Global Solid Oxide Fuel Cell Market Size, Share, and COVID-19 Impact Analysis, By Type (Planar and Tubular), By Application (Portable, Stationary, and Transport), By End-User (Commercial & Industrial, Data Centers, Military & Defense, and Residentials), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2032

Industry: Energy & PowerGlobal Solid Oxide Fuel Cell Market Insights Forecasts to 2032

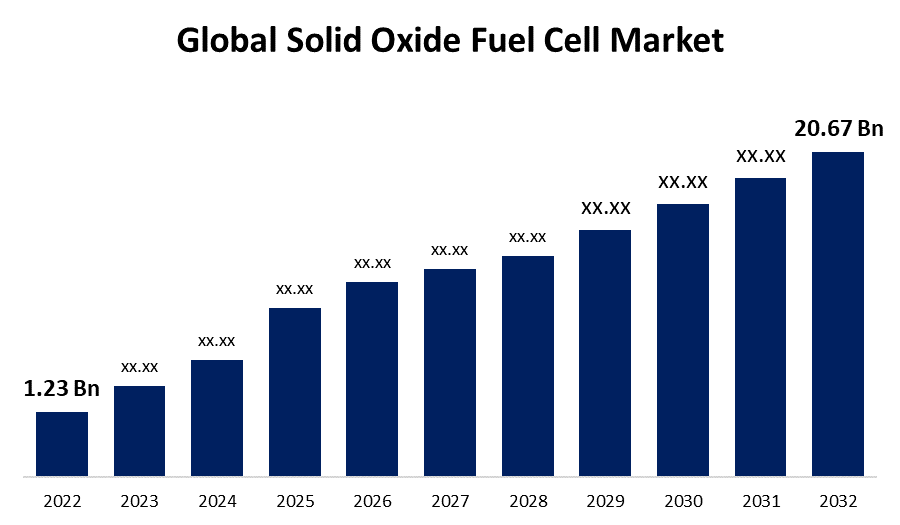

- The Solid Oxide Fuel Cell Market Size was valued at USD 1.23 Billion in 2022.

- The Market is growing at a CAGR of 32.6% from 2023 to 2032

- The Worldwide Solid Oxide Fuel Cell Market is expected to reach USD 20.67 Billion by 2032

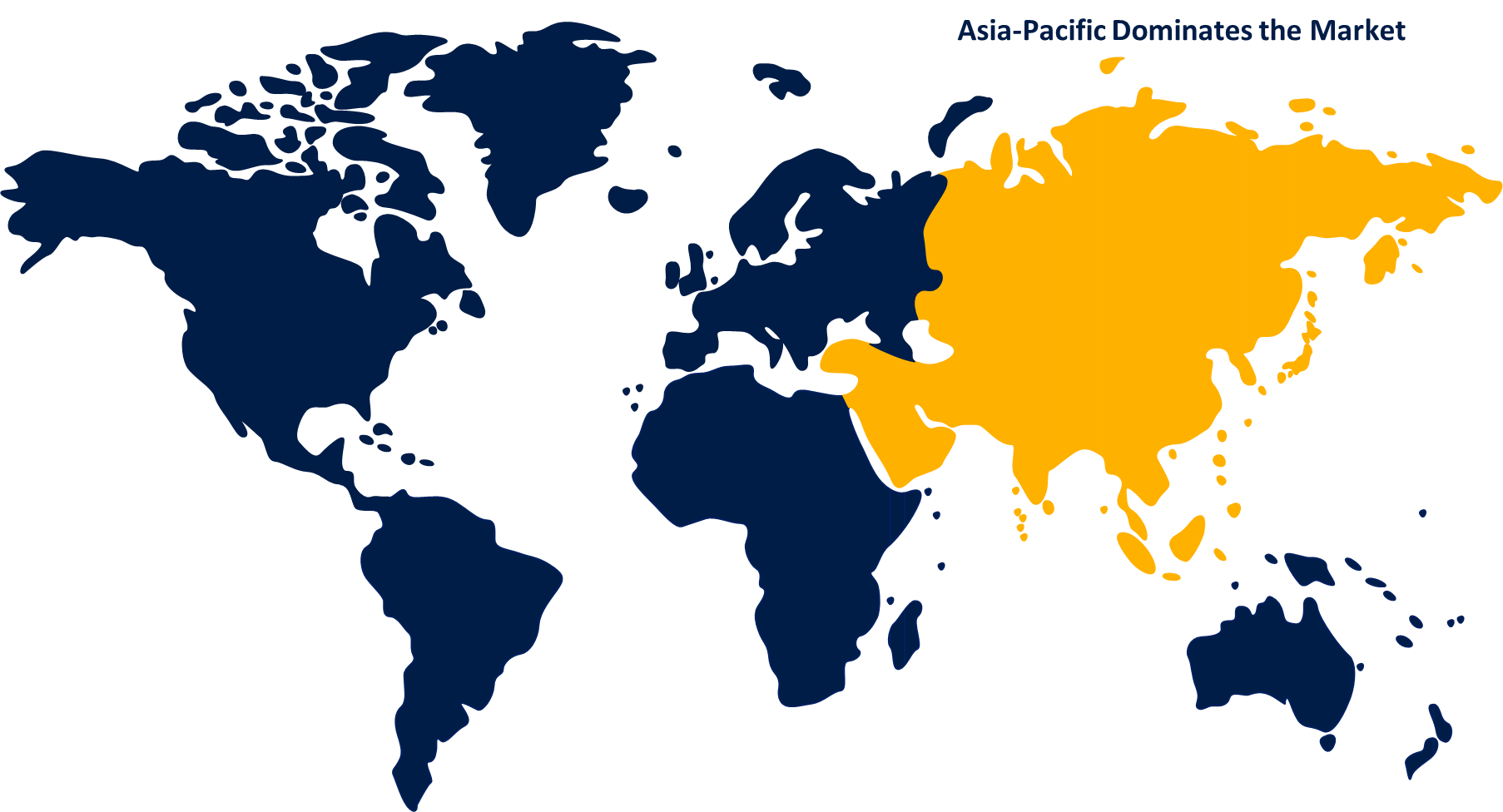

- Asia-Pacific is expected to grow higher during the forecast period

Get more details on this report -

The Global Solid Oxide Fuel Cell Market is expected to reach USD 20.67 Billion by 2032, at a CAGR of 32.6% during the forecast period 2022 to 2032.

Market Overview

Solid Oxide Fuel Cells (SOFCs) are high-temperature electrochemical devices that convert chemical energy directly into electrical energy. They operate by utilizing a solid oxide electrolyte, typically made of ceramics, which enables ion transport between the electrodes. SOFCs are known for their high efficiency, fuel flexibility, and low emissions. Unlike other fuel cell technologies, SOFCs can operate on a wide range of fuels, including hydrogen, natural gas, and even carbon monoxide. This versatility makes them suitable for various applications, including stationary power generation, distributed energy systems, and transportation. The high operating temperatures of SOFCs (typically around 600-1000°C) enable internal reforming, which means they can directly use hydrocarbon fuels without requiring external reformers. This feature simplifies the overall system design and reduces costs. Additionally, SOFCs produce virtually no emissions of pollutants, contributing to a cleaner and more sustainable energy landscape. With ongoing research and development, SOFCs have the potential to play a significant role in the transition to a low-carbon future.

Report Coverage

This research report categorizes the market for solid oxide fuel cell market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the solid oxide fuel cell market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the solid oxide fuel cell market.

Global Solid Oxide Fuel Cell Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.23 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 32.6% |

| 2032 Value Projection: | USD 20.67 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Application, By End-User, By Region and COVID-19 Impact Analysis |

| Companies covered:: | ZTEK Corporation Special Power Source Aisin Seiki Bloom Energy Mitsubishi Power Ltd. Cummins Inc. Ceres General Electric FuelCell Energy Inc. Ningbo SOFCMAN Energy Kyocera Corporation AVL NGK Spark Plug Co., Ltd. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The solid oxide fuel cell (SOFC) market is driven by several factors, due to growing demand for clean and efficient energy sources is a major driver. SOFCs offer high electrical efficiency and low emissions, making them attractive for various applications. Increasing investments in research and development activities aimed at improving SOFC performance, durability, and cost reduction are driving market growth. Additionally, government initiatives and policies promoting renewable energy and reducing carbon emissions are creating a favorable market environment for SOFCs. The expanding need for off-grid and remote power generation, as well as the potential for SOFCs to provide combined heat and power solutions, are further driving market demand. Moreover, advancements in materials and manufacturing technologies, such as thin film deposition and additive manufacturing, are enhancing the commercial viability and scalability of SOFCs, fostering market growth.

Restraining Factors

The solid oxide fuel cell (SOFC) market faces certain restraints. One significant challenge is the high operating temperature requirement of SOFCs, which can lead to longer start-up times and increased system complexity. The need for expensive materials, such as ceramic electrolytes, also adds to the cost of SOFC systems. Another restraint is the limited durability of SOFCs, particularly in terms of electrode degradation and thermal cycling. Furthermore, the lack of a well-established infrastructure for fuel supply and distribution hinders the widespread adoption of SOFC technology. Additionally, the competitive landscape with other fuel cell technologies and renewable energy sources presents a challenge for market penetration. Overcoming these restraints requires continued research and development efforts to enhance the performance, durability, and cost-effectiveness of SOFCs, as well as supportive policies and investment in infrastructure development.

Market Segmentation

- In 2022, the planar segment accounted for around 64.5% market share

On the basis of the product type, the global solid oxide fuel cell market is segmented into planar and tubular. The planar segment has emerged as the dominant force in the solid oxide fuel cell (SOFC) market. Planar SOFCs are characterized by their flat and layered structure, which allows for efficient and uniform distribution of heat and electrical current. This design provides several advantages, including higher power density, improved thermal management, and easier scalability. Planar SOFCs also offer better sealing capabilities, reducing the risk of leaks and improving overall system reliability. Furthermore, the planar design facilitates better integration with balance of plant components, resulting in simplified system integration and reduced installation costs. The dominance of the planar segment is further supported by advancements in materials, manufacturing techniques, and system design, enabling increased performance and cost-effectiveness. With ongoing research and development efforts, the planar segment is expected to continue its dominance in the SOFC market.

- In 2022, the stationary segment dominated with more than 83.4% market share

Based on the type of application, the global solid oxide fuel cell market is segmented into portable, stationary, and transport. The stationary segment has emerged as the dominant force in the solid oxide fuel cell (SOFC) market. Stationary SOFCs are primarily used for power generation in stationary applications, such as residential, commercial, and industrial settings. This dominance can be attributed to several factors such as stationary applications require a reliable and continuous power supply, and SOFCs offer high electrical efficiency and long operational lifetimes, making them an ideal choice. Additionally, stationary SOFCs have a higher tolerance for larger sizes and higher operating temperatures compared to other fuel cell technologies, allowing for greater power output and efficiency. Moreover, the stationary segment benefits from government initiatives and incentives promoting clean energy adoption, as well as increasing demand for decentralized power generation and grid independence. With ongoing advancements in system design, fuel flexibility, and cost reduction, the stationary segment is expected to maintain its dominance in the SOFC market.

Regional Segment Analysis of the Solid Oxide Fuel Cell Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 39.5% revenue share in 2022

Get more details on this report -

Based on region, North America has emerged as a dominant player in the solid oxide fuel cell (SOFC) market for several reasons due to the region having a strong focus on clean energy initiatives and reducing carbon emissions, which has propelled the adoption of SOFCs. The presence of stringent environmental regulations and government incentives for renewable energy technologies further drive the market in North America. The region has a well-established energy infrastructure, making it easier to integrate SOFC systems into existing power grids. Additionally, North America boasts advanced research and development capabilities, fostering innovation and technological advancements in SOFC technology. The presence of key market players, including manufacturers, suppliers, and service providers, further strengthens the market's position in the region. Furthermore, the growing demand for reliable power generation in various sectors, such as residential, commercial, and industrial, contributes to the dominance of North America in the SOFC market.

Recent Developments

- In February 2022, CERES, Weichai, and Bosch have agreed to create a three-way partnership to explore potential in China. Two distinct joint ventures will be formed. The first will be a three-way joint venture ("System JV") for the development and manufacturing of solid oxide fuel cell (SOFC) systems. The "Stack JV" will be founded as a second joint venture to offer fuel cell stacks to the system JV and maybe other third parties.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global solid oxide fuel cell market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- ZTEK Corporation

- Special Power Source

- Aisin Seiki

- Bloom Energy

- Mitsubishi Power Ltd.

- Cummins Inc.

- Ceres

- General Electric

- FuelCell Energy Inc.

- Ningbo SOFCMAN Energy

- Kyocera Corporation

- AVL

- NGK Spark Plug Co., Ltd.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global solid oxide fuel cell market based on the below-mentioned segments:

Solid Oxide Fuel Cell Market, By Type

- Planar

- Tubular

Solid Oxide Fuel Cell Market, By Application

- Portable

- Stationary

- Transport

Solid Oxide Fuel Cell Market, By End-User

- Commercial & Industrial

- Data Centers

- Military & Defense

- Residentials

Solid Oxide Fuel Cell Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?