Global SNP Genotyping and Analysis Market Size, Share, and COVID-19 Impact Analysis, By Technology (Microarrays and GeneChips, Taqman Allelic Discrimination, SNP Pyrosequencing, Applied Biosciences SNPlex, Sequemon MassArray Maldi-TOF, and Other), By Application (Diagnostic Research, Pharmacogenomics, Agricultural Biotechnology, Breeding and Animal Livestock), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Analysis and Forecast 2021 – 2030.

Industry: HealthcareGlobal SNP Genotyping and Analysis Market Insights Forecasts to 2030

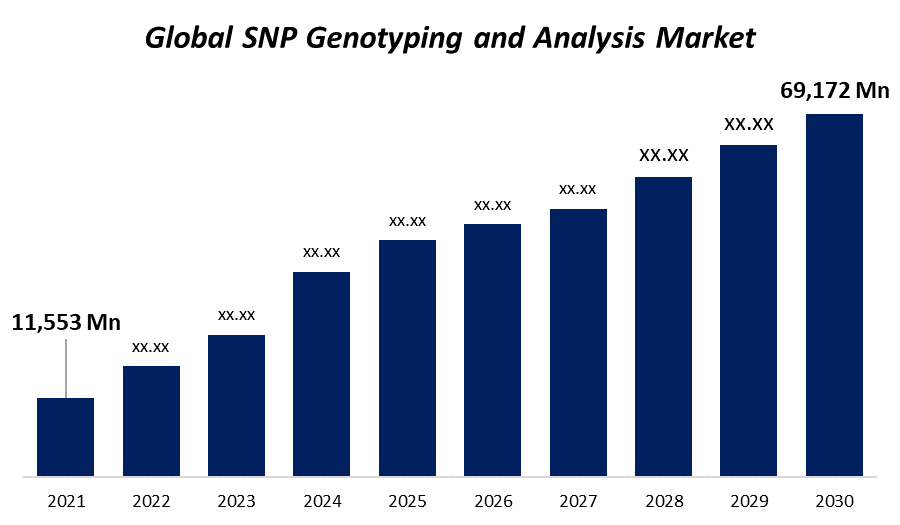

- The global SNP genotyping and analysis market was valued at USD 11,553.0 Million in 2021.

- The market is growing at a CAGR of 22% from 2021 to 2030

- The global SNP genotyping and analysis market is expected to reach USD 69,172 Million by 2030

- The Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The global SNP genotyping and analysis market is expected to reach USD 69,172 Million by 2030, at a CAGR of 22% during the forecast period 2021 to 2030. The SNP genotyping and analysis market has grown due to the rising prevalence of fatal diseases such as cancer, diabetes and others. In addition, the growing demand for genetic analysis in animal and plant feedstock increasing the market growth.

Market Overview

Genotyping is a process that helps in looking at a person's DNA sequence to see if there are any differences in their genes. By using this method, researchers could better look into genetic abnormalities like significant changes in DNA and single nucleotide polymorphisms. The growing use of genotyping in making new drugs worldwide is one of the main things that is driving the growth of the genotyping market. In addition, the market is growing because of several other things, such as the rise of diseases like cancer, diabetes, and Alzheimer's, as well as the introduction of new technologies that make mistakes less likely and give more accurate results. The market for genotyping is also helped by things like the growing number of older people, the rising cost of medical care, and the growing number of investments, funds, and grants. Analysis of single nucleotide polymorphisms (SNPs) is used in many areas of genetics and other related fields. Most of the time, this research is done to discover how genes affect a wide range of complicated diseases. SNP technologies are used to find illnesses and are good at determining what causes a wide range of human diseases. Some of these diseases are cancer, heart disease, Alzheimer's, and asthma, to name a few. It also gives high accuracy, especially when genotyping genome-wide perfect SNPs with high polymorphism.

Report Coverage

This research report categorizes the market for global SNP genotyping and analysis based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global SNP genotyping and analysis market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each global SNP genotyping and analysis market sub-segments.

Global SNP Genotyping and Analysis Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 11,553.0 Million |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 22% |

| 2030 Value Projection: | USD 69,172 Million |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 114 |

| Segments covered: | By Technology, By Application, By Region, COVID-19 Impact Analysis |

| Companies covered:: | Sequenom, Inc., Douglas Scientific LLC, PREMIER Biosoft, Sequenom Inc., Luminex Corp., Life Technologies Corp., Fluidigm, Illumina, Inc., Affymetrix, Inc. |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Segmentation Analysis

- In 2021, the SNP pyrosequencing segment dominated the market with the largest market share of 33.1% and market revenue of 3,824 million.

Based on the technology, the global SNP genotyping and analysis market is categorized into Microarrays and GeneChips, Taqman Allelic Discrimination, SNP Pyrosequencing, Applied Biosciences SNPlex, Sequenom MassArray Maldi-TOF, and Other. In 2021, the SNP pyrosequencing segment dominated the market with the largest market share of 33.1% and market revenue of 3,824 million. Based on the idea of sequencing by synthesis, pyrosequencing is another way to figure out the order of small pieces of DNA. When compared to the Sanger method, Pyrosequencing works better and takes less time. But this method can't always be used in the same ways as the traditional method.

- In 2021, the Pharmacogenomics segment accounted for the largest share of the market, with 40% and a market revenue of 4,621 million.

Based on application, the SNP genotyping and analysis market is categorized into Diagnostic Research, Pharmacogenomics, Agricultural Biotechnology, Breeding and Animal Livestock. In 2021, the pharmacogenomics segment accounted for the largest share of the market, with 40% and market revenue of 4,621 million. A big part of the pharmacogenomics market can be attributed to the growing industry for personalized medicine. For drug development purposes, SNPs in genetic materials are used a lot. Because of this, it is expected that the need for pharmacogenomics will increase, which will make the growth in the SNP Genotyping market.

Regional Segment Analysis of the SNP Genotyping and Analysis Market

Get more details on this report -

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

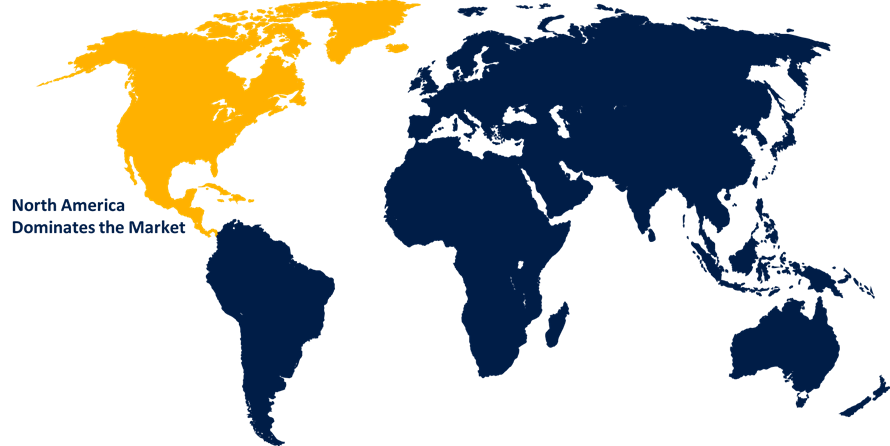

North America emerged as the largest market for the global SNP genotyping and analysis market, with a market share of around 36% and 11,553.0 million of the market revenue in 2021.

- In 2021, North America emerged as the largest market for the global SNP genotyping and analysis market, with a market share of around 36% and 11,553.0 million of the market revenue. North America is expected to be the largest market. In the context of North America, the United States is expected to grow and change a lot. Because of the steadily rising number of chronic illnesses in the United States, it is likely that there will be more demand for genotyping tools and services. According to the most recent version of the article Chronic Diseases in America, which was published by the National Center for Chronic Disease Prevention and Health Promotion in January 2021, six out of ten adults in the United States have at least one chronic disease, and four out of ten adults have two or more chronic diseases. Genotyping techniques can be used to find and treat chronic diseases on early stage.

- The Asia-Pacific market is expected to grow at the fastest CAGR between 2021 and 2030, As a result of government funding in a number of programs and policies, improvements in healthcare facilities, a rise in the demand for personalized medicines, and more growth in the economy.

Competitive Landscape

The report offers the appropriate analysis of the key organizations/companies involved within the global SNP genotyping and analysis market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- Sequenom, Inc.

- Douglas Scientific LLC

- PREMIER Biosoft

- Sequenom Inc.

- Luminex Corp.

- Life Technologies Corp.

- Fluidigm

- Illumina, Inc.

- Affymetrix, Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Some of the Key Developments:

- In February 2021, Novacyt put out its SNPsig portfolio of PCR genotyping assays. These tests can be used to help figure out if a new type of the SARS-CoV-2 virus is present.

- In August 2021, Thermo Fisher Scientific made changes to its products that made them better. The business's Applied Biosystems TaqMan SARS-CoV-2 mutation panel, which is used to diagnose the Delta and Lambda strains of the virus, has been updated.

Market Segment

This study forecasts global, regional, and country revenue from 2019 to 2030. Spherical Insights has segmented the global SNP genotyping and analysis market based on the below-mentioned segments:

Global SNP Genotyping and Analysis Market, By Technology

- Microarrays and GeneChips

- Taqman Allelic Discrimination

- SNP Pyrosequencing

- Applied Biosciences SNPlex

- Sequemon MassArray Maldi-TOF

- Other

Global SNP Genotyping and Analysis Market, By Application

- Diagnostic Research

- Pharmacogenomics

- Agricultural Biotechnology

- Breeding

- Animal Livestock

Global SNP Genotyping and Analysis Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?