South Africa Frozen Food Market Size, Share, and COVID-19 Impact Analysis, By Product (Fruits & Vegetables, Potatoes, Ready Meals, Meat, Fish/Seafood, and Others), By Distribution Channel (Offline and Online), and South Africa Frozen Food Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesSouth Africa Frozen Food Market Insights Forecasts to 2033

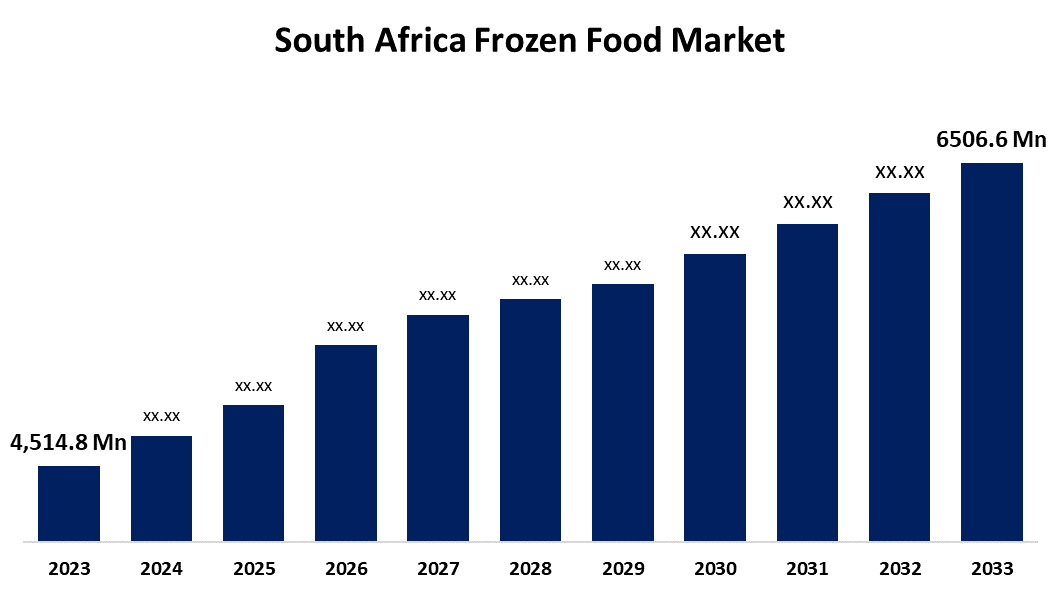

- The South Africa Frozen Food Market Size was valued at USD 4,514.8 Million in 2023.

- The Market Size is Growing at a CAGR of 3.72% from 2023 to 2033

- The South Africa Frozen Food Market Size is Expected to Reach USD 6506.6 Million by 2033

Get more details on this report -

The South Africa Frozen Food Market Size is Anticipated to Reach USD 6506.6 Million by 2033, Growing at a CAGR of 3.72% from 2023 to 2033

Market Overview

Frozen foods are those that have been frozen at a rapid speed and kept at low temperatures until they are to be consumed. Many preservatives are added to such food items for extended shelf life. Frozen foods are packed with lots of nutrients. Natural conveniences save time and long shelf life, in addition to inhibiting the spread of bacteria. This makes it a valuable asset in living and dining environments and also helps increase efficiency in many cooking tasks. Common frozen foods include bread, frozen snacks, ice cream, potato chips, frozen vegetables, fruit, regular chicken, sausage, pizza, burgers, candy corn, and desserts. The South African frozen food market is going to continue growing due to increases in demand for prepared foods, lifestyle improvements changed eating habits, and the busy lifestyles of working women.

Report Coverage

This research report categorizes the market for South Africa frozen food market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Africa frozen food market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Africa frozen food market.

South Africa Frozen Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4,514.8 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.72% |

| 2033 Value Projection: | USD 6506.6 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 167 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Distribution Channel |

| Companies covered:: | Unilever PLC, Nestlé S.A., General Mills, Inc., Nomad Foods Ltd., Tyson Foods Inc., Conagra Brands Inc., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Urbanization has increased to a very large extent in the last few years. Waste generation is closely associated with urbanization because of high consumption of packaged or processed goods. Compared with developed countries, they suffer more in the case of urbanization. The South Africa frozen food market is gaining further support from increasing consumer demand for chilled soups and sausages, frozen dairy products or snacks, and frozen meat and seafood. The reasons for such large amounts of waste are disposed of freely in developing countries largely because of a lack of infrastructure as well as low levels of education and awareness.

Restraining Factors

Consumers view frozen food as a low-quality complement to fresh food, thereby limiting market potential. More specifically, the market for frozen foods in South Africa will face fresh food preferences among consumers as a constraint to growth.

Market Segmentation

The South Africa frozen food market share is classified into product and distribution channels.

- The ready meals segment is expected to hold the largest market share through the forecast period.

The South Africa frozen food market is segmented by product into fruits & vegetables, potatoes, ready meals, meat, fish/seafood, and others. Among these, the ready meals segment is expected to hold the largest market share through the forecast period. The reasons for this dominance are lifestyle changes which have become a part of fast work schedules, particularly because of pressure on working-class people and the shift in preference toward ready-frozen meals. Moreover, the increased popularity among youth and easy availability in convenience stores as well as supermarkets has raised this market share for the ready meals segment.

- The offline segment is expected to dominate the South Africa frozen food market during the forecast period.

Based on the distribution channel, the South Africa frozen food market is divided into online and offline. Among these, the offline segment is expected to dominate the South Africa frozen food market during the forecast period. The convenience stores and hypermarkets with freezing and temperature-controlled facilities aid in extending this segment as a channel for the distribution of frozen products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Africa Frozen Food Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Unilever PLC

- Nestlé S.A.

- General Mills, Inc.

- Nomad Foods Ltd.

- Tyson Foods Inc.

- Conagra Brands Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Africa, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Africa frozen food market based on the below-mentioned segments:

South Africa Frozen Food Market, By Product

- Fruits & Vegetables

- Potatoes

- Ready Meals

- Meat

- Fish/Seafood

- Other

South Africa Frozen Food Market, By Distribution Channel

- Online

- Offline

Need help to buy this report?