South Africa Battery Market Size, Share, and COVID-19 Impact Analysis, By Technology (Lithium-Ion Batteries, Lead-Acid Batteries, and Others), By End-User (Telecom, Energy Storage Systems, Consumer Electronics, Automotive, and Others), and South Africa Battery Market Insights, Industry Trend, Forecasts to 2033

Industry: Energy & PowerSouth Africa Battery Market Insights Forecasts to 2033

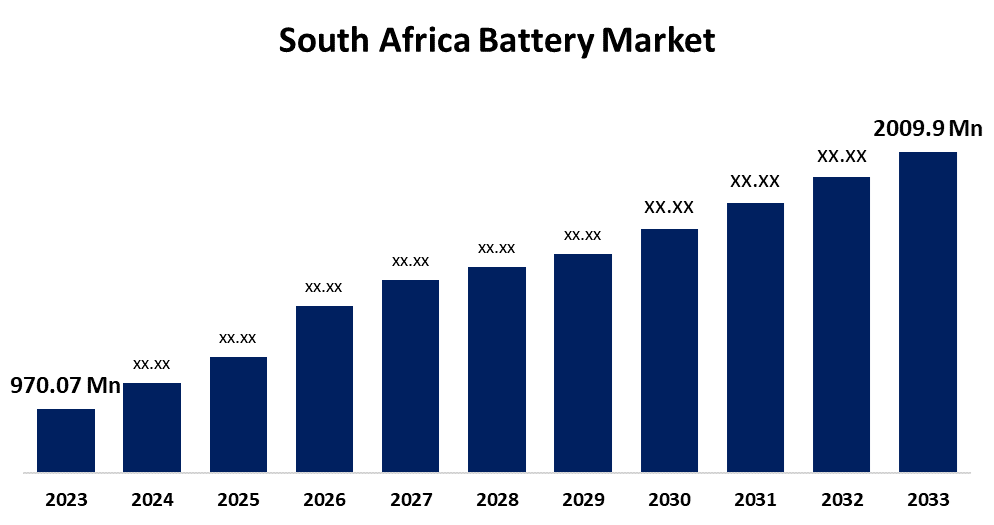

- The South Africa Battery Market Size was valued at USD 970.07 Million in 2023.

- The Market is Growing at a CAGR of 7.56% from 2023 to 2033

- The South Africa Battery Market Size is Expected to Reach USD 2009.9 Million by 2033

Get more details on this report -

The South Africa Battery Market Size is Anticipated to Reach USD 2009.9 Million by 2033, Growing at a CAGR of 7.56% from 2023 to 2033.

Market Overview

An electric battery is a device that changes chemical energy into electrical energy. An electrochemical cell, which consists of one or more cells, stores chemical energy, and from that chemical energy, electricity can be received via an electrochemical oxidation-reduction cycle. One major growth driver in the South Africa battery market is the rapidly increasing demand for portable electronics such as tablets, LCDs, smartphones, and other wearable gadgets like fitness bands. The growth of the South Africa battery market is likely to be tremendous with increased technical advancements that will make the industry cost-effective, and more efficient, and provide better product innovation. Strict pollution rules developed by the governments of developed countries combined with an increasing thrust on fuel efficiency are expected to kick in the battery demand.

Report Coverage

This research report categorizes the market for the South Africa battery market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Africa battery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Africa battery market.

South Africa Battery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 970.07 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.56% |

| 2033 Value Projection: | USD 2009.9 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 93 |

| Segments covered: | By Technology, By End-User and COVID-19 Impact Analysis. |

| Companies covered:: | Duracell Inc, Panasonic Corporation, Toshiba Corporation, Exide Industries Ltd, Murata Manufacturing Co. Ltd, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The battery market is growing more rapidly in health care, oil and gas, and chemical industries mainly because it is installed extensively in uninterrupted power supply systems. Batteries are cost-effective and dependable in most industrial applications such as energy storage, automation, and power backup. With higher automation systems and electric forklifts in the logistics and manufacturing industries, there will be a rise in demand for industrial batteries. The South African government has indicated that it will work with private and public entities to enhance the provision of electricity in the nation through energy storage projects. Through these energy storage projects; energy security will be enhanced while the various sectors of the economy will be developed.

Restraining Factors

A higher rate of battery explosions in quarries, vehicles, mines, and fixed and portable plants. An increased interest in lithium-ion batteries, which are supposed to choke the supply of bicycle lead-acid batteries and discourage on market's growth rate.

Market Segmentation

The South Africa battery market share is classified into technology and end-user.

- The lithium-ion batteries segment is expected to hold the largest market share through the forecast period.

The South Africa battery market is segmented by technology into lithium-ion batteries, lead-acid batteries, and others. Among these, the lithium-ion batteries segment is expected to hold the largest market share through the forecast period. Rechargeable lithium-ion batteries are widely used to drive energy vehicles and electronic devices; they also serve as a well-established means of storing renewable energy. They are mainly light in weight, maintenance-free, and have twice the capacity of conventional batteries, which often renders them more energy-efficient in comparison. With the decline in average lithium-ion battery prices, they become ever more cost-competitive. They also meet the driving range and charging times of electric and plug-in hybrid vehicles because of their high energy density, fast recharge, and high discharge, making them the only technology that can meet OEM criteria.

- The automotive segment is expected to dominate the South Africa battery market during the forecast period.

Based on the end-user, the South Africa battery market is divided into telecom, energy storage systems, consumer electronics, automotive, and others. Among these, the automotive segment is expected to dominate the South Africa battery market during the forecast period. The automotive industry is one of the major in the South African battery market. The pace at which the world is shifting towards electric vehicles places South Africa strategically to take the lead in the production of all types of batteries required for new energy vehicles. Manganese is a necessary component in advanced battery technologies; this gives the country's manganese abundance much value.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Africa battery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Duracell Inc

- Panasonic Corporation

- Toshiba Corporation

- Exide Industries Ltd

- Murata Manufacturing Co. Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, South Africa developed battery energy storage systems (BESS) to integrate renewable energy into its power grid. The Independent Power Producer Office has identified substation sites for the third BESIPPPP round and progressed with the second bid window for 615 MW/2 460 MWh capacity.

Market Segment

This study forecasts revenue at South Africa, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Africa battery market based on the below-mentioned segments:

South Africa Battery Market, By Technology

- Lithium-Ion Batteries

- Lead-Acid Batteries

- Others

South Africa Battery Market, By End-User

- Telecom

- Energy Storage Systems

- Consumer Electronics

- Automotive

- Others

Need help to buy this report?