Global Sodium Cyanide Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Solid Sodium Cyanide and Liquid Sodium Cyanide), By Industry (Mining, Chemical, Dye & Textile and Pharmaceutical), By Sales Channel (Direct Sales and Distributed Sales), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Specialty & Fine ChemicalsGlobal Sodium Cyanide Market Insights Forecasts to 2033

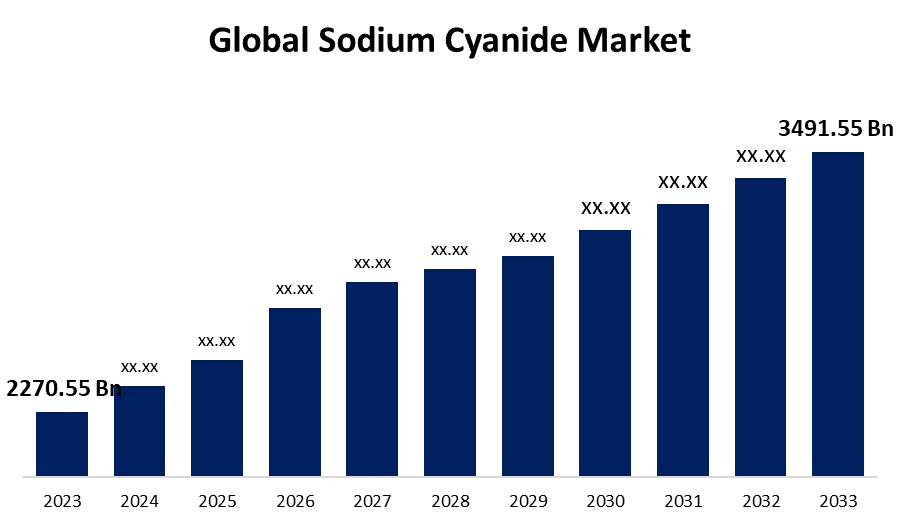

- The Global Sodium Cyanide Market Size was Valued at USD 2270.55 Million in 2023

- The Market Size is Growing at a CAGR of 4.40% from 2023 to 2033

- The Worldwide Sodium Cyanide Market Size is Expected to Reach USD 3491.55 Million by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Sodium Cyanide Market Size is Anticipated to Exceed USD 3491.55 Million by 2033, Growing at a CAGR of 4.40% from 2023 to 2033.

Market Overview

Sodium cyanide is an inorganic toxic chemical compound with the formula NaCN. It is a white, water-soluble solid that can release hydrogen cyanide gas, which is extremely toxic to humans and animals even in small amounts. Sodium cyanide is used in the metal, agrochemical, dye/pigment, and pharmaceutical industries. Because of its toxicity, it is used as a pesticide and for analytical testing. The International Cyanide Management Code for the manufacture, transport, and use of cyanide in gold production, or simply the cyanide code, was established to help the world's gold mining industry. Furthermore, it encourages the improvement of cyanide management practices for producers and carriers of cyanide used in gold mining, as well as their ability to openly demonstrate conformity to the cyanide code via an impartial and open approach. The sodium cyanide market refers to the global industry that manufactures, distributes, and sells sodium cyanide. Companies in the sodium cyanide market take excessive care when transporting and storing this highly dangerous substance.

Report Coverage

This research report categorizes the market for sodium cyanide market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the sodium cyanide market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the sodium cyanide market.

Global Sodium Cyanide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2270.55 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.40% |

| 2033 Value Projection: | USD 3491.55 Mill |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Industry, By Sales Channel, By Region |

| Companies covered:: | Cyanco International, LLC, The Chemours Company, Hindusthan Chemicals Company, Evonik Industries, American Elements, Heabei Chengxini Holding Limited, AnQore, Sinopec Shanghai Petrochemical Company Limited, Australian Gold Reagents Pty Ltd, Orica, Cyplus GmbH, LUKOIL, Taekwang Industrial Corp. Ltd., Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rise of the mining sector, particularly the gold mining sector, is the primary driver of the worldwide sodium cyanide market. The leaching procedure, which is extensively used to extract gold from ore, is based on sodium cyanide. Mining activities have increased due to rising demand for gold due to its use in jewelry and electronics, as well as its importance as a safe haven for investors, resulting in an increase in the requirement for sodium cyanides. Another key reason is the advancement of mining technology that increases the efficacy and efficiency of sodium cyanide in the extraction process. Sodium cyanide is becoming more desirable as a result of advancements such as precise dosing procedures, increased leach recovery rates, and ecologically friendly cyanide management techniques. In addition to maximizing gold yield, these technologies aid in following to safety and environmental laws that are tightening globally.

Restraining Factors

The global sodium cyanide market faces significant challenges due to its severe health and environmental risks, which include potential disastrous consequences from spills and strict regulatory scrutiny. Compliance costs have risen as environmental regulations tighten, impacting industry operations. Additionally, the development of alternative gold extraction methods, such as bioleaching and thiosulfate leaching, which are perceived as more environmentally friendly, poses a threat to sodium cyanide's dominance in the market.

Market Segmentation

The sodium cyanide market share is classified into product type, industry, and sales channel.

- The solid sodium cyanide segment is estimated to hold the highest market revenue share through the projected period.

Based on the product type, the sodium cyanide market is classified into solid sodium cyanide and liquid sodium cyanide. Among these, the solid sodium cyanide segment is estimated to hold the highest market revenue share through the projected period. The increasing demand for gold is driving the segment's rise. Solid sodium cyanide is very useful for dissolving and extracting gold from its ores by a process of leaching and cyanidation. According to the World Gold Council January 2024, the total supply in 2023 climbed by 3% year on y/y, marking the second consecutive year of moderate gains. Annual production of 3,644t was the highest since 2018, with no major production delays reported. Higher gold prices spurred a 9% increase in recycling, reaching 1,237t. Furthermore, solid sodium cyanide is much easier to handle than liquid sodium cyanide, hence it is commonly utilized in end-user industries.

- The mining segment is anticipated to hold the largest market share through the forecast period.

Based on the industry, the sodium cyanide market is divided into mining, chemical, dye & textile, and pharmaceutical. Among these, the mining segment is anticipated to hold the largest market share through the forecast period. The increased global demand for lithium is likely to drive the segment's growth. According to World Economic Forum 2023, the increasing demand for lithium is predicted to reach 1.5 million tonnes of lithium carbonate equivalent by 2025, and more than 3 million tonnes by 2030 due to the growing demand for EVs. Sodium cyanide plays a crucial role in modern gold mining, enabling the extraction of over 90% of mined gold through cyanidation processes. It also aids in recovering silver and other metals from ores, contributing significantly to global metal production.

- The direct sales segment dominates the market with the largest market share through the forecast period.

Based on the sales channel, the sodium cyanide market is categorized into direct sales and distributed sales. Among these, the direct sales segment dominates the market with the largest market share through the forecast period. Direct sales typically involve transactions directly between the producer or manufacturer of sodium cyanide and the mining companies that utilize it for gold and metal extraction processes. This direct approach often provides benefits such as better control over supply chain logistics, pricing negotiations, and ensuring product quality and consistency, which are critical factors in industries dependent on reliable chemical inputs such as mining.

Regional Segment Analysis of the Sodium Cyanide Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the sodium cyanide market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the sodium cyanide market over the predicted timeframe. The expansion of the market can be attributed largely to the expanding quantity of gold reserves and rapid production of gold. According to the World Gold Council, China was the largest producer in the world in 2022 and accounted for around 10% of total global production. Australia is expected to surpass China in output soon. According to the Department of Industry Science and Resources 2022, Australia was the world's second-largest gold-producing country saw a 0.8% increase to 155 tons from the previous year. Furthermore, increased production of other minerals will boost market expansion in the region. China is also the biggest producer of minerals, such as bauxite, copper, cobalt, silver, and magnesium. Moreover, India is aggressively expanding its mining industry with plans for additional gold mines, which bodes well for future sodium cyanide demand. The Asia Pacific market is driven by rapidly expanding economies, the availability of gold reserves, and government attempts to increase mining output in the region.

North America North is expected to grow at the fastest CAGR growth of the sodium cyanide market during the forecast period. The region has big mining corporations with global operations. Many major sodium cyanide companies, like Cyanco and Chemours, have a significant manufacturing presence in the United States and Canada to meet substantial domestic demand from the mining industry. With some of the world's greatest gold reserves, North America's mining industry is primarily reliant on sodium cyanide for extraction procedures. The United States, in particular, has witnessed a significant rise in gold production in recent years, owing to higher gold prices, which have increased demand for sodium cyanide. The region also has a strong chemical industry infrastructure to support sodium cyanide manufacturing and distribution facilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the sodium cyanide market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cyanco International, LLC

- The Chemours Company

- Hindusthan Chemicals Company

- Evonik Industries

- American Elements

- Heabei Chengxini Holding Limited

- AnQore

- Sinopec Shanghai Petrochemical Company Limited

- Australian Gold Reagents Pty Ltd

- Orica

- Cyplus GmbH

- LUKOIL

- Taekwang Industrial Corp. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2024, ORICA expanded its mining chemicals business with Cyanco acquisition, partly funded by equity raising.

- In February 2024, Balaji Speciality Chemicals Limited received a Mega Project Status from the Industries, Energy and Labour Department, Government of Maharashtra. The proposed investment is Rs. 750 crores for Hydrogen Cyanide and Sodium Cyanide 30% (Solution), Sodium Cyanide 100% (Solid), Ethylene Diamine Tetra Acetic Acid / EDTA Disodium, Benzyl Cyanide, Phenylacetic Acid and TriEthyl OrthoFormate products.

- In November 2023, Altynalmas announced the second sodium cyanide factory in the Shu district's free economic zone will begin operations in the fourth quarter of 2023. It is expected to produce 25,000 tons of 98% pure sodium cyanide.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the sodium cyanide market based on the below-mentioned segments:

Global Sodium Cyanide Market, By Product Type

- Solid Sodium Cyanide

- Liquid Sodium Cyanide

Global Sodium Cyanide Market, By Industry

- Mining

- Chemical

- Dye & Textile

- Pharmaceutical

Global Sodium Cyanide Market, By Sales Channel

- Direct Sales

- Distributed Sales

Global Sodium Cyanide Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the sodium cyanide market over the forecast period?The sodium cyanide market is projected to expand at a CAGR of 4.40% during the forecast period.

-

2.What is the market size of the sodium cyanide market?The Global Sodium Cyanide Market Size is Expected to Grow from USD 2270.55 Million in 2023 to USD 3491.55 Million by 2033, at a CAGR of 4.40% during the forecast period 2023-2033.

-

3.Which region holds the largest share of the sodium cyanide market?Asia Pacific is anticipated to hold the largest share of the sodium cyanide market over the predicted timeframe.

Need help to buy this report?