Global Software Defined Vehicle Market Size, Share, and COVID-19 Impact Analysis, By Offering (Hardware, Software and Services), By Vehicle Type (ICE, BEV, HEV/PHEV), By Application (Powertrain & Chassis, ADAS/HAD, Body and Energy, Infotainment, and Connectivity & Security), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Software Defined Vehicle Market Insights Forecasts to 2033

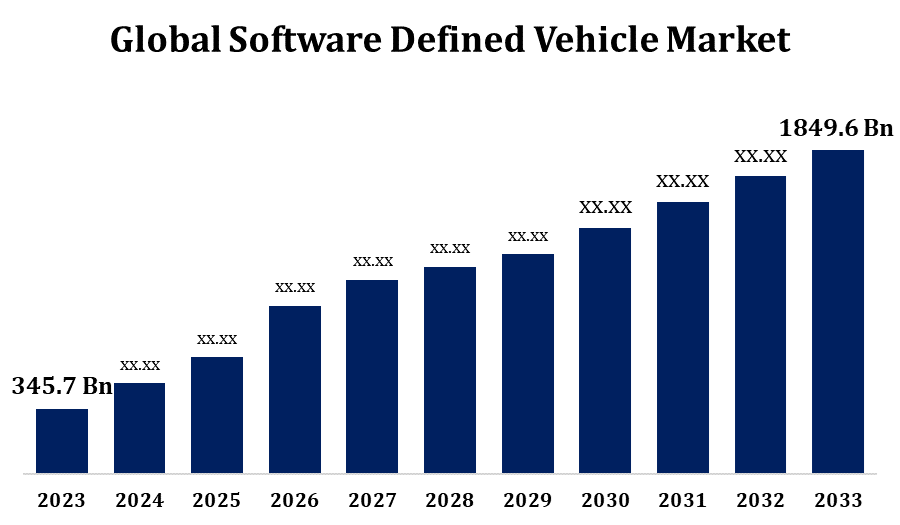

- The Software Defined Vehicle Market was valued at USD 345.7 Billion in 2023.

- The market is growing at a CAGR of 18.26% from 2023 to 2033.

- The Global Software Defined Vehicle Market is expected to reach USD 1849.6 Billion By 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Software Defined Vehicle Market Size is expected to reach USD 1849.6 Billion By 2033, at a CAGR of 18.26% during the Forecast Period 2023 to 2033.

The Software Defined Vehicle Market is rapidly Growing, driven by advancements in automotive electronics, connectivity, and AI. SDVs integrate software-centric architectures that enable over-the-air (OTA) updates, enhanced safety, and autonomous driving capabilities. Automakers are shifting from traditional hardware-dependent designs to flexible, software-driven models, allowing continuous vehicle enhancements and personalized user experiences. Key players include Tesla, Volkswagen, and General Motors, investing in software-defined platforms to improve performance and security. The rise of electric vehicles (EVs) and 5G connectivity further accelerates SDV adoption. Challenges include cybersecurity threats, high development costs, and regulatory compliance. However, increasing consumer demand for smart mobility and partnerships between tech firms and automakers are fueling market growth. The SDV market is poised to revolutionize the automotive industry in the coming years.

Software Defined Vehicle Market Value Chain Analysis

The Software Defined Vehicle market value chain consists of multiple key segments, including semiconductor suppliers, software developers, automakers, and service providers. It begins with chip manufacturers such as Nvidia, Qualcomm, and Intel, which provide high-performance computing hardware. Next, software providers like BlackBerry QNX, Android Automotive, and AUTOSAR develop operating systems, middleware, and artificial intelligence-driven applications. Automakers such as Tesla, BMW, and Ford integrate software into vehicle architectures, enabling over-the-air updates, autonomous functions, and connected services. Cloud and connectivity providers like Amazon Web Services, Microsoft Azure, and fifth-generation mobile network operators ensure seamless data management and vehicle-to-everything communication. Tier-1 suppliers such as Bosch and Continental facilitate hardware-software integration. Finally, service providers offer cybersecurity, data analytics, and subscription-based features. Collaboration among these players is critical to ensuring innovation, security, and scalability in the evolving Software-Defined Vehicle ecosystem.

Software Defined Vehicle Market Opportunity Analysis

The Software Defined Vehicle market presents significant opportunities driven by advancements in connectivity, artificial intelligence, and cloud computing. The growing demand for over-the-air updates, autonomous driving, and personalized in-car experiences is encouraging automakers to adopt software-centric architectures. The shift towards electric vehicles further enhances the need for software-defined solutions to optimize energy efficiency and performance. Technology companies can capitalize on opportunities in cybersecurity, data analytics, and vehicle-to-everything communication. Additionally, regulatory pushes for safer and smarter mobility create a favorable environment for innovation. Subscription-based software services, digital twin technology, and predictive maintenance solutions offer new revenue streams. Collaborations between automotive manufacturers, semiconductor firms, and software providers will be key to unlocking the full potential of this market, making Software-Defined Vehicles a critical part of the future automotive landscape.

Global Software Defined Vehicle Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 345.7 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 18.26% |

| 2033 Value Projection: | USD 1849.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Offering, By Vehicle Type, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Robert Bosch GmbH, Nvidia Corporation, Qualcomm Technologies Inc., Marelli Holdings Co., Ltd., Continental AG, Volkswagen Group, Harman International, Tesla, Volvo Group, Ford Motor Companyand others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Software Defined Vehicle Market Dynamics

Increasing sophistication and incorporation of cutting-edge technologies in contemporary vehicles

The growth of the Software-Defined Vehicle market is driven by the increasing sophistication and incorporation of cutting-edge technologies in contemporary vehicles. Automakers are transitioning from traditional hardware-driven models to software-centric architectures, enabling real-time updates, enhanced automation, and improved vehicle performance. The rise of artificial intelligence, machine learning, and cloud computing allows for seamless over-the-air updates, predictive maintenance, and advanced driver assistance systems. Connectivity advancements, such as fifth-generation mobile networks and vehicle-to-everything communication, further accelerate market expansion. Additionally, the shift toward electric vehicles demands intelligent software solutions to optimize energy management and user experience.

Restraints & Challenges

One major hurdle is cybersecurity, as increased connectivity and over-the-air updates expose vehicles to hacking risks and data breaches. The high cost of software development and integration also poses a challenge, requiring significant investment in advanced computing hardware and cloud infrastructure. Ensuring seamless compatibility between software and vehicle hardware remains complex, as automakers must work closely with technology providers and semiconductor manufacturers. Regulatory compliance is another critical issue, with evolving safety and data privacy laws varying across regions. Additionally, the need for continuous software updates and maintenance adds operational complexities for automakers.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Software Defined Vehicle Market from 2023 to 2033. The market is driven by strong technological advancements, high consumer demand for connected cars, and the presence of major automotive and technology companies. Automakers such as Tesla, General Motors, and Ford are investing heavily in software-centric vehicle architectures, enabling over-the-air updates, autonomous driving, and advanced driver assistance systems. The region’s robust fifth-generation mobile network infrastructure and cloud computing capabilities further support the growth of Software-Defined Vehicles. Additionally, regulatory initiatives promoting vehicle safety, emissions reduction, and smart mobility accelerate market expansion. However, challenges such as cybersecurity threats and high development costs persist. Strategic partnerships between automakers, semiconductor firms, and software providers are playing a crucial role in shaping the future of the Software-Defined Vehicle market in North America.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. China, Japan, and South Korea are at the forefront, with automakers like Toyota, Hyundai, and BYD investing in software-driven vehicle architectures. The expansion of electric vehicles and autonomous driving technologies is further accelerating market adoption. Additionally, the presence of leading semiconductor companies and cloud service providers supports advancements in vehicle connectivity and artificial intelligence integration. Collaboration between automakers, technology firms, and government bodies is essential for the continued development of Software-Defined Vehicles in Asia-Pacific, making the region a key player in the industry’s future growth.

Segmentation Analysis

Insights by Offering

The software segment accounted for the largest market share over the forecast period 2023 to 2033. The demand for over-the-air updates, artificial intelligence-driven systems, and autonomous driving capabilities is pushing the development of sophisticated operating systems, middleware, and cloud-based services. Companies like BlackBerry QNX, Android Automotive, and AUTOSAR are leading the way in providing secure and scalable software platforms. The rise of electric vehicles further fuels the need for intelligent software to optimize battery performance and energy management. Additionally, subscription-based software services, digital twin technology, and predictive maintenance solutions are creating new revenue streams for automakers. As vehicles become more software-centric, the software segment will continue to be a major driver of innovation and market expansion.

Insights by Vehicle Type

The BEV segment accounted for the largest market share over the forecast period 2023 to 2033. Automakers such as Tesla, BYD, and Volkswagen are integrating advanced software to enhance battery efficiency, provide real-time diagnostics, and enable over-the-air updates. Smart energy management systems and artificial intelligence-driven predictive maintenance are further improving vehicle longevity and user experience. Additionally, the expansion of charging infrastructure and vehicle-to-grid technology supports seamless integration with smart grids. As governments worldwide push for electric mobility through incentives and emissions regulations, the demand for software-centric electric vehicles continues to rise. The convergence of electric and software-defined technologies is transforming the automotive industry, making Battery Electric Vehicles a key segment in future mobility solutions.

Insights by Application

The ADAS/HAD segment accounted for the largest market share over the forecast period 2023 to 2033. Automakers are increasingly integrating artificial intelligence, machine learning, and sensor fusion technologies to enhance vehicle safety, automation, and user experience. Advanced Driver Assistance Systems features such as adaptive cruise control, lane-keeping assist, and automated emergency braking are becoming standard, while Highly Automated Driving is progressing toward full autonomy. Companies like Tesla, Waymo, and Mercedes-Benz are investing in real-time data processing, over-the-air updates, and vehicle-to-everything communication to improve automation capabilities. The expansion of fifth-generation mobile networks and edge computing further supports low-latency decision-making. As regulatory frameworks evolve to accommodate higher levels of automation, the Advanced Driver Assistance Systems and Highly Automated Driving segment will continue to be a major growth area in Software-Defined Vehicles.

Recent Market Developments

- In November 2024, Panasonic Automotive Systems Co., Ltd. collaborated with Arm to establish a standardized automotive architecture for Software-Defined Vehicles.

Competitive Landscape

Major players in the market

- Robert Bosch GmbH

- Nvidia Corporation

- Qualcomm Technologies Inc.

- Marelli Holdings Co., Ltd.

- Continental AG

- Volkswagen Group

- Harman International

- Tesla

- Volvo Group

- Ford Motor Company

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Software Defined Vehicle Market, Offering Analysis

- Hardware

- Software

- Services

Software Defined Vehicle Market, Vehicle Type Analysis

- ICE

- BEV

- HEV/PHEV

Software Defined Vehicle Market, Application Analysis

- Powertrain & Chassis

- ADAS/HAD

- Body and Energy

- Infotainment

- Connectivity & Security

Software Defined Vehicle Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Software Defined Vehicle Market?The global Software Defined Vehicle Market is expected to grow from USD 345.7 billion in 2023 to USD 1849.6 billion by 2033, at a CAGR of 18.26% during the forecast period 2023-2033.

-

2. Who are the key market players of the Software Defined Vehicle Market?Some of the key market players of the market are Robert Bosch GmbH, Nvidia Corporation, Qualcomm Technologies Inc., Marelli Holdings Co., Ltd., Continental AG, Volkswagen Group, Harman International, Tesla, Volvo Group, Ford Motor Company.

-

3. Which segment holds the largest market share?The software segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?