South Africa Extra Neutral Alcohol Market Size, Share, and COVID-19 Impact Analysis, By Application (Drugs and Medicines, Cosmetics, Tastes and Perfumes, and Drinkable Alcohol), By Raw Material (Grain-Based and Sugarcane-Based), and South Africa Extra Neutral Alcohol Market Insights, Industry Trend, Forecasts to 2033.

Industry: Chemicals & MaterialsSouth Africa Extra Neutral Alcohol Market Insights Forecasts to 2033

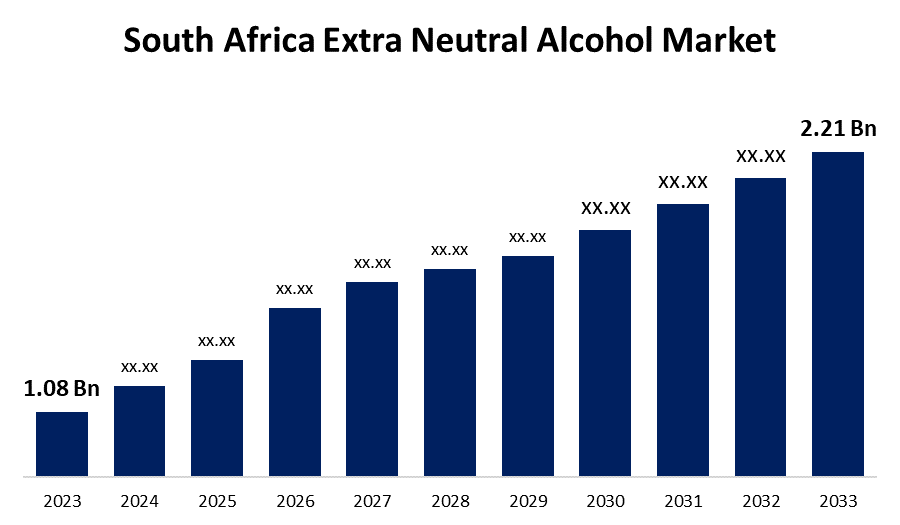

- The South Africa Extra Neutral Alcohol Market Size was valued at USD 1.08 Billion in 2023.

- The Market is Growing at a CAGR of 7.42% from 2023 to 2033.

- The South Africa Extra Neutral Alcohol Market Size is Expected to Reach USD 2.21 Billion by 2033

Get more details on this report -

The South Africa Extra Neutral Alcohol Market is Anticipated to Reach USD 2.21 Billion by 2033, growing at a CAGR of 7.42% from 2023 to 2033.

Market Overview

Pure excess neutral alcohol is tasteless and also odorless. It may be prepared by utilizing different basic ingredients, like sugar molasses, and grains comprising of corn, rye, wheat, barley, rice, and others. ENA is generally used as a base spirit or for brewing, but there are numerous other applications. Extra Neutral Alcohol or ENA is primarily used for beverages. This includes such products as wine, vodka, whiskey, and gin. In addition to its preservative attributes, it is found useful in cosmetic and personal care use in hair sprays, air fresheners, colognes, fragrances, and medications to use for washing. It is an excellent solvent for some paints, lacquers, and printing inks. Yeast is fermented in jaggery or sugar to produce an excess of neutral alcohol, which is then distilled repeatedly to produce colorless and odorless alcohol. People’s attitudes towards alcohol consumption are changing as money plays an increased role because it is now considered socially acceptable.

Report Coverage

This research report categorizes the market for South Africa extra neutral alcohol market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Africa extra-neutral alcohol market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Africa extra-neutral alcohol market.

South Africa Extra Neutral Alcohol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.08 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 7.42% |

| 2033 Value Projection: | USD 2.21 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 276 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application, By Raw Material |

| Companies covered:: | Illovo Sugar (Pty) Ltd., NCP Alcohols (Pty) Ltd., USA Distillers, Agro Chemical and Food Company Limited (ACFC), Sasol Solvents, Mumias Sugar Company, Tag Solvent Products (Pty) Ltd., Swift Chemicals (Pty) Ltd., Enterprise Ethanol, Greenpoint Alcohols (Pty) Ltd., and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Recent successes within the sugar and personal care sectors, coupled with an increase in the use of extra-neutral alcohol in a wide range of pharmaceutical, cosmetic, and other applications, have driven growth for the more neutral market in African countries. Southern African developing countries have huge potential for producing ENA with such pleasing social and economic implications. With rapid urbanization and improving financial conditions, the demand for many new alcoholic beverages, including sparkling wine, vodka, whisky, gin, and others, has increased in developed economies like Europe and North America. Apart from this, the level of life and increase in disposable cash have also brought in their wake influence from the West, which encourages the younger generation to adopt more refined, restrained, and luxury beverages.

Restraining Factors

Strict government regulations and heavy taxes on alcohol due to the above-stated growing consumption in the market would limit its growth. As ethanol is flammable, it requires utmost care in transportation. The state laws make things complicated when referring to taxes. The stringent testing requirements for ethanol from the African regulatory bodies increased the cost of production. These factors would limit the market growth within the given forecast period.

Market Segmentation

The South Africa extra-neutral alcohol market share is classified into the application and raw material.

- The portable alcohol segment is expected to hold the largest market share through the forecast period.

The South Africa extra-neutral alcohol market is segmented by application into drugs and medicines, cosmetics, tastes and perfumes, and drinkable alcohol. Among these, the portable alcohol segment is expected to hold the largest market share through the forecast period. Increasing disposable incomes, growth of club culture in urban areas of the region, and further increase of bars, clubs, and lounges are contributing to the rise of the portable alcohol market.

- The sugarcane-based segment is expected to dominate the South Africa extra neutral alcohol market during the forecast period.

Based on the raw material, the South Africa extra-neutral alcohol market is divided into grain-based and sugarcane-based. Among these, the sugarcane-based segment is expected to dominate the South Africa extra-neutral alcohol market during the forecast period. Rum is prepared by direct extraction of sugar water or by-products. The wine is sold after aging in the barrels. The sugar-based segment will be the most prominent product segment due to the high demand for wine and increasing preference in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Africa extra neutral alcohol market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Illovo Sugar (Pty) Ltd.

- NCP Alcohols (Pty) Ltd.

- USA Distillers

- Agro Chemical and Food Company Limited (ACFC)

- Sasol Solvents

- Mumias Sugar Company

- Tag Solvent Products (Pty) Ltd.

- Swift Chemicals (Pty) Ltd.

- Enterprise Ethanol

- Greenpoint Alcohols (Pty) Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Africa, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Africa extra-neutral alcohol market based on the below-mentioned segments:

South Africa Extra Neutral Alcohol Market, By Application

- Drugs and Medicines

- Cosmetics

- Tastes and Perfumes

- Drinkable Alcohol

South Africa Extra Neutral Alcohol Market, By Raw Material

- Grain-Based

- Sugarcane-Based

Need help to buy this report?