Global Soft Drinks Market Size, Share, and COVID-19 Impact Analysis By Product (Carbonated and Non-carbonated), By Distribution Channel (Hypermarkets And Supermarkets, Convenience Store and Online), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Food & BeveragesGlobal Soft Drinks Market Insights Forecasts to 2033

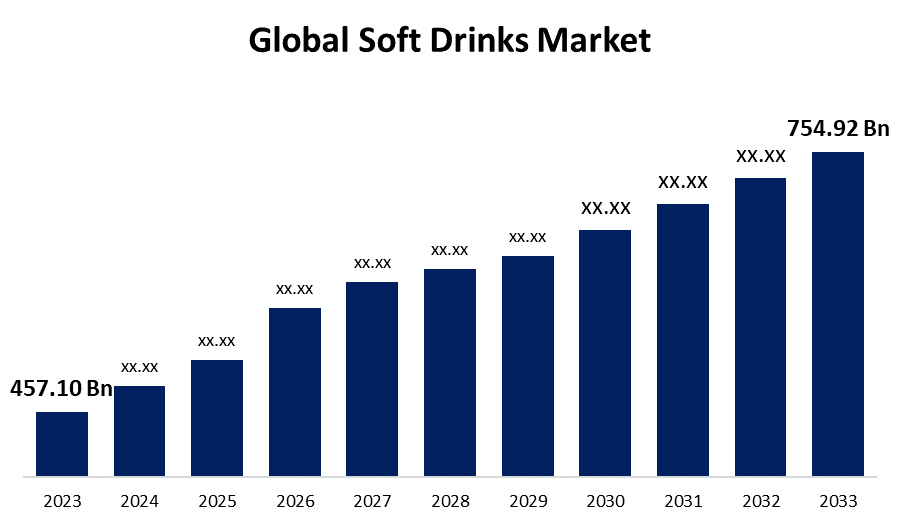

- The Global Soft Drinks Market Size was Valued at USD 457.10 Billion in 2023

- The Market Size is Growing at a CAGR of 5.15% from 2023 to 2033

- The Worldwide Soft Drinks Market Size is Expected to Reach USD 754.92 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Soft Drinks Market Size is Anticipated to Exceed USD 754.92 Billion by 2033, Growing at a CAGR of 5.15% from 2023 to 2033.

Market Overview

Edible acids, sweeteners, and flavors are used in the manufacturing of soft drinks. Any non-alcoholic beverage containing juice, carbonation, edible acids, natural or artificial sweeteners, and carbonation is known to as a soft drink. Soft drinks, which include energy and sports drinks, soda, Ready-To-Drink (RTD), flavored water, and diet drinks, are frequently divided into carbonated and non-carbonated categories. Soft drinks include nutrients like calcium and vitamins, they are an essential part of both a healthy lifestyle and a balanced diet. To adapt their business practices to changing consumer demands, soft drink manufacturers are researching environmentally friendly substitutes, such as recyclable packaging and biodegradable materials. The rising disposable incomes, shifting lifestyles, and population increase will drive growth in market. The desire for low-calorie, low-carb, and clean-label products is driving the soft drink market. The demand for the industry is also anticipated to be driven by growing millennial popularity and increased R&D expenditures in the food and beverage sector.

Report Coverage

This research report categorizes the soft drinks market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the soft drinks market. Recent market developments and competitive strategies such as expansion, type launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the soft drinks market.

Global Soft Drinks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 457.10 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 5.15% |

| 023 – 2033 Value Projection: | USD 754.92 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 248 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Distribution Channel, By Region |

| Companies covered:: | Pepsico, Inc., Nestlé, The Coca-Cola Company, Keurig Dr Pepper Inc (KDP), Red Bull GmbH, Unilever PLC, Monster Energy Company, Appalachian Brewing Company, ITO EN INC., AriZona Beverages USA LLC, Suntory Beverage & Food, Asahi Group Holdings, National Beverage Corp., Refresco Group, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The increasing focus on better choices, customers are looking for drinks that have less sugar, more natural components, and practical advantages. In response to shifting customer demands, product compositions, packaging, and marketing methods are being innovatively driven by the soft drink market. Rising disposable incomes, shifting spending habits, and urbanization are all contributing to the market notable growth in developing economies. Convenience beverages like carbonated drinks, bottled water, and ready-to-drink teas are becoming more and more popular in more people lead more westernized lifestyles. Soft drink sales will be boosted by new product introductions that take into account the target market health requirements.

Restraining Factors

Growing obesity rates and associated issues are predicted to restrict market growth. There has been an important increase in the number of customers who reduce their use of sugar and high-calorie foods and beverages. The sales of carbonated soft drinks, juices, and other soft drink products will be significantly impacted by the soft drink market.

Market Segmentation

The soft drinks market share is classified into product and distribution channels.

- The carbonated segment is estimated to hold the largest market revenue share through the projected period.

Based on the product, the soft drinks market is classified into carbonated and non-carbonated. Among these, the carbonated segment is estimated to hold a significant market revenue share through the projected period. Due to the products more widely used, carbonated drinks bring in greater earnings. To make something all products are constantly being developed and enhanced. Ingredients like flavors, sugar, coloring, and sweeteners give each drink its taste and refreshing quality.

- The hypermarkets and supermarkets segment is anticipated to hold the largest market share through the forecast period.

Based on the distribution channel, the soft drinks market is divided into hypermarkets and supermarkets, convenience stores, and online. Among these, the hypermarkets and supermarkets segment is anticipated to hold the largest market share through the forecast period. Supermarkets and hypermarkets are a sort of structured channel that sells a range of FMGC products directly to customers, providing more services focused on the needs of their customers. These shops increase market revenue while giving customers option of directly inspection products.

Regional Segment Analysis of the Soft Drinks Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the soft drinks market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the soft drinks market over the predicted timeframe. The United States and Canada, two highly developed economies in North America, are early supporters and have a positive effect on the market. Soft drink production is rising along with investments in developing manufacturing assembly lines and packaging technology to meet the growing demand for these beverages. Demand in the business will be driven by the presence of well-known international brands like PepsiCo and Coca-Cola in this region.

Asia Pacific is expected to grow at the fastest CAGR growth of the soft drinks market during the forecast period. China and India, two countries in the Asia-Pacific region, are favorably influencing the market. The market is anticipated to grow at a faster rate due to factors such as the rising disposable income of residents, an increase in food processing facilities, and high consumption by a growing population.

Europe is anticipated to hold a significant share of the soft drinks market over the predicted timeframe. Europe is a well-established and diverse soft drink market that includes many different nations with different customer preferences and regulatory frameworks. Fruit juices, bottled water, carbonated soft drinks (CSDs), and growing interest in functional and non-alcoholic beverages identify the European soft drink market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the soft drinks market along with a comparative evaluation primarily based on their type offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pepsico, Inc.

- Nestlé

- The Coca-Cola Company

- Keurig Dr Pepper Inc (KDP)

- Red Bull GmbH

- Unilever PLC

- Monster Energy Company

- Appalachian Brewing Company

- ITO EN INC.

- AriZona Beverages USA LLC

- Suntory Beverage & Food

- Asahi Group Holdings

- National Beverage Corp.

- Refresco Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, A Golden Mango variant of Coca-Cola Europacific Partners (CCEP)'s Powerade sports drink line was launched in response to growing consumer demand. The 500ml plain bottles of the new flavor, which has a tropical profile, come in new packaging that matches the rest of the line. It has vitamin B6, much like the other Powerade products, which helps to lessen fatigue.

- In December 2023, Lemon Dou was the first liquor brand that Coca-Cola, a well-known soft drink brand, launched in India. Shachu and lime are combined to make Lemon Dou, a cocktail known as Chuhai in Japan.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the soft drinks market based on the below-mentioned segments:

Global Soft Drinks Market, By Product

- Carbonated

- Non-carbonated

Global Soft Drinks Market, By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Store

- Online

- Others

Global Soft Drinks Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the soft drinks market over the forecast period?The Soft Drinks market is projected to expand at a CAGR of 5.15% during the forecast period.

-

2. What is the market size of the Soft Drinks market?The Global Soft Drinks Market Size is Expected to Grow from USD 457.10 Billion in 2023 to USD 754.92 Billion by 2033, at a CAGR of 5.15% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the soft drinks market?North America is anticipated to hold the largest share of the soft drinks market over the predicted timeframe.

Need help to buy this report?