Global Soju Market Size, Share, and COVID-19 Impact Analysis, By Type (Distilled and Diluted), By Packaging (Bottles, Cans, and Pouches), By Distribution Channel (On Trade and Off Trade), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Consumer GoodsGlobal Soju Market Insights Forecasts to 2033

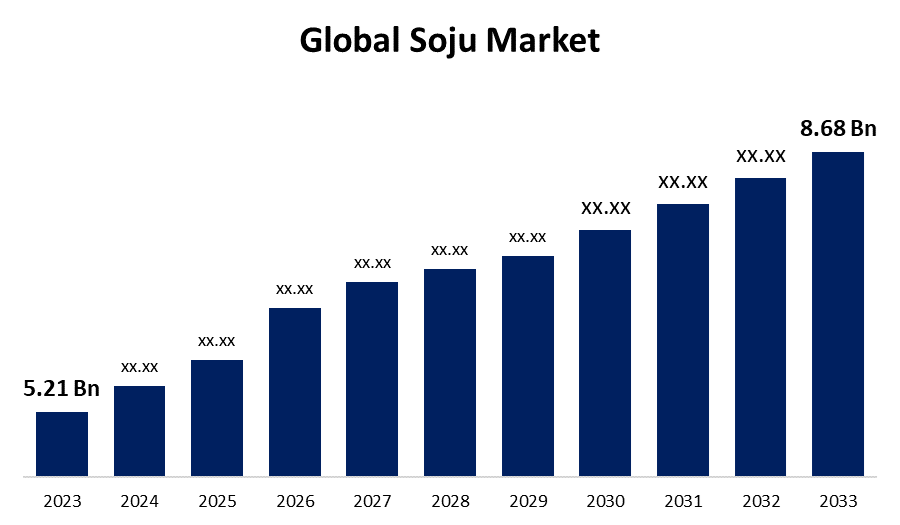

- The Global Soju Market Size was Valued at USD 5.21 Billion in 2023

- The Market Size is Growing at a CAGR of 5.24% from 2023 to 2033

- The Worldwide Soju Market Size is Expected to Reach USD 8.68 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Soju Market Size is Anticipated to Exceed USD 8.68 Billion by 2033, Growing at a CAGR of 5.24% from 2023 to 2033.

Market Overview

Korea is the residence of soju, a clear, colorless beverage. This beverage is highly potent, distilled rice liquor that resembles vodka and is frequently flavored similarly. Taste-wise, it pairs well with a variety of Korean foods because it is clean and smooth. It's the most basic, transparent spirit with 20–24% alcohol by volume. Traditionally, this beverage is consumed unmixed with food or as part of a cocktail. Soju's distinctive flavor profile and adaptability are other factors in its rising appeal. To suit a range of tastes, it can be consumed straight, on the shakes, or in several different cocktails. Its comparatively lower alcohol content and lower calorie count when compared to other spirits also make it a desirable choice for consumers who are health-conscious and searching for lighter options. The demand for soju is further driven by economic factors. Budget-conscious consumers might find soju attractive as it is frequently less expensive than spirits like vodka or whisky. Soju's global demand was further driven by popular Korean music, drama, and cuisine. With the rise in popularity of Korean restaurants, soju has become an internationally recognized popularity. Furthermore, the soju market share is growing at an exponential rate because of the continued influence of Korean culture.

Report Coverage

This research report categorizes the market for the soju market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the soju market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the soju market.

Global Soju Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.21 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.24% |

| 2033 Value Projection: | USD 8.68 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 270 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Packaging, By Distribution Channel, By Region |

| Companies covered:: | HiteJinro Co., Ltd., Lotte Chilsung Beverage Co., Ltd., Korea Alcohol Co., Ltd., Hwayo, The Soju Company, OB Brewing Co., Ltd., Sool Soju, Tokki Soju, The Han, C1 Soju, Bohae, Chungbuk, Hallasan, Mackiss, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Driving Factors

Soju facilitates social connection and is an integral part of parties and social gatherings. It has been essential in many ancient and modern contexts for generations. In Korea, soju has transcended the social domain and given rise to a thriving manufacturing sector. As such, the market demand for soju has increased rapidly, increasing the market shares of soju. Strong marketing and promotional strategies have also played a part in the market's growth. Soju producers have used a variety of marketing methods to reach consumers throughout the world and build a brand presence.

Restraining Factors

The high alcohol content of soju worries individuals who are concerned about their health. Drinking excessive amounts of alcohol can damage the liver, raise the risk of cancer, and cause cardiovascular problems. Consequently, this has resulted in a drop in the market's growth and a decrease in the soju market.

Market Segmentation

The soju market share is classified into type, packaging, and distribution channel.

- The distilled segment is expected to hold the largest market share through the forecast period.

Based on the type, the soju market is categorized into distilled and diluted. Among these, the distilled segment is expected to hold the largest market share through the forecast period. The fermented rice is used to make soju by distilling the alcohol. The mature, filtered rice wine is boiled in a sot with soju gori on top to create distilled soju. The robust social drinking culture that is closely linked to soju, particularly in South Korea, is spreading to other nations. Among Korean expatriates and those with an interest in Korean social customs and cuisine, this trend is particularly noteworthy. Global bartenders also appreciate soju's versatility in cocktails, which helps to increase its availability in pubs and restaurants.

- The bottles segment holds the highest market share through the forecast period.

Based on the packaging, the soju market is categorized into bottles, cans, and pouches. Among these, the bottles segment holds the highest market share through the forecast period. Soju in bottles maintains its flavor and quality longer than in other forms of packaging. Consumer confidence and preference for bottled choices may increase as a result of the sealed bottle's contribution to the soju's integrity and extended quality and pleasure.

- The off trade segment is anticipated to grow at the highest CAGR during the forecast period.

Based on the distribution channel, the soju market is categorized into on trade and off trade. Among these, the off trade segment is anticipated to grow at the highest CAGR during the forecast period. Off-trade channels offer soju easily accessible to customers whenever they choose, whether they are shopping in real stores or online. Due to its accessibility, soju is a more convenient option for home consumption as customers may buy it without having to make trips to pubs or specialized locations. Supermarkets and hypermarkets, convenience stores, internet, and other categories are further subdivided under off-trade.

Regional Segment Analysis of the Soju Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the soju market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the soju market over the predicted timeframe. Customers in North America are starting to recognize the versatility that soju has in cocktails and mixed drinks. Soju's attractiveness at bars and restaurants throughout the region is being increased by bartenders' and mixologists' creative and varied use of liquor in beverage mixes. Soju has gained popularity among American customers due to the growing appeal of Korean food, K-dramas, and K-pop. Soju is becoming a well-known and favored option for anyone looking to have real Korean food and drink experiences as the impact of Korean culture spreads.

Asia Pacific is expected to grow at the fastest CAGR growth in the soju market during the forecast period. South Korea is the nation that consumes soju the most in the Asia Pacific. Due to its South Korean origins and widespread social and cultural significance, soju is a favorite beverage among young people and is frequently paired with food. Because of this, the soju market in the Asia-Pacific area has grown in size. The Asia-Pacific area is rapidly improving and urbanizing, which has resulted in a growing middle class with shifting drinking and lifestyle patterns. The availability of soju in urban pubs, restaurants, and social places is in line with modern social norms and the growing need for a wider selection of alcoholic drinks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the soju market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- HiteJinro Co., Ltd.

- Lotte Chilsung Beverage Co., Ltd.

- Korea Alcohol Co., Ltd.

- Hwayo

- The Soju Company

- OB Brewing Co., Ltd.

- Sool Soju

- Tokki Soju

- The Han

- C1 Soju

- Bohae

- Chungbuk

- Hallasan

- Mackiss

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, In honor of its 100th anniversary, the Korean company Hite Jinro, which sells the most spirits worldwide, revealed an ultra-premium rare expression of soju made from Icheon rice that was distilled in 1924. Because of its superior quality, kings have traditionally accepted Icheon rice as a gift.

- In April 2024, Tiger, which is well-known across Asia, released its most recent invention, the Tiger Soju Infused Lager, which is a noteworthy achievement and the brand's greatest innovation to date. Tiger is renowned for the icon G-DRAGON as its official global brand ambassador, adding even more excitement to this momentous debut. This partnership should have a significant effect and improve the brand's worldwide exposure.

- In March 2024, HiteJinro revealed the launch of Jinro Gold, a new soju product with a 15.5 percent alcohol level. The all-rice distillate used to make the sugar-free soju gives it a smooth, mellow flavor.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the soju market based on the below-mentioned segments:

Global Soju Market, By Type

- Distilled

- Diluted

Global Soju Market, By Packaging

- Bottles

- Cans

- Pouches

Global Soju Market, By Distribution Channel

- On Trade

- Off Trade

Global Soju Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?