South Africa Fintech Market Size, Share, and COVID-19 Impact Analysis, By Technology (Application Programming Interface (API), Artificial Intelligence (AI), Blockchain, Robotic Process Automation, and Data Analytics), By Application (Payment & Fund Transfer, Loans, Insurance & Personal Finance, and Wealth Management), By End User (Banking, Insurance, and Securities), and South Africa Fintech Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialSouth Africa Fintech Market Insights Forecasts to 2033

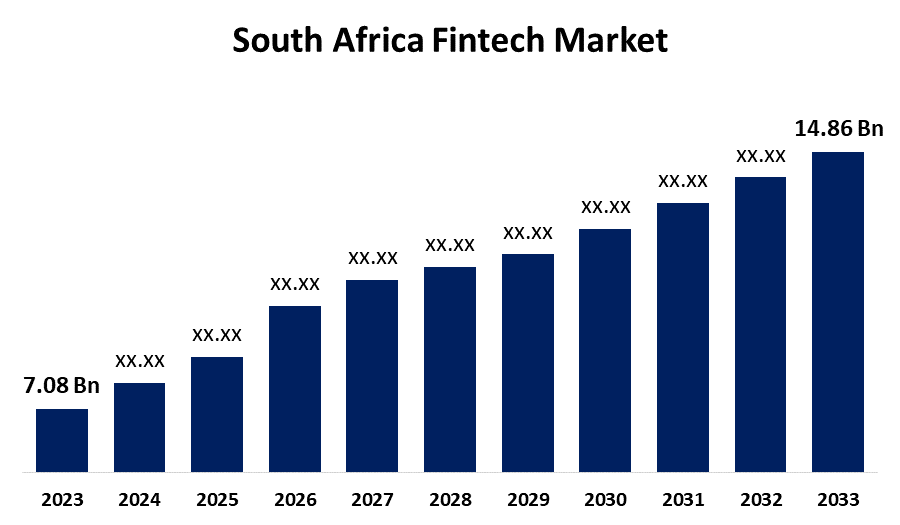

- The South Africa Fintech Market Size was valued at USD 7.08 Billion in 2023.

- The Market Size is Growing at a CAGR of 7.70% from 2023 to 2033

- The South Africa Fintech Market Size is Expected to Reach USD 14.86 Billion by 2033

Get more details on this report -

The South Africa Fintech Market Size is Anticipated to Reach USD 14.86 Billion by 2033, growing at a CAGR of 7.70% from 2023 to 2033.

Market Overview

Fintech, generally stands for “financial technology,” is the technology in which financial service is incorporated, to increase productivity, accessibility, and creativity. A wide range of digital solutions are included that challenge conventional lending, investing, payments, and banking procedures. Modern technologies such as blockchain, artificial intelligence, mobile apps, and online platforms are used by fintech businesses to improve customer experience, expedite procedures, and offer financial services to underserved groups. In recent years, the industry has grown significantly by drawing attention to investment and changing the financial scene. Transformation of digital currencies, peer-to-peer lending, robo-advisory services, crowdfunding, and payments are done by fintech, shaping the future of finance. Rising internet and smartphone usage, a sizable unbanked population, rising demand for digital financial services, benevolent government policies, and a thriving startup ecosystem are some of the factors that expand the South Africa fintech market. For instance, the South African government established the Digital Economy Mission Plan (DEMP) in January 2024, whose main goal is to fulfill the objectives of the National Development Plan (NDP), which include strengthening e-government services, fostering digital innovation, boosting cybersecurity, boosting digital infrastructure, developing digital skills, boosting digital commerce, and fostering digital transformation in key industries.

Report Coverage

This research report categorizes the market for South Africa fintech market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Africa fintech market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Africa fintech market.

South Africa Fintech Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 7.08 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.70% |

| 2033 Value Projection: | USD 14.86 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Application |

| Companies covered:: | MFS Africa, PayU, Yoco, JUMO, Luno, AlphaCode, Entersekt, Bank Zero, TymeBank, Rainfi, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The factor that primarily drives South Africa fintech market is the expansion of digital infrastructure. As South Africans are acquiring more smartphones and internet access, the financial industry is preparing for an enormous shift. Fintech companies are taking advantage by providing people and businesses easy access to financial services by offering innovative products like digital wallets, online lending platforms, and mobile payments. South Africa’s rapid adoption of digital technologies and its increasingly tech-savvy populace, which is promoting financial inclusion and economic growth are the factors that drive the South Africa fintech market.

Restraining Factors

Regulations in South Africa fintech market hamper competition and innovation. Slow regulatory adaptation to technological advancement, unresolved frameworks, drawn-out licensing procedures, and complicated compliance requirements are some of the factors hindering the market of fintech in South Africa.

Market Segmentation

The South Africa fintech market share is classified into technology, application, and end-users.

- The artificial intelligence (AI) segment is expected to hold the largest market share through the forecast period.

The South Africa fintech market is segmented by technology into application programming interface (API), artificial intelligence (AI), blockchain, robotic process automation, and data analytics. Among these, the artificial intelligence (AI) segment is expected to hold the largest market share through the forecast period. This is attributed to the increasing automation, enhancing customer experiences, and simplifying processes, artificial intelligence is transforming the financial industry. Its ability to process huge amounts of data and supply information is driving its adoption in the South Africa fintech market.

- The payment & fund transfer segment is expected to dominate the South Africa fintech market during the forecast period.

Based on the application, the South Africa fintech market is divided into payment & fund transfer, loans, insurance & personal finance, and wealth management. Among these, the payment & fund transfer segment is expected to dominate the South Africa fintech market during the forecast period. This is due to rising smartphone adoption and the demand for safe and financial transactions. The category incorporates digital payment options, such as electronic fund transfers, online banking platforms, and mobile payment apps.

- The banking segment is expected to hold the largest market share through the forecast period.

The South Africa fintech market is segmented by end-users into banking, insurance, and securities. Among these, the banking segment is expected to hold the largest market share through the forecast period. This is attributed to the high demand for digital banking solutions, innovative financial services, and mobile payment platforms. The increasing use of digital wallets, online banking, and other fintech solutions by both consumers and businesses has led to the expansion of the banking segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Africa fintech market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- MFS Africa

- PayU

- Yoco

- JUMO

- Luno

- AlphaCode

- Entersekt

- Bank Zero

- TymeBank

- Rainfi

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In June 2024, for the first Timbuktoo Fintech Hub in Africa, the United Nations Development Programme (UNDP) and the Timbuktoo Africa Innovation Foundation issued a call for applications.

- In March 2023, PayShap, a low-value, real-time rapid payments network for businesses and individuals, was launched by the South African Reserve Bank (SARB) to promote financial inclusion in the nation.

Market Segment

This study forecasts revenue at South Africa, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Africa fintech market based on the below-mentioned segments:

South Africa Fintech Market, By Technology

- Application Programming Interface (API)

- Artificial Intelligence (AI)

- Blockchain

- Robotic Process Automation

- Data Analytics

South Africa Fintech Market, By Application

- Payment & Fund Transfer

- Loans

- Insurance & Personal Finance

- Wealth Management

South Africa Fintech Market, By End-Users

- Banking

- Insurance

- Securities

Need help to buy this report?