Global Smoked Salmon Market Size, Share, and COVID-19 Impact Analysis, By Type (Hot-Smoke Salmon and Cold-Smoke Salmon), By Application (Food Service, Retail, and Others), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Stores, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Food & BeveragesGlobal Smoked Salmon Market Insights Forecasts to 2033

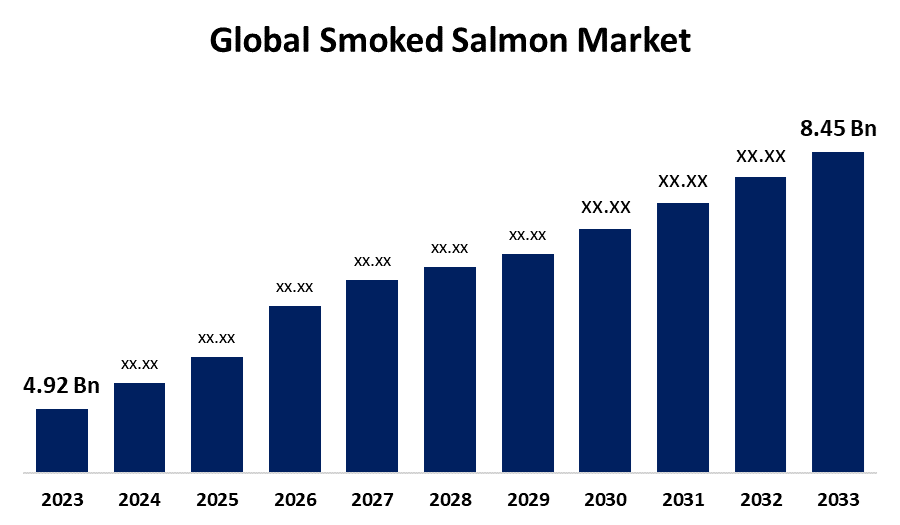

- The Global Smoked Salmon Market Size was estimated at USD 4.92 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 5.56% from 2023 to 2033

- The Worldwide Smoked Salmon Market Size is Expected to Reach USD 8.45 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global smoked salmon Market size was worth around USD 4.92 Billion in 2023 and is predicted to Grow to around USD 8.45 Billion by 2033 with a compound annual Growth rate (CAGR) of 5.56% between 2023 and 2033. The smoked salmon market growth is fueled by increased consumer demand for healthy and ready-to-eat foods, combined with growing knowledge of the health benefits of smoked salmon. With consumers moving towards more nutritious diets, smoked salmon is emerging as a popular option owing to its high content of omega-3 fatty acids, which are renowned for their heart-friendly properties.

Market Overview

The smoked salmon industry is the business engaged in the manufacture, distribution, and sale of smoked salmon products. Smoked salmon is usually produced by curing salmon fillets using salt and then smoking it either through hot or cold smoking. The market involves several kinds of smoked salmon products in various package sizes. Additionally, increasing public awareness of the health benefits of omega-3 fatty acids, which are abundant in salmon, is one of the primary drivers of the smoked salmon market. This has fueled demand from consumers seeking healthy food choices who are health-conscious. Market growth is also driven by the increasing demand for gourmet and high-end food products among consumers and the increasing popularity of seafood as a high-protein diet option. Additionally, technological innovation in packaging has improved the shelf life of smoked salmon, which makes it more attractive to consumers and retailers. This aspect is especially crucial in the food service industry where the need for durable, high-quality ingredients is essential to operations.

Report Coverage

This research report categorizes the smoked salmon market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the smoked salmon market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the smoked salmon market.

Global Smoked Salmon Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.92 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.56% |

| 2033 Value Projection: | USD 8.45 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Distribution, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Mowi ASA, Marine Harvest, Labeyrie Fine Foods, Norvelita UAB, Young’s Seafood Ltd, Thai Union Group PCL, Delpeyrat, Meralliance, Acme Smoked Fish Corporation, Lerøy Seafood Group ASA, Suempol SA, The H. Forman & Son Ltd, Foppen and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Smoked salmon contains a high level of omega-3 fatty acids, which promote heart health, brain function, and anti-inflammation. This has contributed to its popularity among consumers who are health-conscious, since a lean protein source, smoked salmon, is attractive to consumers seeking high-quality protein sources leading to the smoked salmon market demand. In addition, smoked salmon is typically served during special occasions, holidays, and fine dining, hence increasing its demand in the food service industry.

Restraining Factors

Smoked salmon is usually a premium or luxury food product, and its cost can be much higher than other fish or protein sources. This renders it unaffordable for most consumers, especially in developing markets inhibiting the growth of the smoked salmon market.

Market Segmentation

The smoked salmon market share is classified into type, application, and distribution channel.

- The cold-smoke salmon segment dominated the market in 2023 and is projected to grow t a substantial CAGR during the forecast period.

Based on the type, the smoked salmon market is divided into hot-smoke salmon and cold-smoke salmon. Among these, the cold-smoke salmon segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth is attributed to cold-smoked salmon possessing a smooth, silky and delicate structure, almost raw taste that is preferred by most consumers. The process of smoking, which takes place at low temperatures, does not cook the fish so that it can preserve its raw-like texture, which is very much sought after by gourmet consumers.

- The retail segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the application, the smoked salmon market is divided into food service, retail, and others. Among these, the retail segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The growth is driven by retail purchases enabling consumers to buy smoked salmon at their convenience. Whether in supermarkets, hypermarkets, specialty food stores, or websites, consumers can obtain smoked salmon without having to eat out or depend on food service establishments. Such convenience makes it a popular choice for most individuals who desire to have smoked salmon at home.

- The supermarkets/hypermarkets segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the smoked salmon market is divided into supermarkets/hypermarkets, specialty stores, online stores, and others. Among these, the supermarkets/hypermarkets segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is due to supermarkets and hypermarkets are among the most accessible forms of retailing, with a large and diverse clientele. They are used to provide daily needs for shopping, which makes them the destination store for consumers where they can buy smoked salmon and other grocery items.

Regional Segment Analysis of the Smoked Salmon Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Europe is anticipated to hold the largest share of the smoked salmon market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the smoked salmon market over the predicted timeframe. Smoked salmon has a long tradition of existence in European cuisine, especially in Norway, Scotland, and the UK. For centuries, these nations have smoked fish as part of traditional practices, and smoked salmon is a common food source across Europe. For generations, smoking salmon was used to preserve it, and thus this is a common and accepted food product throughout Europe.

Asia Pacific is expected to grow at a rapid CAGR in the smoked salmon market during the forecast period. Seafood is increasingly becoming a significant diet component across most APAC nations, influenced by shifting tastes and dietary trends. With consumers gravitating toward more protein-heavy diets and leaner meat options, fish such as salmon are becoming increasingly popular. The surge in demand for seafood has also naturally spilled over to smoked salmon.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the smoked salmon market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mowi ASA

- Marine Harvest

- Labeyrie Fine Foods

- Norvelita UAB

- Young's Seafood Ltd

- Thai Union Group PCL

- Delpeyrat

- Meralliance

- Acme Smoked Fish Corporation

- Lerøy Seafood Group ASA

- Suempol SA

- The H. Forman & Son Ltd

- Foppen

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, Salmon Evolution announced its strategic alliance with Lofotprodukt AS. Smoked salmon produced from Salmon Evolution's land-based salmon was introduced by Lofotprodukt AS in Week 8 under its premium brand, Lofoten.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the smoked salmon market based on the below-mentioned segments:

Global Smoked Salmon Market, By Type

- Hot-Smoke Salmon

- Cold-Smoke Salmon

Global Smoked Salmon Market, By Application

- Food Service

- Retail

- Others

Global Smoked Salmon Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Stores

- Others

Global Smoked Salmon Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the smoked salmon market over the forecast period?The global smoked salmon market is projected to expand at a CAGR of 5.56% during the forecast period.

-

2. What is the market size of the smoked salmon market?The global smoked salmon market size is expected to grow from USD 4.92 Billion in 2023 to USD 8.45 Billion by 2033, at a CAGR of 5.56% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the smoked salmon market?Europe is anticipated to hold the largest share of the smoked salmon market over the predicted timeframe.

Need help to buy this report?