Global Sodium Silicate Market Size, Share, and COVID-19 Impact Analysis, By Type (Solid and Liquid), By Application (Detergents, Pulp and Paper, Derivative Silicates, Construction, Water Treatment, and Others), By Form (Crystalline, and Anhydrous), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Sodium Silicate Market Insights Forecasts to 2033

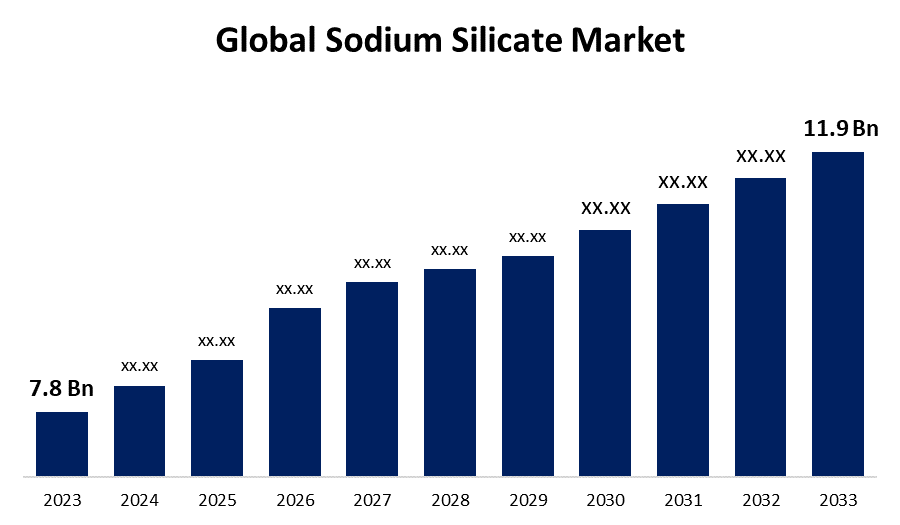

- The Global Sodium Silicate Market Size was Valued at USD 7.8 Billion in 2023

- The Market Size is Growing at a CAGR of 4.31% from 2023 to 2033

- The Worldwide Sodium Silicate Market Size is Expected to Reach USD 11.9 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Sodium Silicate Market Size is Anticipated to Exceed USD 11.9 Billion by 2033, Growing at a CAGR of 4.31% from 2023 to 2033.

Market Overview

Sodium silicate is defined as the segment inside chemical manufacturing that emphasizes the production, distribution, and operation of emergency-grade sodium silicate solutions. Sodium silicate solutions are frequently utilized in firefighting and emergency response situations owing to their ability to conquer fires, control dangerous spills, and alleviate certain chemical reactions. Sodium silicate is an inorganic sodium saline with silicate as a counterion. Sodium silicate is correspondingly recognized as water glass. Sodium silicate is crystal-like, voluntarily liquefies in water, and discoveries a broad range of applications. Growing consciousness of infection prevention has improved the demand for detergents and driven their consumption. Infrastructural expansion in numerous regions owing to swift urbanization is estimated to boost the demand from the building industry during the forecast period. Sodium silicate is a main source of reactive silica that has tremendous demand in several application industries, including cleaner, gum, nutrition and drink, and paper and tissue. Growing demand for other byproducts such as silica gels and silica sols in applications, as well as paints and coatings, plastics, and ink, is anticipated to have a positive influence on the market development over the forecast period. Development in the water treatment sector is powering the sodium silicate market value. Sodium silicate is cast in water treatment as one of the apparatuses of activated silica coagulant to help with manganese and iron stabilization and corrosion control. Sodium silicates and metasilicates perform as binders in heavy-duty dishwasher tablets and washing detergents. Sodium solutions are added to the detergent slurry, which aids in exercising control over the viscidness essential to produce powder of the desired density.

Report Coverage

This research report categorizes the market for the sodium silicate market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global sodium silicate market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the sodium silicate market.

Global Sodium Silicate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.8 Billion |

| Forecast Period: | 2023 to 2033 |

| Forecast Period CAGR 2023 to 2033 : | 4.31% |

| 2033 Value Projection: | USD 11.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Form, By Region and COVID-19 Impact Analysis |

| Companies covered:: | PQ Corp., Evonik Industries AG, BASF SE, W.R. Grace & Co., CIECH Group, Silmaco NV, Oriental Silicas Corporation, Industrial Chemicals Ltd., SILKEM d.o.o, Magnifin, Glassven C.A., Zaklady Chemiczne Rudniki S.A., Huber Engineered Materials, PPG Industries, Tokuyama Siltech Co. Ltd., and others Key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Sodium silicate’s dimensions to remove stains and regulate pH levels create a dynamic component of detergents and cleaning solutions. The market for sodium silicate is escalating as an effect of increasing detergent utilization. Furthermore, cement, coatings, and silica-based construction materials are all formed with sodium silicate. The requirement for sodium silicate is being obsessed with the rising construction industry, particularly in developing nations. Sodium silicate is applied in the paper and pulp occupational as a sizing agent, filler, and binder. The requirement for sodium silicate is being determined by the intensifying paper and pulp industries. Sodium silicate is a necessary ingredient used in sealants and adhesives. The need for sodium silicate is growing as an effect of the increasing utilization of sealants and adhesives in a variety of sectors. Water treatment processes, such as taming and stabilizing the water, need sodium silicate. The need for sodium silicate is being determined by the mounting focus on water treatment and purification. Several chemical processes use sodium silicate as a catalyst. The necessity for sodium silicate as a catalyst is being obsessed with the increasing chemical industry.

Restraining Factors

Perilous derivatives like silicate dirt and liquid surplus can be formed during the production of sodium silicate. Regulations affecting the environment and uncertainties about these derivatives might hinder industry growth. Moreover, other elements and ingredients exist that have comparable properties to sodium silicate. The sodium silicate market’s potential development might be controlled by the availability and affordability of these alternatives. Soda ash and silica sand are two raw materials required in the industry of sodium silicate. Price vacillations for these raw materials have the probability to affect total industrial costs and, in turn, market expansion. Producers of sodium silicate might aspect complications adhering to a diversity of safety, environmental, and health regulations, which could hamper the market’s expansion.

Market Segmentation

The global sodium silicate market share is classified into type, application, and form.

- The liquid segment is expected to hold the largest share of the global sodium silicate market during the forecast period.

Based on the type, the global sodium silicate market is divided into solid and liquid. Among these, the liquid segment is anticipated to hold the largest share of the sodium silicate market during the forecast period. The requirement for liquid type has augmented attributed to its massive utilization in liquid detergents. Furthermore, utilizing a liquid form of silicates in the cement propels segmental development globally. The segment’s development is related to the improved demand for bearable products as customers became more conscious of green chemicals.

- The detergents segment is expected to hold the largest share of the global sodium silicate market during the forecast period.

Based on the application, the global sodium silicate market is divided into detergents, pulp and paper, derivative silicates, construction, water treatment, and others. Among these, the detergents segment is expected to hold the largest share of the global sodium silicate market during the forecast period. This is attributed to the detergent leading the market as the alkaline nature of sodium silicate performs as a shielding agent, which helps in optimizing the washing properties of detergents. Moreover, its cost-efficiency enables producers to formulate economically striking detergent products. Apart from this, sodium silicate performs as a water softener in detergents, which helps eliminate minerals, such as calcium and magnesium. Additionally, the biodegradable and non-toxic nature of sodium silicate aligns with the increasing focus on environmentally responsible products, therefore contributing to its preference for detergent formulations.

- The crystalline segment is expected to hold the largest share of the global sodium silicate market during the forecast period.

Based on the form, the global sodium silicate market is divided into crystalline and anhydrous. Among these, the crystalline segment is expected to hold the largest share of the sodium silicate market during the forecast period. This is attributed to the crystalline sodium silicate leading the market as it is utilized in controlled-release applications, such as in agriculture for slow-release fertilizers, which certifies that nutrients are delivered to plants over a prolonged period, thus optimizing competence. Additionally, it can be mass-produced to have a higher transparency level associated with other forms, which is crucial for applications in production, such as pharmaceuticals, where rigorous quality standards must be met.

Regional Segment Analysis of the Global Sodium Silicate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global sodium silicate market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the sodium silicate market over the predicted timeframe. This is attributed to the Asia Pacific leading the sodium silicate market owing to the noteworthy development in numerous productions, including detergents, pulp and paper, automotive, construction, and chemicals. Moreover, the increasing domestic feasting of consumer products, such as detergents and cleaning agents, where sodium silicate is a vital ingredient, is enhancing the market growth. Furthermore, the obligation of favorable policies by the regional governments auxiliary industrial growth over subsidies and incentives is prompting market growth. Apart from this, the region's plenty of raw materials obligatory for the production of sodium silicate, such as silica sand, which supports industrial and aids in keeping production costs relatively low, is preferring the market growth. Additionally, Asia Pacific has deliberately positioned itself as an export pivot for chemicals, including sodium silicate, due to its competitive pricing and production capabilities.

North America is expected to grow at the fastest pace in the sodium silicate market during the forecast period. This is attributed to North America, the development of the pulp and paper segment in the region is related to the huge requirement for food and beverage products. Moreover, countries in the region, such as Canada and the U.S., have a huge number of supermarkets, mega markets, and malls to satisfy customer requirements for food products. The amplified demand for these products put pressure on non-plastic packaging producers, leading to the demand for pulp and paper products. Therefore, the improved demand from the food and beverage industry will increase the sodium silicate market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the sodium silicate market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PQ Corp.

- Evonik Industries AG

- BASF SE

- W.R. Grace & Co.

- CIECH Group

- Silmaco NV

- Oriental Silicas Corporation

- Industrial Chemicals Ltd.

- SILKEM d.o.o

- Magnifin, Glassven C.A.

- Zaklady Chemiczne Rudniki S.A.

- Huber Engineered Materials

- PPG Industries

- Tokuyama Siltech Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2023, CIECH S.A., one of the major providers of sodium silicates, finalized the construction of a modern warehouse facility to progress its logistical capabilities.

- In January 2023, Solvay S.A. invested in its Livorno site in Italy to encourage circular silica products made from bio-based sodium silicate.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global sodium silicate market based on the below-mentioned segments:

Global Sodium Silicate Market, By Type

- Solid

- Liquid

Global Sodium Silicate Market, By Application

- Detergents

- Pulp and Paper

- Derivative Silicates

- Construction

- Water Treatment

- Others

Global Sodium Silicate Market, By Form

- Crystalline

- Anhydrous

Global Sodium Silicate Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?PQ Corp., Evonik Industries AG, BASF SE, W.R Grace & Co., CIECH Group, Silmaco NV, Oriental Silicas Corporation, Industrial Chemicals Ltd., SILKEM d.o.o, Magnifin, Glassven C.A., Zaklady Chemiczne Rudniki S.A., Huber Engineered Materials, PPG Industries, Tokuyama Siltech Co. Ltd., and others.

-

2. What is the size of the global sodium silicate market?The Global Sodium Silicate Market is expected to grow from USD 7.8 Billion in 2023 to USD 11.9 Billion by 2033, at a CAGR of 4.31% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Asia Pacific is anticipated to hold the largest share of the global sodium silicate market over the predicted timeframe.

Need help to buy this report?