Global Solid State Drive Market Size, Share, and COVID-19 Impact Analysis, By Interface (SATA, SAS, and PCIe), By Technology (SLC, MLC, TLC, and Others), By Application (Enterprise and Client), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032.

Industry: Semiconductors & ElectronicsGlobal Solid State Drive Market Insights Forecasts to 2032

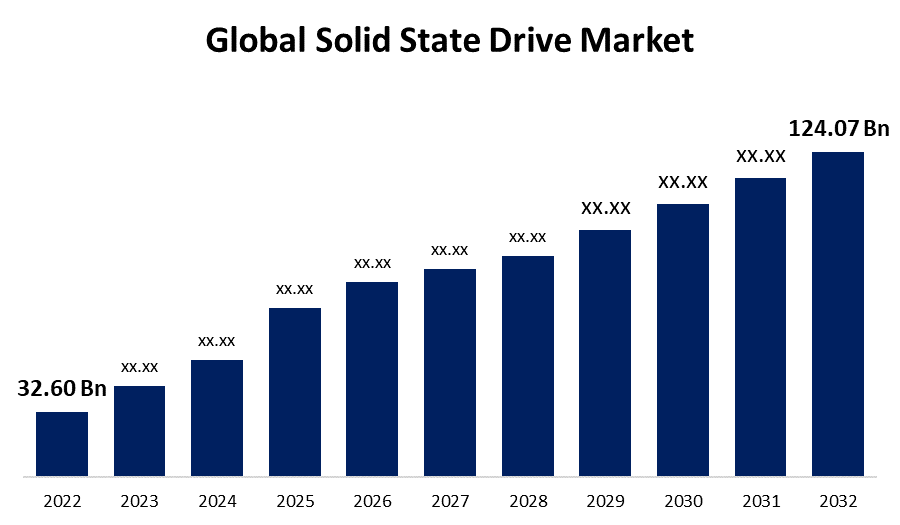

- The Solid-State Drive Market Size was valued at USD 32.60 Billion in 2022.

- The Market Size is Growing at a CAGR of 14.3% from 2023 to 2032

- The Worldwide Solid state Drive Market is expected to reach USD 124.07 Billion by 2032

- Europe is expected to grow fastest during the forecast period

Get more details on this report -

The Global Solid State Drive Market Size is expected to reach USD 124.07 Billion by 2032, at a CAGR of 14.3% during the forecast period 2023 to 2032.

Market Overview

A Solid State Drive (SSD) is a data storage device that has revolutionized the world of computing. Unlike traditional Hard Disk Drives (HDDs), which rely on spinning magnetic disks to store and retrieve data, SSDs use NAND flash memory to store data electronically. This fundamental difference results in significant advantages, including blazing-fast read and write speeds, enhanced durability, and lower power consumption. SSDs have become the preferred choice for laptops, desktops, servers, and even smartphones due to their ability to dramatically improve system performance and responsiveness. They excel in tasks such as booting up the operating system, launching applications, and transferring files quickly. With evolving technology, SSDs continue to increase in capacity and decrease in price, making them an essential component in modern computing devices and a cornerstone of data storage and retrieval efficiency.

Report Coverage

This research report categorizes the market for solid state drive market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the solid state drive market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the solid state drive market.

Global Solid State Drive Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 32.60 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 14.3% |

| 2032 Value Projection: | USD 124.07 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Interface, By Technology, By Application, By Region and COVID-19 Impact |

| Companies covered:: | Intel Corporation, Micron Technology, Inc., Samsung Electronics Co., Ltd., Seagate Technology PLC, Western Digital Corporation, Toshiba, Viking, Adata, Bitmicro Networks, Kingston, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth & Analysis. |

Get more details on this report -

Driving Factors

The Solid State Drive (SSD) market is driven by a multitude of factors that collectively contribute to its rapid growth and adoption across various industries, the relentless demand for improved performance and speed in computing devices has been a primary driver. SSDs offer significantly faster data access and transfer speeds compared to traditional Hard Disk Drives (HDDs), making them essential for consumers and businesses seeking enhanced productivity and efficiency. Another crucial driver is the continuous evolution of technology and manufacturing processes. As SSD production becomes more efficient and cost-effective, prices have been steadily declining, making these drives increasingly accessible to a broader range of consumers. Additionally, advancements in NAND flash memory technology, including 3D NAND and QLC NAND, have expanded SSD capacity options and improved overall reliability. The growing trend of cloud computing and data centers is yet another key driver. Data centers require high-performance storage solutions, and SSDs, with their speed and reliability, have become the go-to choice for such applications. The need for quick data retrieval, reduced latency, and power efficiency in data centers fuels the SSD market's growth. Moreover, the surge in mobile computing and the proliferation of smartphones and tablets have boosted demand for SSDs in the mobile device sector. SSDs are crucial for providing rapid app loading times, longer battery life, and robust data security. Concerns about data security and reliability have also fueled SSD adoption. SSDs are inherently more durable than HDDs because they lack moving parts, making them less prone to physical damage. This characteristic is especially important for industries requiring rugged and reliable storage solutions, such as aerospace, military, and industrial applications. Furthermore, environmental awareness has played a role in driving the SSD market. SSDs consume less power and generate less heat compared to HDDs, making them a greener storage option. This aligns with the growing emphasis on energy efficiency and sustainability in technology.

Restraining Factors

The solid state drive (SSD) market does face several notable restraints. One primary restraint is cost, as SSDs tend to be more expensive per gigabyte compared to traditional Hard Disk Drives (HDDs). This price differential can limit their adoption in cost-sensitive sectors or for users requiring high-capacity storage. Additionally, while SSDs are more durable than HDDs, they have a limited number of write cycles, which can affect their long-term reliability in write-intensive applications. Compatibility issues with older hardware and concerns about data retention during prolonged storage periods also pose challenges. Finally, the rate of technological advancements in SSDs means that early adopters may face obsolescence concerns as newer, faster models are continually introduced to the market.

Market Segmentation

- In 2022, the SATA segment accounted for around 74.2% market share

On the basis of the interface, the global solid state drive market is segmented into SATA, SAS, and PCIe. The SATA (Serial Advanced Technology Attachment) segment has maintained its dominance in the global Solid State Drive (SSD) market due to its widespread compatibility and cost-effectiveness. SATA SSDs are compatible with a wide range of computing devices, making them a preferred choice for both consumer and enterprise applications. Their competitive pricing has made SSD technology accessible to a broader customer base. While NVMe (Non-Volatile Memory Express) SSDs offer higher speeds, SATA SSDs continue to hold a significant market share, particularly in budget-conscious segments, where their balanced performance and affordability make them the preferred storage solution.

- The TLC segment held the largest market with more than 37.5% revenue share in 2022

Based on the technology, the global solid state drive market is segmented into SLC, MLC, TLC, and Others. The TLC (Triple-Level Cell) segment has risen to dominance in the global Solid State Drive (SSD) market due to its compelling combination of cost-efficiency and performance. TLC SSDs offer a competitive price point compared to other NAND flash memory technologies like MLC (Multi-Level Cell) and SLC (Single-Level Cell) while delivering commendable read and write speeds. This balance appeals to a broad range of consumers and enterprises, making TLC SSDs the preferred choice for many. Additionally, ongoing technological advancements have improved TLC SSD endurance, further cementing its dominant position in the SSD market by offering a cost-effective and reliable storage solution.

- The client segment is expected to grow at a significant CAGR during the forecast period

Based on the type of application, the global solid state drive market is segmented into enterprise and client. The client segment in the solid state drive (SSD) market is poised for significant growth in the forecast period. This surge is primarily driven by the increasing demand for SSDs in personal computing devices like laptops, desktops, and ultrabooks. Consumers increasingly value the benefits of faster boot times, improved application performance, and energy efficiency that SSDs offer over traditional HDDs. Furthermore, as technology becomes more integrated into daily life, the demand for reliable and responsive storage solutions in client devices is expected to drive substantial growth in this segment.

Regional Segment Analysis of the Solid State Drive Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 34.7% revenue share in 2022.

Get more details on this report -

Based on region, North America has emerged as the dominant player in the global Solid State Drive (SSD) market due to robust IT infrastructure, significant investments in data centers, and the presence of leading tech giants have driven the high demand for SSDs. Furthermore, the region's tech-savvy consumer base values faster computing speeds and data security, further fueling SSD adoption. Additionally, North American businesses prioritize efficiency and performance, making SSDs an ideal choice for improving productivity. Combined, these factors have established North America as a frontrunner in the global SSD market, with a strong market share and continued growth potential.

Europe is expected to be the fastest-growing market in the forecast period for several compelling reasons. The region is experiencing a surge in demand for Solid State Drives (SSDs) due to the increasing adoption of SSDs in data centers, enterprises, and consumer electronics. Growing concerns over data security and privacy are driving businesses and individuals to opt for the superior speed and reliability of SSDs. Additionally, government initiatives promoting digitalization and sustainable technology practices are boosting the market further.

Recent Developments

- In June 2022, Micron has released the 5400 SATA SSD Advanced Memory System for Critical Infrastructure. Using the 5400 SSD, the business provides 176-layer NAND innovation to its data centre SATA SSD. The 5400 SSD from Micron is the 11th generation4 datacenter SATA SSD.

- In July 2022, Kioxia Introduces New Speed Levels for its Enterprise NVMe SSD Family Built on PCIe 5.0 Technology. The PCIe 5.0 technology in E3.S and 2.5-inch Enterprise and Datacenter Standard Form Factor (EDSFF) is used in the KIOXIA CM7 line series. The EDSFF E3 series enables the next generation of SSDs using PCIe 5.0 and above to meet future data centre architectures while supporting a wide range of new applications and devices.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global solid state drive market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Intel Corporation

- Micron Technology, Inc.

- Samsung Electronics Co., Ltd.

- Seagate Technology PLC

- Western Digital Corporation

- Toshiba

- Viking

- Adata

- Bitmicro Networks

- Kingston

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global solid state drive market based on the below-mentioned segments:

Solid State Drive Market, By Interface

- SATA

- SAS

- PCIe

Solid State Drive Market, By Technology

- SLC

- MLC

- TLC

- Others

Solid State Drive Market, By Application

- Enterprise

- Client

Solid State Drive Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?