South Africa Canned Food Market Size, Share, and COVID-19 Impact Analysis, By Type (Canned Fish/Seafood, Canned Meat Products, Canned Fruits, Canned Vegetables), By Distribution Channel (Online, Supermarket/Hypermarket, Convenience Stores), and South Africa Canned Food Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesSouth Africa Canned Food Market Insights Forecasts to 2033

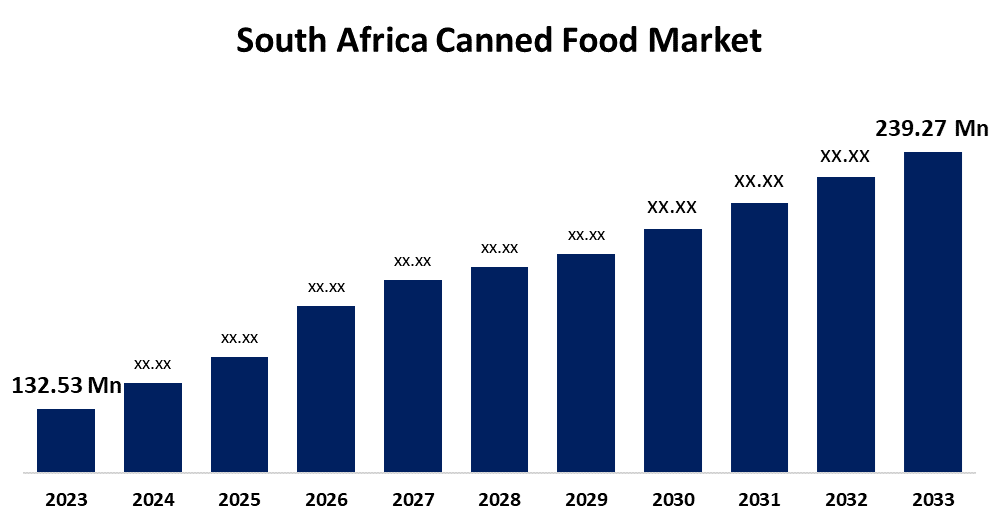

- The South Africa Canned Food Market Size was valued at USD 132.53 Million in 2023.

- The Market is Growing at a CAGR of 6.09% from 2023 to 2033

- The South Africa Canned Food Market Size is Expected to Reach USD 239.27 Million by 2033

Get more details on this report -

The South Africa Canned Food Market is Anticipated to Reach USD 239.27 Million by 2033, growing at a CAGR of 6.09% from 2023 to 2033.

Market Overview

Canned food can be defined as the process of preserving and packaging food in airtight containers, usually metal cans, to increase its shelf life. These foods are sealed in a container and heated to kill molds, bacteria, and yeast to prevent the food from spoiling. The advantages of canned food products include convenience, longer shelf life, and preservation of nutritional value. These consist of a wide range of products, including prepared foods, fruits, vegetables, and meats. These foods are sealed in a container and heated to kill molds, yeast, and bacteria. Convenience, extended shelf life, shifting consumer habits, an increase in demand for prepared and ready-to-eat food items, and urbanization are the factors that primarily drives the South Africa canned food market.

Report Coverage

This research report categorizes the market for the South Africa canned food market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Africa canned food market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Africa canned food market.

South Africa Canned Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 132.53 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.09% |

| 2033 Value Projection: | USD 239.27 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Dursots, RFG Foods, Miami Canners, Tiger Brands, Tristar Foods, BM Food Manufacturers (Pty) Ltd. and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for canned foods in South Africa is growing quickly due to rising disposable income. As consumers' purchasing power rises as a consequence of their increased financial stability, there is a strong demand for convenient and shelf-stable food options. Economic empowerment is driving the canned food industry as consumers seek out quick and easy meal options. The trend of increasing disposable income in South Africa has created a thriving market for canned goods. Consumer demand for ready-to-cook and ready-to-eat food products has increased in both developed and emerging economies, which has helped the canned food market grow. The rise in the working population and the reduction in cooking time have both had a positive effect on market growth.

Restraining Factors

The non-biodegradable tin and aluminum cans used to make canned food products emit toxic substances and hazardous gases when they come into contact with biotic or abiotic stimuli. Customers' growing awareness of dietary options has raised doubts about the long-term health effects of canned goods. As customers look for healthier options, the fear might prevent the market from growing.

Market Segmentation

The South Africa canned food market share is classified into type and distribution channels.

- The canned meat products segment is expected to hold the largest market share through the forecast period.

The South Africa canned food market is segmented by type into canned fish/seafood, canned meat products, canned fruits, and canned vegetables. Among these, the canned meat products segment is expected to hold the largest market share through the forecast period. This is attributed to accommodate a wide range of consumer preferences, the segment offers a variety of preserved meat options. The popularity of canned meat products can be attributed to several factors, including the versatility, long shelf life, and ease of preparation of meat-based dishes.

- The supermarket/hypermarket segment is expected to dominate the South Africa canned food market during the forecast period.

Based on the distribution channel, the South Africa canned food market is divided into online, supermarket/hypermarket, and convenience stores. Among these, the supermarket/hypermarket segment is expected to dominate the South Africa canned food market during the forecast period. This is attributed to consumer preferences and purchasing patterns and due to their accessibility and wide range of products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Africa canned food market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dursots

- RFG Foods

- Miami Canners

- Tiger Brands

- Tristar Foods

- BM Food Manufacturers (Pty) Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2021, Tyson Foods Inc. declared that it would invest over USD 1.3 billion over the next three years to boost automation in meat plants to boost production capacity.

Market Segment

This study forecasts revenue at South Africa, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Africa canned food market based on the below-mentioned segments:

South Africa Canned Food Market, By Type

- Canned Fish/Seafood

- Canned Meat Products

- Canned Fruits

- Canned Vegetables

South Africa Canned Food Market, By Distribution Channel

- Online

- Supermarket/Hypermarket

- Convenience Stores

Need help to buy this report?