South Africa Ethnic Foods Market Size, Share, and COVID-19 Impact Analysis, By Type (Indian Cuisine, Latin American Cuisine, Mediterranean Cuisine, Middle Eastern Cuisine, African Cuisine, Chinese Cuisine, and Southeast Asian Cuisine), By Product (Frozen Ethnic Foods, Sauces and Condiments, Snacks, Bakery and Confectionery, Beverages, Spices and Herbs, Pulses, Rice, Noodles, Soups, and Others), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail, Foodservice, and Others) and South Africa Ethnic Foods Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesSouth Africa Ethnic Foods Market Insights Forecasts to 2033

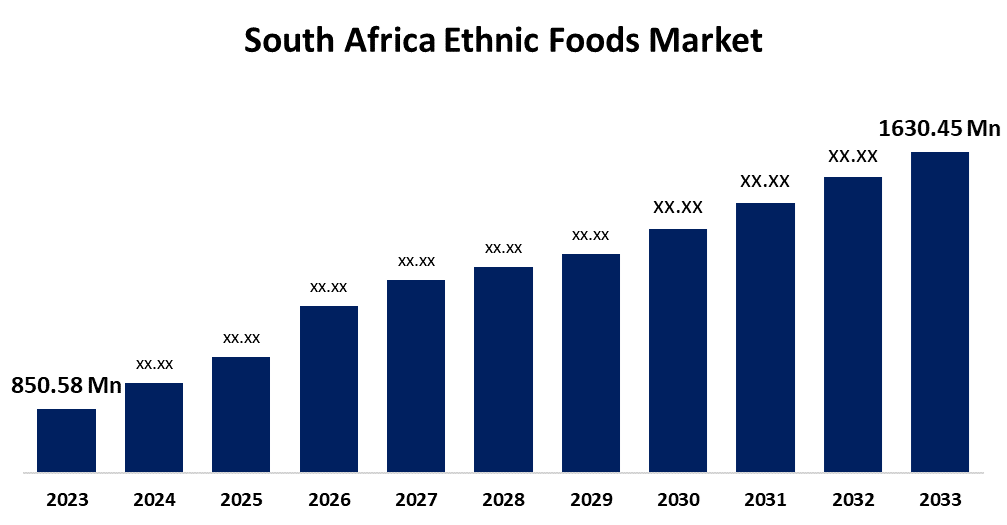

- The South Africa Ethnic Foods Market Size was valued at USD 850.58 Million in 2023

- The Market is Growing at a CAGR of 6.72% from 2023 to 2033

- The South Africa Ethnic Foods Market Size is Expected to Reach USD 1630.45 Million by 2033

Get more details on this report -

The South Africa Ethnic Foods Market Size is Anticipated to Reach USD 1630.45 Million by 2033, Growing at a CAGR of 6.72% from 2023 to 2033.

Market Overview

Ethnic foods refer to those foods that belong to a tribe or nation and are prepared by people belonging to the same culture, language, religion, or family. It is led by an increasingly diverse and culturally oriented consumer demand for culinary experiences. As South African culture continues to become multicultural and urbanized, this list of ethnic foods will continue to grow, from a wider variety of traditional dishes from many ethnic groups across the country, creating a demand locally and overseas. Various factors are propelling the growth of the ethnic food industry in South Africa. First and foremost, growing awareness and appreciation for cultural diversity push up demand for ethnic foods. Additionally, health-conscious consumers propel this industry since most products under ethnic foods generally contain natural and organic ingredients.

Report Coverage

This research report categorizes the market for the South Africa ethnic foods market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Africa ethnic foods market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Africa ethnic foods market.

South Africa Ethnic Foods Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 850.58 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.72% |

| 2033 Value Projection: | USD 1630.45 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Product, By Distribution Channel and COVID-19 Impact Analysis. |

| Companies covered:: | Famous Brands, Asli Fine Foods, Old Ei Paso (General Mills), Tiger Brands, Chesa Nyama, Natco Foods Ltd., Santa Maria UK Ltd. (Paulig Group), and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Ethnically, the large cultural diversities and urbanization in cities like Johannesburg are leading to a very healthy ethnic food market in South Africa. The ethnic food of urbanization, for example, stems from the cultural diversity one can observe in cities. Consumers look for healthy nutrition with fresh, natural products; thus, there has been a trend towards organically produced and diet-specific ethnically foods. Distribution channels like supermarkets and online are on an expansion spree, thereby making ethnic foods available nationwide. Media and food tourism primarily drive the South African ethnic food market. Their growth is further supported by cooking shows, blogs, and social media. Tourists who search for authentic culinary experiences by exploring the rich culinary heritage of the country contribute to the growth of the market. The events associated with local ethnic foods increase their popularity not only amongst the residents but also among the visitors.

Restraining Factors

Some of the factors that are expected to hit the growth of the ethnic food market of South Africa include accessing authentic ingredients, very high costs for production and distribution, regulations compliance, cultural and taste barriers, competition from local food, and economic instability. Among some of the issues that require energy and loads of resources are importation cost implications of several fundamental ingredients, cumbersome regulations, and attracting customers at a time when competition and economic fluctuations undermine the market.

Market Segmentation

The South Africa ethnic foods market share is classified into type, product, and distribution channel.

- The Indian cuisine segment is expected to hold the largest market share through the forecast period.

The South Africa ethnic foods market is segmented by type into Indian cuisine, Latin American cuisine, Mediterranean cuisine, Middle Eastern cuisine, African cuisine, Chinese cuisine, and Southeast Asian cuisine. Among these, the Indian cuisine segment is expected to hold the largest market share through the forecast period. South Africa has seriously taken the Indian food market. The reason behind this is its great love for food. The desire to consume delicious and varied staples and the sheer population of Indians in the country has seen to it that Indian food is sustained. The trend of readymade food is increasing these days and restaurants also serve special dishes like samosas, curries, and biryani.

- The frozen ethnic foods segment is expected to dominate the South Africa ethnic foods market during the forecast period.

Based on the product, the South Africa ethnic foods market is divided into frozen ethnic foods, sauces and condiments, snacks, bakery and confectionery, beverages, spices and herbs, pulses, rice, noodles, soups, and others. Among these, the frozen ethnic foods segment is expected to dominate the South Africa ethnic foods market during the forecast period. The instant pressed meal paradigm has expanded and greatly helped also, by making easy followup in South African groceries.

- The supermarkets/hypermarkets segment is expected to hold the largest market share through the forecast period.

The South Africa ethnic foods market is segmented by distribution channel into supermarkets/hypermarkets, specialty stores, online retail, food service, and others. Among these, the supermarkets/hypermarkets segment is expected to hold the largest market share through the forecast period. General Store makes the South African ethnic food market sustained through its wide variety of products all found at one location.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Africa ethnic foods market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Famous Brands

- Asli Fine Foods

- Old Ei Paso (General Mills)

- Tiger Brands

- Chesa Nyama

- Natco Foods Ltd.

- Santa Maria UK Ltd. (Paulig Group)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Africa, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Africa ethnic foods market based on the below-mentioned segments:

South Africa Ethnic Foods Market, By Type

- Indian Cuisine

- Latin American Cuisine

- Mediterranean Cuisine

- Middle Eastern Cuisine

- African Cuisine

- Chinese Cuisine

- Southeast Asian Cuisine

South Africa Ethnic Foods Market, By Product

- Frozen Ethnic Foods

- Sauces and Condiments

- Snacks

- Bakery and Confectionery

- Beverages

- Spices and Herbs

- Pulses, Rice, Noodles

- Soups

- Others

South Africa Ethnic Foods Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Foodservice

- Others

Need help to buy this report?