Global Solar PV Inverter Market Size, Share, and COVID-19 Impact Analysis, By Product (String PV Inverter, Central PV Inverter), By Phase (Single Phase, Three Phase), By End-use (Commercial & Industrial, Utilities), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Energy & PowerGlobal Solar PV Inverter Market Size Insights Forecasts to 2032

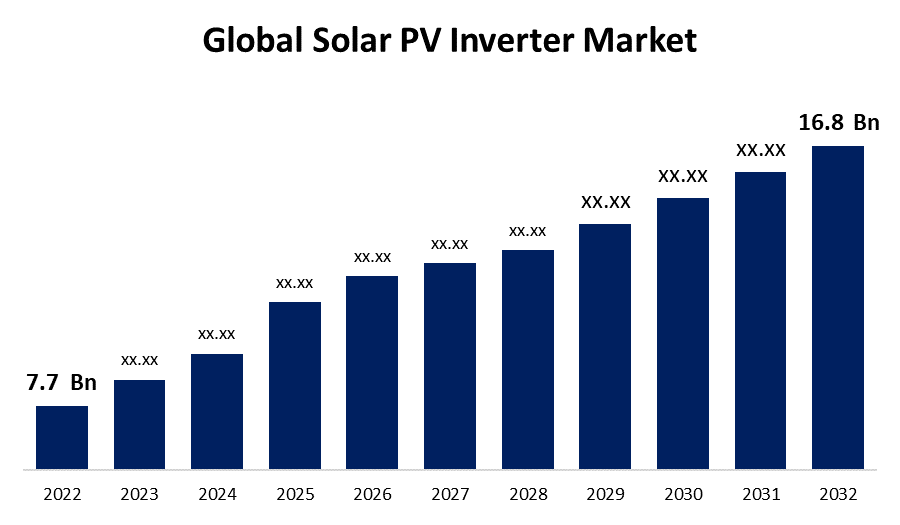

- The Global Solar PV Inverter Market Size was valued at USD 7.7 Billion in 2022.

- The Market Size is Growing at a CAGR of 8.1% from 2022 to 2032

- The Worldwide Solar PV Inverter Market Size is expected to reach USD 16.8 Billion by 2032

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Solar PV Inverter Market Size is expected to reach USD 16.8 Billion by 2032, at a CAGR of 8.1% during the forecast period 2022 to 2032.

A solar PV inverter is a photovoltaic inverter. It is an electrical device that converts a direct current (DC) voltage from photovoltaic arrays into alternating current (AC) currents, which power home appliances and some utility grids. Aside from that, solar inverters help to maximize electricity production by constantly shifting resistance (load). It is an electrical device used to change a light bulb. Solar PV inverters are an essential component of a larger solar system. These inverters convert direct current (DC) electricity to alternate current (AC), determining the overall efficiency of the solar system. Solar PV inverters have distinct characteristics and features that take into account various factors influencing solar system production. Shade, roof orientation, roof inclination, summer vs. winter production, tilting panels, and many other factors all contribute to the required output. DC (direct current) voltage from photovoltaic arrays is converted into AC (alternating current) currents, which power home appliances and some utility grids.

Global Solar PV Inverter Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 7.7 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.1% |

| 2032 Value Projection: | USD 16.8 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Product, By Phase, By End-use, and By Region |

| Companies covered:: | Delta Electronics, Inc, Eaton, Emerson Electric Co., Fimer Group, Hitachi Hi-Rel Power Electronics Private Limited, Omron Corporation, Power Electronics S.L., Siemens Energy, SMA Solar Technology AG, SunPower Corporation, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The renewable industry has tremendously been competitive against other sources of electricity. The International Renewable Energy Agency (IRENA) has proposed that these energy resources are anticipated to grow by a full order of magnitude over the next 30 years. The two significant reasons standing behind this statement include the declining price of solar components that will allow more solar and wind power to be built and the economic factors concerning solar power for the next few decades. Rapid development in the renewable energy sector and the ease of installation of solar inverters are the key factors driving market growth during the forecast period.

Restraining Factors

The solar inverters market is expected to be restrained during the forecast period due to high costs and difficulty in use. Increasing electronic goods prices, technical issues with advanced technology, and a lack of income hinder market growth. Lack of awareness and the adoption of alternative options are also limiting market growth.

Market Segmentation

By Product Insights

The string PV inverter segment dominates the market with the largest revenue share over the forecast period.

Based on the product, the global solar PV inverter market is segmented into string PV inverters and central PV inverters. Among these, the string PV Inverter segment is dominating the market with the largest revenue share over the forecast period. These inverters are highly reliable with timely maintenance and adaptable enough to be installed in a secure location. The inverters are integrated with large arrays installed on field installations, industrial facilities, and buildings, converting DC power from all PV panels into AC power and serving as a single point of distribution. Lower initial costs and ease of installation are two of the primary factors driving segment growth. These inverters are durable, have high design flexibility, high efficiency, three-phase design variations, and are well-supported (by trusted brands). These inverters also support remote system monitoring.

By Phase Insights

The three-phase segment is witnessing significant CAGR growth over the forecast period.

Based on phase, the global solar PV inverter market is segmented into single-phase and three-phase. Among these, the three-phase segment is witnessing significant CAGR growth over the forecast period. This expansion can be attributed to the increasing importance of the power generation, distribution, and transmission sectors. Furthermore, the shift from 1,000-volt to 1,500-volt solar arrays resulted in larger PV power plants in large commercial, industrial, and utility installations, fueling the growth of the three-phase solar (PV) inverter market during the forecast period.

By End-Use Insights

The utilities segment is expected to hold the largest share of the global Solar PV Inverter market during the forecast period.

Based on the end-use, the global Solar PV Inverter market is classified into commercial & industrial, utilities. Among these, the utilities segment is expected to hold the largest share of the Solar PV Inverter market during the forecast period. The central and string inverter is the most commonly used PV inverter in the utility sector. The main drivers for the growth of the utility sector are increased renewable energy demand, declining costs of solar power and equipment, and emerging government subsidies. The presence of key players, who offer consumers industry-leading utility-scale solutions to achieve higher efficiency and lower balance-of-system costs with their pre-integrated power stations, is driving the segment's growth.

Regional Insights

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the largest market share over the forecast period. China is the biggest contributor to this region's rapid growth in the solar market and a major global competitor. A growing number of solar power plants in developing countries has also contributed significantly to the region's market growth. According to the Energy Information Administration (EIA), solar and wind together will generate 12% of China's electricity in 2021.

North America, on the contrary, is expected to grow the fastest during the forecast period. The United States is the largest contributor to market growth. The United States is a significant market for various types of PV inverters. Recent inverter trends in the country include the dominance of 60 kW or greater three-phase string inverters and 1.5 MW or greater central inverters. Despite strong growth in string inverters in North America, central PV inverters are expected to maintain the largest market share over the forecast period.

List of Key Market Players

- Delta Electronics, Inc

- Eaton

- Emerson Electric Co.

- Fimer Group

- Hitachi Hi-Rel Power Electronics Private Limited

- Omron Corporation

- Power Electronics S.L.

- Siemens Energy

- SMA Solar Technology AG

- SunPower Corporation

Key Market Developments

- In September 2021, Sungrow negotiated a deal with a local distributor in Pakistan to supply commercial and residential inverters to eliminate power outages.

- In March 2021, Fronius International introduced the Primo GEN24 Plus, a single-phase hybrid inverter. With a high-tech, flexible, and stylish design, this inverter debuted in the 3.0-6.0 kW category.

- In March 2020, Fimer Group purchased ABB, a manufacturer of solar inverters. This acquisition was made to expand the company's presence.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the global solar PV inverter market based on the below-mentioned segments:

Solar PV Inverter Market, Product Analysis

- String PV Inverter

- Central PV Inverter

- Others

Solar PV Inverter Market, Voltage Analysis

- Less than 1000 V

- 1000-1500 V

- Above 1500 V

- Others

Solar PV Inverter Market, End-Use Analysis

- Commercial & Industrial

- Utilities

- Others

Solar PV Inverter Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the solar PV inverter market over the forecast period?The solar PV inverter market is projected to expand at a CAGR of 8.1% during the forecast period.

-

2. What is the projected market size & growth rate of the solar PV inverter market?The solar PV inverter market was valued at USD 7.7 Billion in 2022 and is projected to reach USD 16.8 Billion by 2032, growing at a CAGR of 8.1% from 2022 to 2032.

-

3. Which region is expected to hold the highest share in the solar PV inverter market?The Asia Pacific region is expected to hold the highest share in the solar PV inverter market.

Need help to buy this report?