Global Solid State and Other Energy Efficient Lighting Market Size, Share, and COVID-19 Impact Analysis, By Offering (Hardware, Software, and Services), By Application (General Lighting, Backlighting, Automotive Lighting, Medical Lighting, and Others (Projector and Emergency Lighting)), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Energy & PowerGlobal Solid State and Other Energy Efficient Lighting Market Insights Forecasts to 2033

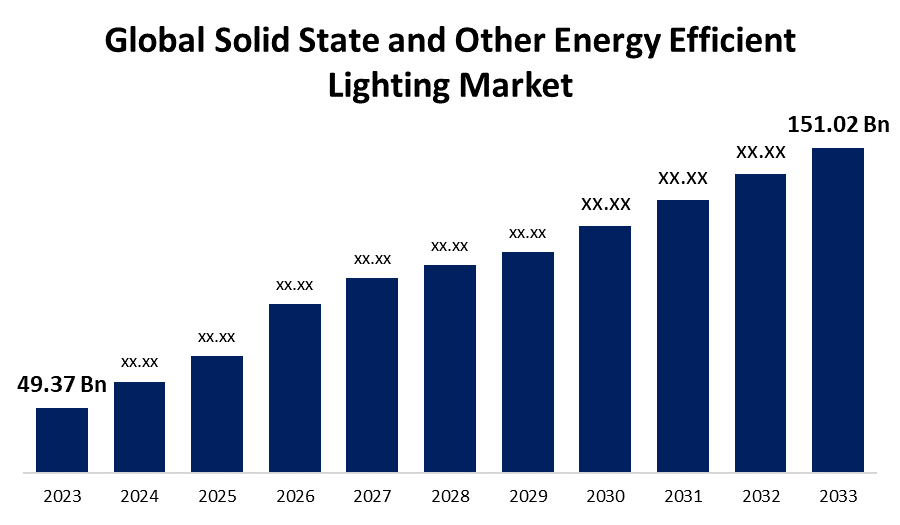

- The Global Solid State and Other Energy Efficient Lighting Market Size was Valued at USD 49.37 Billion in 2023

- The Market Size is Growing at a CAGR of 11.83% from 2023 to 2033

- The Worldwide Solid State and Other Energy Efficient Lighting Market Size is Expected to Reach USD 151.02 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Solid State and Other Energy Efficient Lighting Market Size is Anticipated to Exceed USD 151.02 Billion by 2033, Growing at a CAGR of 11.83% from 2023 to 2033.

Market Overview

Solid-state lighting (SSL) is a lighting technology that uses LEDs, OLEDs, or PLEDs as illumination sources instead of plasma, electrical filaments, or gas. SSL can include, LED clusters that fit older incandescent sockets, LED control and indicator panels, individual diodes for decorative purposes, and OLED screens that produce color and light. Energy-efficient lighting uses fixtures and bulbs that produce the same amount of light as traditional incandescent bulbs but with less energy. It can help reduce energy consumption, lower energy bills, and reduce greenhouse gas emissions.

According to U.S. Department of Energy (DOE), lighting accounts for around 15% of an average home's electricity use, and the average household saves about $225 in energy costs per year by using LED lighting. LEDs use up to 90% less energy and last up to 25 times longer than traditional incandescent bulbs. According to DOE projections, if DOE targets for efficiency, controls, and connected lighting are met, advanced lighting systems are expected to save 6.9 trillion kWh of electricity by 2035. The total cumulative energy savings would be equivalent to $710 billion in avoided energy costs and 2.1 billion metric tons of avoided carbon dioxide emissions.

Report Coverage

This research report categorizes the market for solid state and other energy efficient lighting based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the solid state and other energy efficient lighting market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the solid state and other energy efficient lighting market.

Global Solid State and Other Energy Efficient Lighting Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 49.37 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 11.83% |

| 2033 Value Projection: | USD 151.02 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Offering, By Application, By Region |

| Companies covered:: | Royal Philips Electronics N.V., Seoul Semiconductor Co., Ltd., General Electric Company, Nichia Corporation, AIXTRON SE, Applied Materials, Inc., Applied Science and Technology Research Institute Company Limited, Bridgelux, Inc., Cree, Inc., Acuity Brands, Inc., Advanced Lighting Technologies, Inc., Energy Focus, Inc., Intematix Corporation, LED Engin, Inc., Toyoda Gosei Co., Ltd., TCP International Holdings Ltd., Topanga Technologies, Inc., Ceravision Ltd, Bright Light Systems, Inc., OSRAM Licht AG, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Solid-state lighting (SSL), such as light-emitting diodes (LEDs) and organic LEDs (OLEDs), has become popular due to various driving factors. These include the rising need for energy efficiency and sustainability, as SSL technologies consume much less power compared to traditional incandescent and fluorescent bulbs. Additionally, technological advancements have led to improved light quality, longer lifespans, and reduced maintenance costs. Government regulations and incentives aimed at reducing carbon emissions and promoting energy-efficient solutions further boost the adoption of SSL. Finally, increased consumer awareness of the environmental impact of energy consumption has heightened the preference for eco-friendly lighting options.

Restraining Factors

One significant barrier is the higher initial cost of SSL products compared to traditional lighting options, which can deter budget-conscious consumers and businesses. Additionally, concerns about color rendering and light quality may limit acceptance, particularly in applications where accurate color representation is crucial. Moreover, the rapid pace of technological advancements can lead to consumer hesitation, as potential buyers may fear that newer, more efficient models will soon replace their purchases. Lastly, a lack of awareness and understanding of SSL benefits among certain demographics can impede market growth.

Market Segmentation

The solid state and other energy efficient lighting market share is classified into offering and application.

- The services segment is estimated to hold the highest market revenue share through the projected period.

Based on the offering, the solid state and other energy efficient lighting market is classified into hardware, software, and services. Among these, the services segment is estimated to hold the highest market revenue share through the projected period. This is because of the increasing demand for comprehensive solutions that go beyond mere product sales. As businesses and consumers seek to maximize the benefits of solid-state lighting (SSL), services such as installation, maintenance, and energy management become essential. These services not only ensure optimal performance and longevity of lighting systems but also enhance energy efficiency and cost savings over time. Additionally, the growing trend towards smart lighting solutions, which often require specialized installation and ongoing support. As companies prioritize sustainability and seek to optimize their energy consumption, the value of expert services in facilitating these transitions is expected to significantly contribute to market growth.

- The automotive lighting segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the solid state and other energy efficient lighting market is divided into general lighting, backlighting, automotive lighting, medical lighting, and others (projector and emergency lighting). Among these, the automotive lighting segment is anticipated to hold the largest market share through the forecast period. This is due to the increasing integration of advanced lighting technologies, such as LED and OLED, in vehicles. These technologies offer superior energy efficiency, longer lifespans, and enhanced visibility, which are critical for improving safety and aesthetics in automotive design. Additionally, the rising consumer demand for innovative features, such as adaptive headlights and ambient interior lighting, is driving automakers to adopt solid-state lighting solutions. Regulatory requirements for improved lighting performance and energy efficiency further bolster this trend, compelling manufacturers to transition away from traditional incandescent bulbs. As the automotive industry increasingly focuses on sustainability and smart technologies, the demand for advanced lighting solutions is expected to expand, solidifying its market leadership throughout the forecast period.

Regional Segment Analysis of the Solid State and Other Energy Efficient Lighting Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the solid state and other energy efficient lighting market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the solid state and other energy efficient lighting market over the predicted timeframe. This is due to rapid urbanization, increasing industrialization, and significant government initiatives aimed at promoting energy efficiency and sustainability. Countries like China and India are investing heavily in infrastructure development, leading to a surge in demand for advanced lighting solutions in commercial, residential, and public sectors. Additionally, the region benefits from a growing middle class with rising disposable incomes, which drives consumer interest in energy-efficient products. Government regulations and incentives, such as subsidies for energy-efficient lighting, further support market growth. Moreover, the presence of major manufacturers and a robust supply chain in the region enhances the availability and affordability of solid-state lighting products, positioning Asia Pacific as a leader in this market over the forecast period.

North America is expected to grow at the fastest CAGR growth of the solid state and other energy-efficient lighting market during the forecast period. This growth is driven by a combination of technological advancements and increasing regulatory support. The region is currently experiencing a strong push toward energy efficiency, as a result of government initiatives aimed at reducing carbon emissions and promoting sustainable practices. Furthermore, the increasing demand for smart lighting solutions, incorporating Internet of Things (IoT) technology, is driving innovation and adoption among both consumers and businesses. Established manufacturers and a robust distribution network in the region further enhance the availability of advanced lighting products. With growing awareness of the benefits of energy conservation and declining costs of solid-state lighting technologies, North America is poised for significant market expansion in the years to come.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the solid state and other energy efficient lighting market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Royal Philips Electronics N.V.

- Seoul Semiconductor Co., Ltd.

- General Electric Company

- Nichia Corporation

- AIXTRON SE

- Applied Materials, Inc.

- Applied Science and Technology Research Institute Company Limited

- Bridgelux, Inc.

- Cree, Inc.

- Acuity Brands, Inc.

- Advanced Lighting Technologies, Inc.

- Energy Focus, Inc.

- Intematix Corporation

- LED Engin, Inc.

- Toyoda Gosei Co., Ltd.

- TCP International Holdings Ltd.

- Topanga Technologies, Inc.

- Ceravision Ltd

- Bright Light Systems, Inc.

- OSRAM Licht AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Nichia, the world's largest LED manufacturer and inventor of the high-brightness blue and white LED, commercialized a chip-scale LED (Part No. NFSWL11A-D6) that achieves a horizontal light distribution.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the solid state and other energy efficient lighting market based on the below-mentioned segments:

Global Solid State and Other Energy Efficient Lighting Market, By Offering

- Hardware

- Software

- Services

Global Solid State and Other Energy Efficient Lighting Market, By Application

- General Lighting

- Backlighting

- Automotive Lighting

- Medical Lighting

- Others (Projector and Emergency Lighting)

Global Solid State and Other Energy Efficient Lighting Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the solid state and other energy efficient lighting market over the forecast period?The solid state and other energy efficient lighting market is projected to expand at a CAGR of 11.83% during the forecast period.

-

2. What is the market size of the solid state and other energy efficient lighting market?The Global Solid State and Other Energy Efficient Lighting Market Size is Expected to Grow from USD 49.37 Billion in 2023 to USD 151.02 Billion by 2033, at a CAGR of 11.83% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the solid state and other energy efficient lighting market?Asia Pacific is anticipated to hold the largest share of the solid state and other energy efficient lighting market over the predicted timeframe.

Need help to buy this report?