Global Solid Tire Market Size, Share, and COVID-19 Impact Analysis, By Product (Curled-on Solid Tire, Pressed-on Solid Tire), By Application (Engineered Vehicle, Construction Machinery, Military Vehicle, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Automotive & TransportationGlobal Solid Tire Market Insights Forecasts to 2033

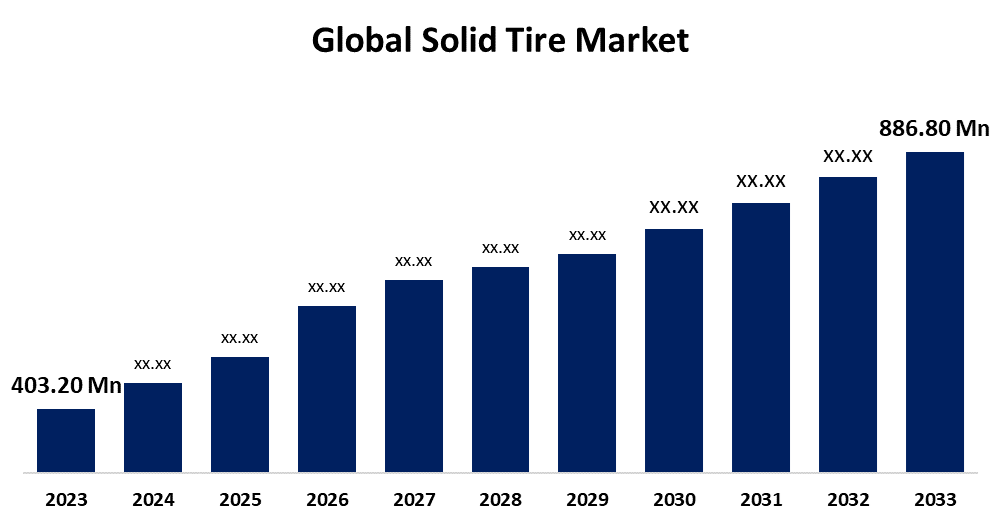

- The Global Solid Tire Market Size was Valued at USD 403.20 Million in 2023

- The Market Size is Growing at a CAGR of 8.20% from 2023 to 2033

- The Worldwide Solid Tire Market Size is Expected to Reach USD 886.80 Million by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Solid Tire Market Size is Anticipated to Exceed USD 886.80 Million by 2033, Growing at a CAGR of 8.20% from 2023 to 2033.

Market Overview

A solid tire is a tire that is made from layers of rubber and is not filled with air. These tires are typically made from durable materials like rubber, polyurethane, or other compounds, and they are designed to provide support and traction without the need for inflation. Solid tires are often used in applications where the risk of punctures or maintenance is a concern, such as in forklifts, industrial equipment, and certain types of off-road vehicles. Solid tires are ideal for heavy-duty applications in industries including construction, warehousing, and manufacturing due to their puncture resistance, durability, and low maintenance. They offer long-lasting performance, load-bearing capacity, increased safety, and reliable performance in tough terrains. They are found in material handling equipment, heavy construction machinery, agricultural, off-road vehicles, and recreational vehicles.

In August 2024, Yokohama Off-Highway Tires (Yokohama-ATG) recently introduced the Galaxy Giraffe ND Severe Duty Service (SDS) tire. According to the manufacturer, the Galaxy Giraffe ND Severe Duty Service (SDS) tire boasts three-stage solid construction for telehandlers operating in varied settings, including loose dirt, heavy debris, and indoor surfaces.

Report Coverage

This research report categorizes the market for solid tire based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the solid tire market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the solid tire market.

Global Solid Tire Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 403.20 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.20% |

| 2033 Value Projection: | USD 886.80 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Product, By Region and COVID-19 Impact Analysis |

| Companies covered:: | CAMSO, Continental AG, Global Rubber Industries, Initial Appearance LLC, Nexen Tire, Setco Solid Tire & Rim Assembly, Superior Tire & Rubber Corp., TY Cushion Tire, Trelleborg, Michelin and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the solid tire market is propelled by several factors including their superior durability, low maintenance costs, and longer lifespan compared to pneumatic tires. These tires are ideal for heavy-duty applications in industries such as construction, logistics, and manufacturing, where reliability and performance are crucial. The increasing demand for material handling equipment, construction machinery, and infrastructure development is further fueling market expansion. Technological advancements in tire materials and design, along with the growing focus on cost-efficiency and sustainability, are also contributing to the market's growth. Furthermore, the rise of e-commerce and logistics, along with the adoption of solid tires in emerging markets, is driving demand across various sectors.

Restraining Factors

The growth of the solid tire market is restrained by factors such as higher initial costs, limited comfort and shock absorption, and performance limitations in specific applications. Furthermore, environmental concerns related to disposal, the increased weight, and resistance to adoption in some traditional sectors might further limit the widespread use of solid tires.

Market Segmentation

The solid tire market share is classified into product and application.

- The curled-on solid tire segment is estimated to hold the highest market revenue share through the projected period.

Based on the product, the solid tire market is classified into curled-on solid tire and pressed-on solid tire. Among these, the curled-on solid tire segment is estimated to hold the highest market revenue share through the projected period. The segment's dominance is attributed to its superior durability, longer lifespan, and better performance in harsh industrial environments, which reduce maintenance costs and increase overall cost-efficiency. These tires are particularly favored in industries like construction, logistics, and warehousing, where heavy machinery is used and tire longevity is crucial.

- The construction machinery segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the solid tire market is divided into engineered vehicle, construction machinery, military vehicle, and others. Among these, the construction machinery segment is anticipated to hold the largest market share through the forecast period. The segment's prominence can be attributed to the increasing demand for durable, low-maintenance tires in heavy-duty construction equipment like bulldozers, excavators, and loaders. Solid tires are particularly well-suited for construction machinery due to their ability to withstand rough terrains, harsh conditions, and heavy loads, all while reducing the risk of punctures. As the construction industry continues to grow globally, the need for robust, high-performance tires to ensure operational efficiency and minimize downtime is driving the demand for solid tires in the construction machinery sector.

Regional Segment Analysis of the Solid Tire Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the solid tire market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the solid tire market over the predicted timeframe. The region’s dominance is propelled by its strong industrial base, particularly in sectors like construction, manufacturing, and logistics. The region's increasing demand for heavy-duty equipment, such as forklifts, bulldozers, and material handling vehicles, which rely on durable and low-maintenance solid tires, contributes to this growth. Furthermore, technological advancements in tire performance and ongoing infrastructure development initiatives further boost the adoption of solid tires.

Asia Pacific is expected to grow at the fastest CAGR growth of the solid tire market during the forecast period. The region's growth is attributed to rapid industrialization, a surge in infrastructure and construction projects, and the expansion of e-commerce and logistics sectors, all of which increase the demand for heavy machinery and material handling equipment that require durable solid tires. Furthermore, the region’s cost-effective and low-maintenance tire solutions are highly attractive to industries looking to reduce operational costs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the solid tire market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CAMSO

- Continental AG

- Global Rubber Industries

- Initial Appearance LLC

- Nexen Tire

- Setco Solid Tire & Rim Assembly

- Superior Tire & Rubber Corp.

- TY Cushion Tire

- Trelleborg

- Michelin

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, MAXAM Tire introduced the EcoPoint³ TBR product line, catering to diverse transportation industry needs with premium line haul, regional, and mixed service series, featuring advanced technology for superior performance and durability.

- In June 2024, Goodyear launched the Cooper Discoverer Stronghold all-terrain (AT) tire, the latest addition to the Cooper Discoverer family.

- In January 2024, Yokohama Off-Highway Tires recently introduced the Galaxy MFS 101 severe-duty solid tire, which the company claims combines solid construction with a heat-dissipating design, extra rubber above the 60J wear limit, and a high-performance steel bead design to transfer torque with less slip.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the solid tire market based on the below-mentioned segments:

Global Solid Tire Market, By Product

- Curled-on Solid Tire

- Pressed-on Solid Tire

Global Solid Tire Market, By Application

- Engineered Vehicle

- Construction Machinery

- Military Vehicle

- Others

Global Solid Tire Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the solid tire market over the forecast period?The solid tire market is projected to expand at a CAGR of 8.20% during the forecast period.

-

2. What is the market size of the solid tire market?The Global Solid Tire Market Size is Expected to Grow from USD 403.20 Million in 2023 to USD 886.80 Million by 2033, Growing at a CAGR of 8.20% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the solid tire market?North America is anticipated to hold the largest share of the solid tire market over the predicted timeframe.

Need help to buy this report?