South Africa Baby Care Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Baby Food, Body Care, and Safety & Convenience), By Category (Premium and Mass), and South Africa Baby Care Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsSouth Africa Baby Care Market Insights Forecasts to 2033

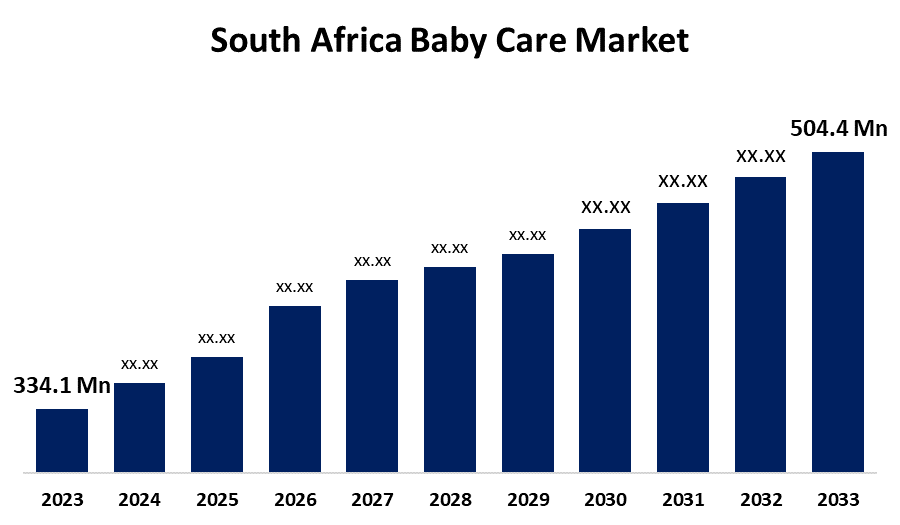

- The South Africa Baby Care Market Size was valued at USD 334.1 Million in 2023.

- The Market is Growing at a CAGR of 4.21% from 2023 to 2033

- The South Africa Baby Care Market Size is Expected to Reach USD 504.4 Million by 2033

Get more details on this report -

The South Africa Baby Care Market is Anticipated to Reach USD 504.4 Million by 2033, growing at a CAGR of 4.21% from 2023 to 2033

Market Overview

The South Africa baby care products market encompasses a wide range of products that ensure the health, hygiene, and general well-being of infants and toddlers. It ranges from baby food, diapers, skincare, toiletries, feeding bottles, and other associated accessories. In line with this, the growing demand for safe, effective, and high-quality products is a significant factor for this market to expand further. Several factors drive the growth of the baby care market in South Africa. Growing awareness among parents regarding infant health and the increased focus on premium, organic, and eco-friendly products are key contributors. Furthermore, the rise in working parents has led to an increase in demand for convenience-oriented products such as disposable diapers, baby wipes, and ready-to-feed baby food. The rise of e-commerce platforms has also made these products more accessible to a wider audience, enhancing their availability. South Africa's baby care market has been significantly impacted by government interventions, including campaigns for infant health improvement, Department of Health regulations, and partnerships with international organizations to reduce infant deaths and improve access to lifesaving products.

Report Coverage

This research report categorizes the market for the South Africa baby care market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Africa baby care market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Africa baby care market.

South Africa Baby Care Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 334.1 Million |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.21% |

| 023 – 2033 Value Projection: | USD 504.4 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product Type, By Category |

| Companies covered:: | Pigeon Corporation, Johnson & Johnson, L’oreal SA, Nestlé, Avon Products, Procter & Gamble, Danone S.A., Unilever, The Baby Food Company, Tula Baby, Others, and |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Driving Factors

The South Africa baby care market is driven by growing parental awareness about infant health, hygiene, and nutrition, leading to increased demand for high-quality, organic, and natural products. Urbanization and rising disposable incomes have driven demand for premium baby care solutions. Working parents are also seeking practical items like disposable diapers, baby wipes, and ready-to-use food. The expansion of e-commerce in rural areas has made baby care products more accessible. Government initiatives supporting infant health and nutrition further strengthen the market by encouraging responsible consumer choices and raising awareness about proper infant care.

Restraining Factors

The market for premium baby care products faces challenges due to economic constraints, stringent regulatory requirements, high competition, and the presence of counterfeit products. Economic challenges, particularly among lower-income segments, limit access to premium products, while stringent requirements increase production costs and hinder new brand entry. Counterfeit products also undermine consumer confidence.

Market Segmentation

The South Africa baby care market share is classified into product type and category.

- The baby food segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The South Africa baby care market is segmented by product type into baby food, body care, and safety & convenience. Among these, the baby food segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The growing infant nutrition consciousness is driving a surge in demand for specialized, convenient, and nutritious baby food options, particularly ready-to-feed and fortified options, due to the growing importance of good nutrition during early childhood.

- The mass segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the category, the South Africa baby care market is divided into premium and mass. Among these, the mass segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Mass-market baby care products are popular due to their affordability and accessibility to a larger consumer base, particularly those struggling economically. These products, such as diapers, baby food, and body care items, are readily available in supermarkets, pharmacies, and discount stores, making them accessible to families with diverse income sources.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Africa baby care market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pigeon Corporation

- Johnson & Johnson

- L'oreal SA, Nestlé

- Avon Products

- Procter & Gamble

- Danone S.A.

- Unilever

- The Baby Food Company

- Tula Baby

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2023, Procter & Gamble (P&G) opened a new Pampers Premium Care diaper production line at its Kempton Park, Gauteng, facility. Along with other government officials, President Cyril Ramaphosa attended the inauguration ceremony, which showcased P&G's substantial commitment to South Africa.

Market Segment

This study forecasts revenue at South Africa, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Africa baby care market based on the below-mentioned segments

South Africa Baby Care Market, By Product Type

- Baby Food

- Body Care

- Safety & Convenience

South Africa Baby Care Market, By Category

- Premium

- Mass

Need help to buy this report?