South Africa Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Life Insurance and Non-life Insurance), By Distribution Channel (Insurance Brokers, Agencies, Direct Marketing, and Bancassurance), and South Africa Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialSouth Africa Insurance Market Insights Forecasts to 2033

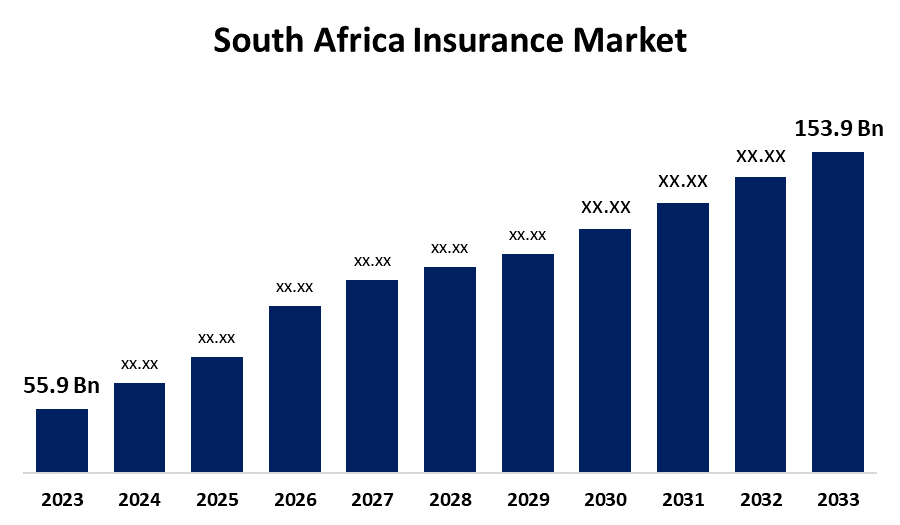

- The South Africa Insurance Market Size was valued at USD 55.9 Billion in 2023.

- The Market Size is Growing at a CAGR of 10.66% from 2023 to 2033

- The South Africa Insurance Market Size is Expected to Reach USD 153.9 Billion by 2033

Get more details on this report -

The South Africa Insurance Market Size is Anticipated to Reach USD 153.9 Billion by 2033, Growing at a CAGR of 10.66% from 2023 to 2033

Market Overview

Insurance refers to an agreement or policy that protects the policyholder against financial losses. The three fundamental types of insurance are classified into three broad categories, which are health and medical, property and casualty, and life insurance. A class of insurance labeled as life insurance is a lifeline to individuals throughout their lifetime. Despite the prevalence of many poor and emerging economies on the African continent, the continental insurance business is still growing steadily. However, the insurance industry of this region has always had development potential due to the region's overall economic growth over the preceding decades. The South Africa insurance market can expand because of an enhanced understanding by the middle class about the benefits of insurance, such as protection against unanticipated risks, laws, and regulations, and increased digitalization. For instance, the market has stabilized after insurers took strategic steps to limit risk exposures, such as raising premium rates and imposing underwriting restrictions, according to KPMG's South African Insurance Industry Survey 2024.

Report Coverage

This research report categorizes the market for South Africa insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Africa insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Africa insurance market.

South Africa Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 55.9 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 10.66% |

| 2033 Value Projection: | USD 153.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 165 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Distribution Channel |

| Companies covered:: | Old Mutual Limited, Sanlam Limited, Discovery Limited, MMI Holdings Ltd, Liberty Holdings Limited, Hollard Insurance Group, Guardrisk Insurance Company Ltd, Mutual & Federal Insurance Company Ltd, Momentum Metropolitan Holdings Limited, Alexander Forbes Group Holdings Limited, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

South Africa insurance market is expected to increase, which will primarily be due to a higher clearly defined literacy rate and proportion of youth with higher education levels. The generally improved education environments will make the public well aware of the actual size in regards to the insurance benefit size, thus making investment lucrative for players in the market. The South Africa insurance market is predicted to grow majorly due to factors including increased internet connectivity, a rising middle class, rapid urbanization, and population growth. Now, through innovative digital solutions extended in their business operations, and also by creating innovative products for key customer needs, insurance companies are recreating their business model and largely contributing to the growth of the industry.

Restraining Factors

Problems among the lines of concern facing the South Africa insurance market include low penetration rates, regulatory obstacles, and a lack of knowledge about insurance advantages. It will ensure that a person receives financial support in the form of paying off all the expenses undertaken in the hospital for the treatment of the insured. Basic regular premiums need to be paid wherein the policyholder continues being insured. The insurance plan is usually too costly; therefore, the growth of the market is affected.

Market Segmentation

The South Africa insurance market share is classified into type and distribution channels.

- The life insurance segment is expected to hold the largest market share through the forecast period.

The South Africa insurance market is segmented by type into life insurance and non-life insurance. Among these, the life insurance segment is expected to hold the largest market share through the forecast period. The growth can be attributed to more and more people nowadays becoming conscious of financial security and trying to prevent damage through financial loss in case of unfortunate events and thus people try to purchase insurance plans.

- The direct marketing segment is expected to dominate the South Africa insurance market during the forecast period.

Based on the distribution channel, the South Africa insurance market is divided into insurance brokers, agencies, direct marketing, and bancassurance. Among these, the direct marketing segment is expected to dominate the South Africa insurance market during the forecast period. Direct marketing includes telemarketing, internet search marketing, and traditional media advertising. Consumers can easily compare online plan features and costs, especially on the many websites that offer cost comparisons for insurance. Because it is more competitive and much less expensive than using corporate networks to promote insurance products, direct marketing is the most cost-effective marketing channel for consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Africa insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Old Mutual Limited

- Sanlam Limited

- Discovery Limited

- MMI Holdings Ltd

- Liberty Holdings Limited

- Hollard Insurance Group

- Guardrisk Insurance Company Ltd

- Mutual & Federal Insurance Company Ltd

- Momentum Metropolitan Holdings Limited

- Alexander Forbes Group Holdings Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Africa, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Africa insurance market based on the below-mentioned segments:

South Africa Insurance Market, By Type

- Life Insurance

- Non-Life Insurance

South Africa Insurance Market, By Commission

- Insurance Brokers

- Agencies

- Direct Marketing

- Bancassurance

Need help to buy this report?