption in industrial, residential, and commercial sectors. Additionally, smart water metering is intended with resources such as thermoplastics letting companies encourage sustainability by reprocessing smart water metering devices.

Report Coverage

This research report categorizes the market for the global smart water metering market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global smart water metering market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global smart water metering market.

Global Smart Water Metering Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.4 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.34% |

| 2033 Value Projection: | USD 11.83 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By Technology, By Product and By Region |

| Companies covered:: | Kamsturp, Itron, Landis + Gyr, Honeywell International Inc., Badger Meter, Inc., Sensus USA Inc., Diehl Stiftung & Co. KG, Neptune Technology Group Inc., Siemens AG, Schneider Electric SE, Elster Group GmbH, Aclara Technologies LLC, Arad Group, Holley Technology UK Ltd., Master Meter Inc., and other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Smart water metering increases efficiency and gives utilities the chance to identify leaks and unusual use, which in turn helps them gather consumption data automatically. The demand for smart water meters is rising as a result of government initiatives and funding. Many countries' governments are moving in the right direction to promote sustainable water use that is sustainable. These steps have been implemented in response to the drastically rising water demand brought on by urbanization and a quickly expanding population. The increase in energy consumption has led to the emergence of new companies and job locations. To fulfill the current and future demands for water, sustainable use has become increasingly important. These systems are the best choice since they can monitor water use throughout the whole supply chain of a water company. The market for smart water meters is expanding as a result of the rise in the number of water utilities adopting them.

Restraining Factors

When compared to electricity and gas meters, water meters are still being disregarded in the current situation, where smart grid expenditures are accelerating. This is because smart water meter installation and use are not subject to any government rules or mandates.

Market Segmentation

The global smart water metering market share is classified into application, technology, and product.

- The residential segment is expected to dominate the market during the forecast period.

Based on the application, the global smart water metering market is divided into residential, commercial, and utility. Among these, the residential segment is expected to dominate the market during the forecast period. This is because efficient monitoring systems have been put in place and water use patterns have been optimized. The industry will flourish as a result of the advanced metering units' ongoing development and cost competitiveness.

- The AMR segment is anticipated to dominate the market during the forecast period.

Based on the technology, the global smart water metering market is divided into AMI and AMR. Among these, the AMR segment is anticipated to dominate the market during the forecast period. The purpose of AMR units is to make data analysis and two-way communication easier. Customers and water providers benefit from the continuous meter reading capabilities provided by AMR machines, which also lessen the need for manual labor, reduce meter tampering, and stop water theft.

- The cold water meter segment is anticipated to hold the largest share of the global smart water metering market during the forecast period.

Based on the product, the global smart water metering market is divided into hot water meter and cold water meter. Among these, the cold water meter segment is anticipated to hold the largest share of the global smart water metering market during the forecast period. The accurate monitoring and analysis of cold-water consumption patterns made possible by these meters is in line with the requirement for the effective use of water resources. The adoption of these goods will be fueled by the execution of government programs for smart cities and the broad distribution of these meters across dispersed metering and end-use locations.

Regional Segment Analysis of the Global Smart Water Metering Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global smart water metering market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global smart water metering market over the predicted timeframe. This can be explained by the region's significant environmental focus. By substituting modern AMI (Advanced Metering Infrastructure) for mechanical and electromechanical water meter systems, the US Environmental Protection Agency has announced intentions to make all drinking water supply lines in the country "smarter." These devices find use in several industries in the US and Canada, such as sewage treatment, flood detection and management, and water and wastewater management. Energy-saving line monitoring and leak detection are two of the most popular uses of smart water meters in the region. To maximize revenue collection and streamline operations in response to growing demand from North America, utilities are focusing on enhancing software capabilities.

Asia Pacific is expected to grow at the fastest pace in the global smart water metering market during the forecast period. Due to the growing need for effective water management and conservation, the Asia-Pacific region is seeing a sharp increase in the use of smart water metering technologies. To solve the problem of water scarcity and maximize resource allocation, governments and water utilities in countries like China, India, Japan, and Australia are aggressively using smart water metering systems. Improving water management techniques in this region will need the use of smart water meters.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global smart water metering market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kamsturp

- Itron

- Landis + Gyr

- Honeywell International Inc.

- Badger Meter, Inc.

- Sensus USA Inc.

- Diehl Stiftung & Co. KG

- Neptune Technology Group Inc.

- Siemens AG

- Schneider Electric SE

- Elster Group GmbH

- Aclara Technologies LLC

- Arad Group

- Holley Technology UK Ltd.

- Master Meter Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2022, the ModMAG M2000 Electromagnetic flow meter, with the BACnet MS/TP communication protocol, was introduced by Badger Meter, Inc.

- In December 2021, the Maltese Utility Water Services Corporation (WSC) was able to minimize non-revenue water and overcome the obstacles of high levels of limescale and low flow rates with the use of Diehl Metering.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global smart water metering market based on the below-mentioned segments:

Global Smart Water Metering Market, By Application

- Residential

- Commercial

- Utility

Global Smart Water Metering Market, By Technology

- AMI

- AMR

Global Smart Water Metering Market, By Product

- Hot Water Meter

- Cold Water Meter

Global Smart Water Metering Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?