South Africa Corrosion Protective Coating Market Size, Share, and COVID-19 Impact Analysis, By Product (Solvent-Borne, Water-Borne, and Powder Coatings), By Material (Epoxy, Polyurethane, Acrylic, Alkyd, Zinc, Chlorinated Rubber, and Others), and South Africa corrosion protective coating Market Insights, Industry Trend, Forecasts to 2033

Industry: Advanced MaterialsSouth Africa Corrosion Protective Coating Market Insights Forecasts to 2033

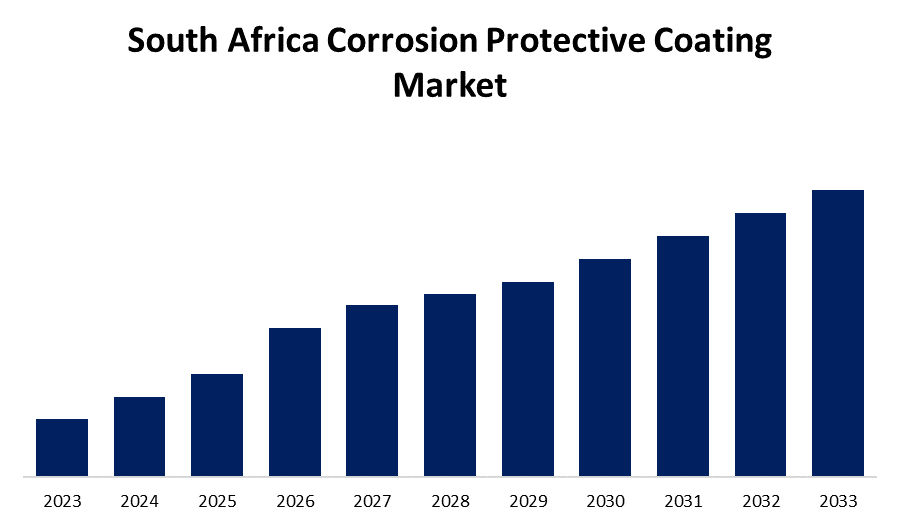

- The Market Size is Growing at a CAGR of 5.3% from 2023 to 2033

- The South Africa Corrosion Protective Coating Market Size is Expected to Hold a Significant Share by 2033

Get more details on this report -

The South Africa Corrosion Protective Coating Market Size is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 5.3% from 2023 to 2033.

Market Overview

Specialty paints and surface treatments used in corrosion protection coat commodities reduce or prevent metal surface degradation by preventing corrosive substances such as water, chemicals, and the environment from affecting the surface. Major applications include the automotive, aviation, marine, and utilities industries. The oil and gas industry is one of the costliest users of corrosion protection coatings, mainly because the surrounding environment experienced by equipment operating within this industry is very severe. With the country’s energy demand expansion combined with mainly offshore oil exploration investments, effective corrosion protection becomes more crucial to ensure resource sustainability, durability, and reliability to the country's focus on infrastructure within the forms of bridges, dams, pipelines, and buildings to drive higher demand for tough coatings. The pace of urbanization contributes to growing construction activity and infrastructure development in urban areas. It necessitates strict corrosion control for various environmental conditions of buildings and other structures involved. The durable protective coatings thus yield benefits in reducing maintenance costs and prolonging the asset life.

Report Coverage

This research report categorizes the market for the South Africa corrosion protective coating based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Africa corrosion protective coating market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Africa corrosion protective coating market.

South Africa Corrosion Protective Coating Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.3% |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 168 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By Material. |

| Companies covered:: | Akzo Nobel N.V, Jotun, PPG Industries, Inc., BASF SE, E. I. du Pont de Nemours and Company, The Sherwin-Williams Company, Nippon Paint Holdings Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

These high levels of maintenance and repair services costs, especially within the public sector, are the primary motivator for the South African crop protection products market expectations as the construction industry and the growing populace in the region will have a boost in the protective coatings market. Manufacturers' increased focus on the new environmentally friendly coating technologies is likely to spur market growth. The tough volatile organic compound (VOC) control regulations encourage the development of environmentally friendly coating technologies, which is estimated to have a positive impact on the South African corrosion protection coating market during the forecast period. Increased spending on corrosion protection techniques in recent applications will act as a long-term driving factor for the market of corrosion protection coatings.

Restraining Factors

Some of the other common ingredients used in coatings include pigments, fillers, binders, additives, and urea white. The increasing cost of the manufacture of coatings is also likely to restrain the South African corrosion protection market. Pigments, solvents, binders, additives, and white urea are some of the major components that make up coatings.

Market Segmentation

The South Africa corrosion protective coating market share is classified into product and material.

- The solvent-borne segment is expected to hold the largest market share through the forecast period.

The South Africa corrosion protective coating market is segmented by product into solvent-borne, water-borne, and powder coatings. Among these, the solvent-borne segment is expected to hold the largest market share through the forecast period. All this is attributed to its high-performance characteristics that include high adhesion properties and durability with good chemical resistance. It gives better hostility to hostile environments and can be used in such industrious sectors as oil and gas and marine resources, among others. Advancements in the formulation techniques have led to the development of materials with low VOC contents, making coatings observe strident environmental limits yet maintaining in high-performance standards. This combination of endeavors and conformity is driving coating products to the top of the industry.

- The epoxy segment is expected to dominate the South Africa corrosion protective coating market during the forecast period.

Based on the material, the South Africa corrosion protective coating market is divided into epoxy, polyurethane, acrylic, alkyd, zinc, chlorinated rubber, and others. Among these, the epoxy segment is expected to dominate the South Africa corrosion protective coating market during the forecast period. This is mainly because of the high resistance against corrosion, strength, and adjustability. They stick well to different types of coatings and adhere well to extreme conditions. In addition to this, epoxy coatings have good chemical resistance and can surely find their place in oil and gas, chemical processing, marine, etc.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Africa corrosion protective coating market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Akzo Nobel N.V

- Jotun

- PPG Industries, Inc.

- BASF SE

- E. I. du Pont de Nemours and Company

- The Sherwin-Williams Company

- Nippon Paint Holdings Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

South Africa Corrosion Protective Coating Market, By Product

- Solvent-Borne

- Water-Borne

- Powder Coatings

South Africa Corrosion Protective Coating Market, By Material

- Epoxy

- Polyurethan

- Acrylic

- Alkyd

- Zinc

- Chlorinated Rubber

- Others

Need help to buy this report?