South Africa Motor Insurance Market Size, Share, and COVID-19 Impact Analysis, By Policy Type (Third-party Liability Insurance, Comprehensive Coverage, and Collision Coverage), By Vehicle Type (Passenger Vehicles and Commercial Vehicles), and South Africa Motor Insurance Market Insights, Industry Trend, Forecasts to 2033

Industry: Banking & FinancialSouth Africa Motor Insurance Market Insights Forecasts to 2033

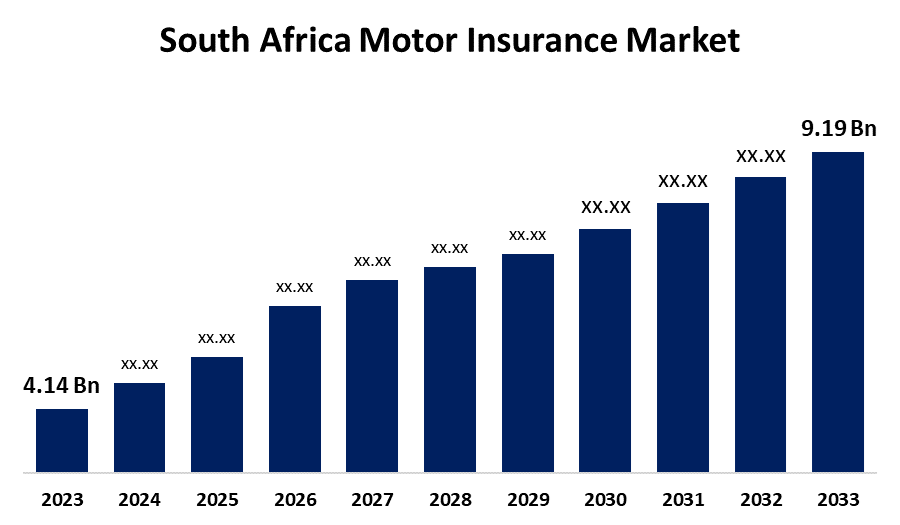

- The South Africa Motor Insurance Market Size was valued at USD 4.14 Billion in 2023.

- The Market is Growing at a CAGR of 8.30% from 2023 to 2033

- The South Africa Motor Insurance Market Size is Expected to Reach USD 9.19 Billion by 2033

Get more details on this report -

The South Africa Motor Insurance Market Size is Anticipated to Reach USD 9.19 Billion by 2033, Growing at a CAGR of 8.30% from 2023 to 2033.

Market Overview

An agreement between a person and an insurance provider that protects the policyholder and their car losses in the case of a theft, accident, or natural disaster is known as motor insurance. Third-party coverage restricted to external damage and comprehensive coverage covering both third-party liabilities and damage to one’s vehicle are all policy options. Some of the variables that affect premiums are the type of car, age, driving record, and level of coverage. Knowing that any potential financial strains will be lessened in the event of unanticipated auto accidents, motor insurance provides peace of mind, allowing car owners to drive with assurance. The South Africa motor insurance market has expanded due to rising vehicle ownership, increasing road accidents, urbanization, technological advancement, and mandatory insurance regulations. Various government initiatives boost the motor insurance market in South Africa. For instance, the goal of the South African Insurance Association (SAIA) is to make third-party auto insurance mandatory for all South Africans and to guarantee that every car has insurance that will cover other property damage in the case of an accident.

Report Coverage

This research report categorizes the market for the South Africa motor insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the South Africa motor insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the South Africa motor insurance market.

South Africa Motor Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.14 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 8.30% |

| 2033 Value Projection: | USD 9.19 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Policy Type, By Vehicle Type and COVID-19 Impact Analysis. |

| Companies covered:: | Hollard Insurance, OUTsurance, Santam, Discovery Insure, Auto & General, MiWay, Old Mutual Insure, Budget Insurance, Virseker, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The incorporation of innovative digital technologies is one of the major growth drivers in the South Africa motor insurance market. Insurers can provide customized coverage according to each driver’s driving habits, increasing the precision of risk assessments by using telematics, AI, and data analytics. This results in increased customer engagement and fairer premium pricing. By improving operational efficiency digital platforms that streamline claims processing also improve operational efficiency. Enhanced competition, better customer experience, and opportunities for long-term growth as it adopts digital transformation are experienced by the motor insurance market in South Africa.

Restraining Factors

The nation’s long-standing economic inequality severely hinders the motor insurance market in South Africa. The inaccessibility and affordability of insurance products, which impedes attempts to reduce the financial risks associated with auto accidents and enhance overall road safety hampers the market’s capacity to reach a wide range of socioeconomic groups

Market Segmentation

The South Africa motor insurance market share is classified into policy type and vehicle type.

- The third-party liability insurance segment is expected to hold the largest market share through the forecast period.

The South Africa motor insurance market is segmented by policy type into third-party liability insurance, comprehensive coverage, and collision coverage. Among these, the third-party liability insurance segment is expected to hold the largest market share through the forecast period. This is due to expanding car ownership and more demanding implementation of insurance requirements.

- The passenger vehicles segment is expected to dominate the South Africa motor insurance market during the forecast period.

Based on the by vehicle type, the South Africa motor insurance market is divided into passenger vehicles and commercial vehicles. Among these, the passenger vehicles segment is expected to dominate the South Africa motor insurance market during the forecast period. Since passenger cars are typically less expensive than commercial vehicles, a wider range of people can afford them.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the South Africa motor insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hollard Insurance

- OUTsurance

- Santam

- Discovery Insure

- Auto & General

- MiWay

- Old Mutual Insure

- Budget Insurance

- Virseker

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at South Africa, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the South Africa motor insurance market based on the below-mentioned segments:

South Africa Motor Insurance Market, By Policy Type

- Third-Party Liability Insurance

- Comprehensive Coverage

- Collision Coverage

South Africa Motor Insurance Market, By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

Need help to buy this report?